Dell, HPE Battle For Server Market Share Leadership

The global vendor server market generated $25.8 billion in total server revenue in the fourth quarter of 2020 with Dell Technologies and HPE leading the way.

Server Market Hits $25.8 Billion

Dell Technologies and Hewlett Packard Enterprise continued to battle it out for global server market share leadership in the fourth quarter of 2020.

The worldwide server market reached $25.8 billion in the fourth quarter of 2020, representing a year-over-year increase of 1.5 percent, according to new data from research firm IDC. Global server shipments declined 3 percent year over year to nearly 3.3 million units in the fourth quarter.

“Global demand for enterprise servers was relatively flat during the fourth quarter of 2020 with the strongest increase to demand coming from China (PRC),” said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC in a statement.

IDC did not provide exact vendor server revenue numbers for fourth quarter 2020 as it typically does with its IDC Worldwide Quarterly Server Tracker market report. Additionally, IDC did not provide exact vendor market share percentages as it has traditionally done in the past. IDC declined to provide exact server figures to CRN when contacted.

CRN based market share percentage on IDC’s server vendor revenue graphic chart as well as on previous IDC server reports. Here are the six vendors that captured the biggest server market share in the world during the fourth quarter of 2020.

Server Market Overview

Breaking down the server market segments in the fourth quarter 2020, volume server revenue was up 3.7 percent to $20.4 billion year over year. Sales from midrange servers increased 8.4 percent year over year to $3.3 billion, while high-end servers declined by 21.8 percent to $2.1 billion.

Server sales generated from x86 servers in the fourth quarter increased 3 percent to around $23.1 billion, while non-x86 server revenue declined 9 percent year over year to $2.8 billion.

“Blade systems continued to decline, down 18.1 percent while rack optimized servers grew 10.3 percent year over year,” said IDC’s Maguranis. “Similar to the previous quarter, servers running AMD CPUs as well as ARM-based servers continued to grow revenue, increasing 101 percent and 345 percent year over year respectively, albeit on a small but growing base.”

On a geographic basis, China (PRC) was the fastest-growing region with nearly 23 percent year over year revenue growth. Latin America was the only other region with sales growth in the fourth quarter, up 1.5 percent year over year. North America server sales declined 6.2 percent year over year, with Canada down 24 percent and the United Sates dropping 5.5 percent. Both EMEA and Japan declined during the quarter at rates of 1.1 percent and 6.3 percent, respectively.

IDC said it “declares a statistical tie” in the worldwide server market when there is a “difference of one percent or less” in the share of revenues or shipments among two or more vendors. In IDC’s fourth quarter 2020 server market share report, there was a statistical tie between Dell and HPE/New H3C Group, as well as a tie between Lenovo and Huawei.

Tie No. 5: Lenovo

Q4 Market Share: 5.5%

The PC giant and growing data center infrastructure player captured approximately 5.5 percent share of the worldwide server market, representing flat share gain year over year, according to IDC. In terms of server units shipped, Lenovo ranks fifth with roughly 5 percent share of the total server units shipped worldwide.

Last month, Lenovo’s Data Center Group (DCG) – which includes the company’s server, storage and hyperconverged infrastructure business -- reported third fiscal quarter revenue of $1.63 billion. Lenovo DCG captured $1 billion in the enterprise and SMB market segment, the highest amount in over three years.

Tie No. 5: Huawei

Q4 Market Share: 5.6%

The Chinese technology conglomerate captured approximately 5.6 percent share of the global server market, according to IDC, up slightly year over year. Huawei ranks fourth in terms of server units shipped, by shipping roughly 6 percent of all servers on a global basis.

It appears Huawei benefitted from China’s server spending surge in the fourth quarter, but not much as its regional rival Inspur did.

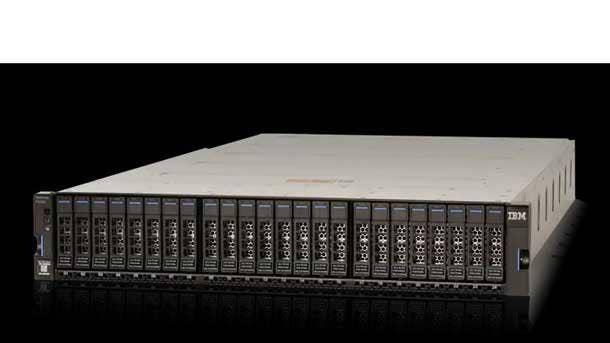

No. 4: IBM

Q4 Market Share: 7%

IBM ranks fourth in the world for server revenue with approximately 7 percent share, according to IDC, down several share points year over year. The Armonk, N.Y.-based company did not make IDC’s list of top market share vendors in terms of server units shipped, meaning IBM shipped less than 5 percent of all severs in the fourth quarter.

IBM is planning to spin out the company’s IT management and infrastructure business in the near future.

No. 3: Inspur / Inspur Power Systems

Q4 Market Share: 8%

China-based Inspur has been one of the fastest-growing server companies in the world over the past several years, benefitting greatly from large spending trends inside of China. Inspur captured approximately 8 percent share in the global server market, according to IDC, up several share points year over year. In terms of servers shipped, Inspur

Due to the existing joint venture between IBM and Inspur, IDC is reporting server market share on a global level for Inspur and Inspur Power Systems as ‘Inspur/Inspur Power Systems’.

Tie No. 1: Dell Technologies

Q4 Market Share: 15.5%

Dell Technologies shipped more servers than any other company in the world during the fourth quarter of 2020. Dell shipped approximately 16.5 percent of all servers in the quarter, up slightly year over year, according to IDC. The Round Rock, Texas-based company tied for first in terms of total server revenue by capturing roughly 15.5 percent of the total market, representing a slight decline year over year.

Last month, Dell reported fourth fiscal quarter sales of $4.4 billion in server and networking, representing an increase of 3 percent year over year.

Tie No. 1: HPE/New H3C Group

Q4 Market Share: 16%

Hewlett Packard Enterprise and its New H3G Group won the most market share in terms of revenue at approximately 16 percent, although IDC declared a statistical tie for first place as Dell and HPE were both within 1 percentage point of each other. In terms of server units shipped, HPE/New H3C Group ranks second at roughly 14.5 percent share of the total amount of server shipments in the fourth quarter.

“HPE’s quarter-over-quarter growth of 13.7 percent is more than double that of Dell’s, which was 5.6 percent,” said HPE in a statement to CRN after IDC released its market share report. “HPE’s strong performance is based on continued demand for compute solutions that span from industry-standard servers to high-end supercomputing.”

Due to the existing joint venture between HPE and its China based affiliate New H3C Group, IDC reports server market share on a global level for HPE and New H3C Group as HPE/New H3C Group.