The 10 Biggest Dell Technologies News Stories Of 2021

Here’s the 10 most important Dell Technologies news stories of 2021—from VMware and Apex to channel partner conflict.

The Top 10 Dell Stories

From channel conflict to launching its as-a-service vision with Apex, Dell Technologies captured headlines throughout 2021 as it continued to shed businesses and drive PC revenue to record-breaking heights.

The Round Rock, Texas-based PC and infrastructure giant reported a record-breaking third fiscal quarter of $28.4 billion in sales, up 21 percent year over year, with double-digit sales growth quarter after quarter throughout last year.

A new Dell emerged in 2021, highlighted by the launch of Apex and the spin-off of virtualization and software superstar star VMware.

CRN breaks down the 10 biggest and most important Dell Technologies news stories of 2021 that partners, customers and investors need to know about in the new year.

10. Dell’s Hardware Started Using More Non-Intel Processors

Historically, Dell Technologies has used Intel CPUs inside its servers and PCs over the years.

However, even with CEO Michael Dell’s close friend and former VMware CEO Pat Gelsinger becoming the new CEO of Intel last year, Dell told CRN his company will leverage the most innovative chips inside its hardware moving forward.

In fact, Dell launched several new PowerEdge servers in 2021 that exclusively use AMD chips.

“As the No.1 provider of servers in the world, you can be sure we’re taking advantage of all the latest ingredients that allow us to provide the best solution out there,” said Dell in an interview with CRN last year. “[Intel CEO] Pat Gelsinger is a great friend and the Ice Lake generation of microprocessors from Intel offer remarkable improvements across all the performance characteristics that are super important. Having said that, there are other microprocessors out there.”

Dell’s commitment to looking across the broad spectrum of chips manufacturers from AMD and Intel to Nvidia and even chip startups comes during an explosion of innovation and massive market competition between the likes of Intel, AMD, Nvidia and companies making Arm-based processors.

Watch to see just how deep Dell goes with Intel competitors in 2022 and if the latest tech shift affects the two companies‘ longstanding partnership in any way.

9. Dell’s New Co-COO Chuck Whitten

Dell Technologies hired a new co-chief operating officer in 2021 with the hiring of Bain & Company’s Anthony Charles “Chuck” Whitten in a move to drive “Dell’s next phase of growth.”

Whitten joined Dell in August following a 22-year stint at Bain & Company, responsible for running day-to-day operations, shaping the company’s strategic agenda and setting priorities across the Dell executive leadership team. He is also tasked with setting up Dell’s long-term strategy and plans for emerging markets such as cloud, edge computing, telecom and as-a-service.

“Together [Dell Technologies Vice Chairman and Co-COO] Jeff [Clarke], Chuck and I will shape the future of the company and accelerate the outcomes we can drive for customers,” said CEO Michael Dell when announcing the hiring of Whitten. “Chuck’s leadership, energy, knowledge and humanity make him the obvious choice to join our team and strengthen our industry leadership.”

Whitten, a longtime top advisor for Dell while working at Bain & Company, will report directly to CEO Michael Dell. Over the past decade he focused exclusively on the technology sector, including working alongside Dell’s leadership team in recent years to help shape Dell’s strategy and growth initiatives.

“Chuck joins the company at a pivotal time to give us greater leadership capacity to cover more ground, assess more opportunities and speed decision making to best serve customers,” Clarke said last year.

It will be interesting to see just how big of a public role Whitten will play for Dell in 2022.

8. Dell Slashes Partner Account Manager Ranks, Reduces Pay For Level

In a major blow to channel partners across North America, Dell Technologies in 2021 cut the number of partner account managers (PAMs) in North America, reduced the ranks of veteran channel managers and slashed the on-target earnings (OTE) for rep positions by as much as 30 percent, sources told CRN.

Executives at multiple top Dell partners, all Platinum level or higher, told CRN in September that they have lost highly respected, veteran partner managers that were best in class and have been replaced by PAMs with less experience who are being compensated at a lower pay level.

Having less-experienced PAMs in place could potentially stunt the growth of Dell’s channel business, solution providers said, noting that PAMs typically work as the liaison between a channel partner and the vendor, helping push deals and sales opportunities through the channel.

In fact, after several months of having less PAMs or less-experienced PAMs, Dell partners told CRN in late 2021 that the move was exacerbating channel conflict.

“We review our operational models regularly to ensure we’re optimizing and simplifying our engagement with partners, which we know is important to both our partners and our sales teams,” Dell’s Global Channel Chief Rola Dagher told CRN last year.

Partners are hoping Dell hires more PAMs in 2022 who are ready to work intimately with the channel.

7. Sells Boomi For $4 Billion

After being part of Dell Technologies for over a decade, Integration Platform as-a-Service (IPaas) standout Boomi was sold to private equity firms Francisco Partners and TPG Capital for $4 billion in October.

Dell at the time said it was selling off Boomi, which it acquired in 2010, in order to focus on “high-priority areas” as the new remote workforce continues to take shape stemming from the global COVID-19 pandemic.

“For us, we’re focused on fueling growth by continuing to modernize our core infrastructure and PC businesses and expanding in high-priority areas, including hybrid and private cloud, edge, telecom and Apex,” said Dell’s Jeff Clarke when the company unveiled its planned Boomi sale. “[This is] all designed to help organizations thrive in the do-from-anywhere economy.”

Chesterbrook, Pa.-based Boomi aims to drive intelligent use of data on its cloud-based Platform as-a-Service architecture, with more than 15,000 global customers that leverage the technology to discover, manage and orchestrate data.

In a recent interview with CRN, Boomi CEO Chris McNabb said the two companies still plan to work together in the future where it makes sense.

“There’s absolutely going to be continued initiatives as it makes sense and as it’s valuable for our joint partners and customers,” said McNabb. “When we talked about the relationship with Dell, before the sale of Boomi, Boomi was a wholly owned subsidiary within Dell, which means we did everything at an arm’s length. They were, in essence, a channel partner to Boomi already. And one of our biggest and most strategic partners—and that’s going to continue forward.”

6. Dell’s Massive Server Launch

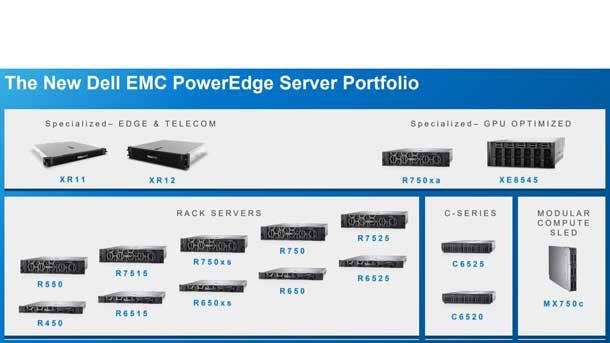

In 2021, Dell Technologies launched more new servers than ever before including more than a dozen new PowerEdge servers and five new rack and tower servers targeting small-and-medium businesses (SMBs) and edge computing use cases.

“We are embarking on a path to get to autonomous compute infrastructure,” said Ravi Pendekanti, senior vice president of server solutions product management and marketing at Dell Technologies last year.

“We are building on what I would call workload-specific platforms to make sure we have an optimized platform for specific workloads,” said Pendekanti. “We’ve been hearing customers say they’re not just looking for the optimal performance, the key is they’re looking for the best price performance.”

Dell’s new PowerEdge server portfolio leverages a combination of both Intel and AMD processors. Arguably the largest server launched in 2021 is the new Dell EMC PowerEdge XE8545 that combines AMD and Nvidia technology designed for accelerated workloads and ideal for machine learning, HPC and GPU virtualization.

The new PowerEdge servers can be consumed as-a-service through Dell Technologies’ consumption-based Apex offering.

With such a massive investment in creating new best-in-class servers, it will be interesting to see if Dell lets these new PowerEdge servers mature in the market or if any new additional servers will be launched in 2022.

5. PC Sales Hit Record-Breaking Heights

Dell’s PC business broke all its previous sales records in 2021 spanning back decades.

Dell’s fiscal year 2022, which runs from January 2021 to January 2022 will most likely be a historic year for the company in terms of record-breaking sales led by its red-hot PC business.

The global COVID-19 pandemic had businesses and organizations of all shapes and sizes clamoring in 2021 for products in Dell’s Client Solutions Group (CSG) which includes desktop PCs, Chromebooks, notebooks and thin clients.

For its recent third fiscal quarter 2022, Dell’s CSG business generated record third quarter revenue of $16.5 billion, representing an increase of 35 percent year over year.

In Dell’s second fiscal quarter, CSG sales climbed 27 percent year over year to a record of $14.3 billion.

In its first fiscal quarter, Dell’s CSG revenue generated a record first quarter revenue of $13.3 billion, up 20 percent year over year.

Dell’s current fourth fiscal quarter will most likely be yet another record-breaking quarter. It will be interesting to see if Dell’s roaring PCs growth can be sustained in 2022.

4. Dell Transformed Itself In 2021

Less than three years ago, Dell Technologies was made up of eight businesses under the Dell Technologies umbrella following its historic acquisition of EMC and VMware.

As of 2022, Dell has since sold Integration Platform as-a-Service (IPaas) specialist Boomi, DevOps application star Pivotal Software, and cybersecurity standout RSA for billions of dollars each, while also spinning off its majority stake in VMware in November. Dell Technologies now consists of its roaring PC business Dell, leading storage and server infrastructure company Dell EMC, SecureWorks for cybersecurity, and Virtustream for cloud software and services.

With the global COVID-19 pandemic driving Dell PC sales to new heights while at the same time driving companies’ digital transformation plans at lightning speed, CEO Michael Dell is – yet again – transforming his company. As a major part of Dell’s transformation, the company has also launched Apex, the company’s new as-a-service portfolio, with plans to make Dell’s entire product portfolio available as-a-service in the future.

With Dell selling the trio of businesses and the VMware spin-off generating billions for the company, Dell’s massive amount of debt stemming from its historic $67 billion acquisition of EMC and VMware is dropping rapidly, which could allow the company to potentially go after a big acquisition to boost either its thriving PC business or its Apex as-a-service push in 2022.

This year could set up the shape and vision for what Dell will look like over the next decade.

3. Dell Launched Consumption-based As-A-Service Portfolio: Apex

Dell Technologies planted its stake in the ground in the as-a-service marketplace with bold plans to eventually sell all of its products in a consumption-based, as-a-service motion through Dell Apex.

“Apex is essentially the creation of the new Dell as we move forward,” said Dell’s Sam Grocott, senior vice president of product marketing, to CRN last year. “We’re transforming internally every facet of the business, as well as externally, as we drive this change to as-a-service consumption model for our entire portfolio.”

Dell Apex not only puts the pressure on its main competition HPE GreenLake, but also public cloud titans like Amazon Web Services (AWS). In fact, Dell’s worldwide sales leader Bill Scannell told CRN that with Apex’s buying options, flexibility and Opex cost savings, Apex can be upwards of 50 percent less expense compared to AWS.

Apex currently consists of Apex Data Storage Services, an on-premise as-a-service portfolio of scalable and elastic storage resources; Apex Cloud Services for as-a-service hybrid or private cloud infrastructure with integrated compute, storage, networking and virtualization resources to simplify cloud adoption; and Apex Custom where customers can create their own on-demand pay-per-use or usage-based IT environment leveraging Dell’s entire infrastructure product portfolio.

Dell said it can quickly deliver and deploy Apex solutions so channel partners can focus on driving “higher-value” services on top of Apex as well as up to a whopping 30 percent incentive on the committed contract value on Apex deals.

However, Dell is still working to make Apex a strong channel play.

“Very quickly, we’re going to make sure that we can transact Apex offerings through our channel partners,” Scannell said in December. Dell followed the same route as some rivals when it brought the Apex as-a-service offering to market first as a direct play with plans to later bring partners onboard, he said.

“We’re going to offer everything we do as-a-service. And just like some of my competitors when they first came out with their as-a-service offering, they didn’t have the ability to transact that through the channel partner—it had to be direct, and then they gave a back-end bonus,” said Scannell.

All U.S. channel partners now can resell, in addition to hosting and referrals, Apex offerings including Apex Data Storage Services, Apex Hybrid Cloud Services and Apex Private Cloud. Dell Technologies Solution Providers and Storage Authorized Distributors in the U.S. may resell Apex Data Storage Services through the Apex Console.

Apex is one of the largest go-to-market and sales strategy transformations in Dell’s 38-year history. It will be interesting to see what new Apex offers Dell launches in 2022 and if channel partners will have more accessibility.

2. VMware Becomes Independent Via Dell Spin-Off

On Nov. 1, Dell Technologies spun off its majority stake in VMware, making VMware an independent company for the first time since 2004.

Dell and VMware had a highly successful go-to-market and innovation strategy from 2016 to 2021, specifically with many joint channel partners. The two companies hope to keep that alive at least for the next five-year through a commercial agreement.

However, with VMware no longer direct attached to Dell, CEO Raghu Raghuram said his company will look to form new and expanded partnerships with other vendors as it looks to become the Switzerland of the multi-cloud world. VMware is likely looking to form new partnerships with public cloud players as well as other hardware providers who may compete with Dell as its now free to do so.

For Dell’s part, spinning off VMware helped it achieve an investment grade rating in 2021 to pave the way to attract new types of investors thanks to an improved capital structure. Dell also received over $9 billion in cash dividends from the spin-off that it will use to pay down its core debt balance.

It is key to note that CEO Michael Dell is still chairman of VMware and is the largest shareholder.

It will be interesting to see how Dell and VMware’s relationship pans out in the public in 2022 as both will want to keep a friendly arms-distance away from each other. Additionally, Dell could potentially make a major acquisition this year thanks to the spin-off.

1. Dell Direct Sales In Conflict With Channel Partners

The most shocking news CRN discovered in 2021 was that channel conflict between Dell’s 27,000-strong direct salesforce and its channel community in both its client systems and infrastructure business consisting of servers, storage and hyperconverged infrastructure.

Some of Dell’s most strategic solution providers said conflict with Dell’s direct sellers has reached a breaking point, including the direct salesforce increasingly trying to steal new customer opportunities, particularly through controversial deal registration rejections.

“Dell direct is our biggest competitor,” said the president of a longtime Dell Titanium partner to CRN in December. “It’s not just for client systems anymore. Our biggest issue across the board is the Dell direct mentality, because there are just no checks and balances. … It’s just like the Wild West out there.”

Partners said channel conflict is manifesting itself as an increase in the number of deals nationwide getting rejected from registration. In some cases, those rejections come because Dell direct reps are going behind their backs promising to give customers a lower price if they buy direct, solution providers told CRN. What’s more, partners said they have seen Dell direct reps aggressively attempt to gather account information from channel sales reps in an effort to take new opportunities in existing accounts—such as new infrastructure orders or services sales—direct.

On the client systems side, CRN learned after speaking with over a dozen Dell Technologies channel partners, that Dell’s direct sales force had started gunning for a larger share of PC sales in North America which is driving huge conflict with the company’s channel community.

Top solution provider executives—all of whom are Platinum or higher partner levels—said they now see Dell as a competitor on PC sales and are exploring their options for taking client systems deals to other OEMs such as HP and Lenovo.

“The way I see it is the Dell direct reps are now in competition with the channel on client systems,” said the CEO of a national Dell solution provider who has already seen one of his company’s recent Dell PC deals taken direct. “This is a direct kick in the face to the VAR community. Based on how this all plays out, it will force partners to become uber aggressive to try to take Dell out to protect their turf.

When CRN asked Dell’s North America President John Byrne last year how he would describe Dell’s client systems sales strategy: direct-led, partner-led or channel neutral, Byrne responded: “All of the above. We want both routes. We want both to be growing and both to be growing dramatically.” As to whether he directed both channel and direct reps to move Dell’s client business to a direct-first sales model versus partner-led, Byrne reiterated, “We want both routes of market to grow—both direct and channel.”

Dell partners said the channel conflict began escalating in early 2021 and has since gotten worse over the last several months.

In response, Dell’s Bill Scannell, vehemently denied that there is widespread Dell channel conflict. “Are there a couple of partners that have an issue?” asked Scannell rhetorically in an interview with CRN. “I’m sure they do. And as I’ve said to them on stage at FRS [Field Readiness Seminar, Dell’s sales kickoff] and at the partner Advisory Boards—call us. I’m [email protected]—publish that. If people have an issue, call me. Our partners are our most important assets. It’s our route to markets. It’s why we’re growing so well.”

Scannell said Dell’s channel business has grown faster than its overall business in fiscal year 2022, including in the company’s recent third quarter when Dell’s total revenue grew 21 percent compared to 34 percent growth from partners. “Partners are growing faster than we are as a company right now. We should be dancing in the streets,” said Scannell.

The biggest Dell story of 2021 will continue to be the most important story in 2022.

With partners up in arms about Dell’s direct salesforce encroaching more into channel deals and opportunities—as well as a reduction in seasoned partner account managers (PAMs) and the lack of a solid channel strategy for Dell’s Apex—the biggest question for Dell in 2022 is if it will try to fix these channel issues or continue with business as usual.