The 10 Top VMware News Stories Of 2020

From a new channel chief and partner program to VMware’s Kubernetes charge and COVID-19 response, here are the ten most important news story from VMware in 2020.

Top 10 VMware Stories That Made Headlines In 2020

The virtualization kingpin planted its stake in the ground this year as a market leader in Kubernetes and hybrid cloud as VMware ramped up both its sales and innovation engine in 2020.

The Palo Alto, Calif.-based company significantly enhanced the majority of its flagship products in 2020 while also acquiring a total of five companies over the past 12 months. VMware wasn’t significantly impacted by the global COVID-19 pandemic with its CEO Pat Gelsinger correctly predicting in March that the virus would change the IT world forever.

From key executive departures to a new global Partner Program and channel chief, CRN breaks down the ten biggest news stores of 2020 from VMware.

10. VMware Sales And Innovation Soar In 2020

VMware has a truly stellar year both on the sales and innovation front.

In terms of sales, VMware posted year-over-year revenue gains each quarter this year. The company predicts total revenue for fiscal year 2021, which ends Jan. 29, to reach $11.7 billion, up from $10.8 billion in fiscal year 2020. The nearly $1 billion increase in sales stemmed from new revenue boosts around remote workforces, security, hybrid cloud, software-as-a-service (SaaS) and its new Tanzu Kubernetes portfolio.

There were countless enhancements to VMware’s key products such as VMware Cloud Foundation, NSX-T and vRealize. The biggest enhancement in 2020 was the rearchitecture of vSphere with the launch of vSphere 7 by injecting Kubernetes APIs to provide a cloud-like experience for developers and operators, along with new security and lifecycle management capabilities.

One blockbuster launch this year is VMware’s answer to the emerging opportunities around 5G. The VMware Telco Cloud Platform 5G Edition is a cloud-native platform powered by VMware’s cloud infrastructure coupled with automation, edge network functions, lifecycle management and much more aimed at the Communication Service Provider (CSP) market. In September, VMware acquired the technology and team behind Mode.net to better deliver its VMware Telco Cloud Platform to CSPs globally.

9. VMware Combats COVID-19; Gelsinger Predicts It As ‘Black Swan’ Event

When the COVID-19 pandemic and lockdowns first hit America in early March, VMware CEO Pat Gelsinger boldly predicted on March 17 that the coronavirus pandemic would be the “black swan” event that changes the way the world works, connects and live.

“The future of work is changing. As the work-from-home model becomes the norm and work itself becomes more distributed, we will continue to build infrastructure and technology solutions optimized for the workplace of the future,” said Gelsinger in a blog post on March 17. “This is a ‘black swan’ event that I believe will permanently change the way we work, learn, connect, worship and simple how we live in community with each other.”

To help customers affected by the coronavirus, VMware began offering free trials of Workspace ONE and its new SD-WAN Work @Home offering, while also extending free trials of Horizon.

VMware also implemented several cost management changes due to the economic uncertainly which included a company-wide employee salary freeze and temporary salary reductions for top executives, including Gelsinger.

8. Cloud Leader Ravi Ramaswami Jumps Ship To Lead Rival Nutanix

VMware is betting big on hybrid cloud, seeking to become the one-stop-shop software provider to enable multi-cloud environments for enterprises across the globe.

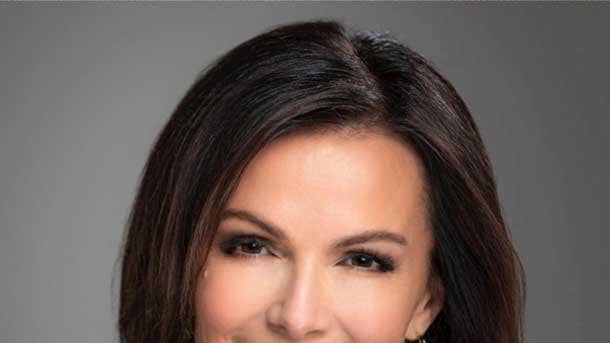

However, the company this month lost Ravi Ramaswami (pictured), chief operating officer of Products and Cloud Services at VMware, who was responsible for business units developing products, cloud services and cloud operations for VMware over the past four years. Ramaswami played a key role in successfully transitioning VMware towards a subscription and SaaS model over the past several years.

What made the departure even more of a blow to VMware is that Ramaswami left to become president and CEO of Nutanix, one of VMware’s top software competitors on a global basis. VMware and Nutanix go head-to-head in many different markets including hyperconverged infrastructure software, hybrid cloud management and even in hypervisors.

“To get a guy who competed with Nutanix from your biggest competitor is exactly the person you want to join Nutanix because he knows the pluses and minus of VMware,” said Tim Joyce, president and CEO of Roundstone Solutions, an Orinda, Calif.-based Nutanix partner. “He can most likely help the Nutanix teams figure out how to beat VMware and is a perfect fit.”’

In an interview with CRN, Ramaswami said he plans on elevating Nutanix to a $2 billion hybrid loud software powerhouse.

“Nutanix has done a great job going from zero to $1 billion. Now it’s about building the next billion at Nutanix,” he told CRN. “That’s where my experience in terms of operating at scale as well as my prior technology background in the development area can help Nutanix get there.”

7. Dell Technologies Explores Spinout Of VMware

In July, Dell Technologies sent shockwaves through the industry by confirming its exploring the spin-off of its 81 percent stake in VMware. Dell owns the majority stake in VMware through its blockbuster acquisition of EMC in 2016.

However, CRN discovered that Dell plans to spin-off its 81 percent stake in VMware to Dell Technologies and VMware shareholder, versus simply selling off VMware. In an interview with CRN, Dell Technologies CEO and VMware Chairman Michael Dell said the move will boost both companies.

“It simplifies the capital structures, it enhances strategic flexibility and gives both companies more flexibility, while we continue with the mutually beneficial strategic and commercial partnership that we’ve had for many, many years that has worked extremely well and it continues to,” said Dell. “So this is different from selling VMware—we are not selling VMware, by the way. Some people are a little confused about that.”

If all goes as planned, Dell will not spin-off its shares of VMware before September 2021 for tax reasons. Dell is seeking to get it to qualify as tax-free for federal income tax purposes.

6. VMware Cloud on AWS Pros And Channel Cons

VMware is betting big that its VMware Cloud on AWS solution is the answer to hybrid cloud.

Sales of VMware Cloud on AWS skyrocketed at a triple digit clip each quarter for VMware in 2020 as CEO Gelsinger told the world that his company’s preferred public cloud partnership will be Amazon with VMware expecting to double down on VMware Cloud on AWS in 2021.

However, many of VMware’s largest channel partners sounded the alarm this year regarding issues with direct AWS sellers scooping up massive VMware Cloud on AWS (VMC) deals from partners in the eleventh hour. A few largest solution providers said multimillion-dollar VMC registered deals that were channel led where taken from them in the last minute by AWS sales teams. VMware confirmed to CRN, “there have been some challenges for partners, which we are working directly with AWS to address.”

VMware’s new global channel chief Sandy Hogan (who will be discussed later on CRN’s list) has stepped up to the plate to fix the issue. Hogan said VMware is creating better teaming agreements between VMware, AWS and the channel partner around VMC, as well as improving protection and rules of engagement for partners.

5. VMware Welcomes New Partner Program

For the first time since 2009, VMware launched a new flagship partner program this year with VMware Partner Connect.

The new partner program dramatically changes the way VMware engages and incentivizes its channel partners across the globe, and integrates the channel programs of Pivotal Software, Carbon Black and VeloCloud.

“If you looked at our portfolio, our solutions and offerings, and then the way the old program was going to market with partners -- it was antiquated,” said Jenni Flinders in March, who was VMware’s vice president and worldwide channel chief at the time. “We really wanted to build out our MSP capabilities with partners who are building repeatable IP and who are building integrated solutions with us.”

VMware Partner Connect, a three-tier program that pushes technical services competences versus sales thresholds, made all previous partner programs obsolete as partners will now need to sign only one agreement with the company. The program is designed to align to each individual solution provider’s business model. Partners can now specialize in a certain aspect of VMware technologies—such as hybrid cloud, network and security, application modernization or digital workspace—without needing to fulfill other VMware requirements that do not align to their business strategy.

Partner Connect includes a new Incentives and Development Funds portal that provides enhanced dashboards and visibility to track activity with VMware. It also includes the new VMware Learning Zone that provides a variety of new content, including the ability to customize learning plans based on individual partner preferences.

“This new one now centers around the customer journey and VMware’s journey to transition to SaaS and subscription,” said Flinders. “It’s a huge transformation. We reimagined the whole program.”

4. Acquisition Frenzy

Following the biggest acquisition year in VMware’s history in 2019, the company made five acquisitions in 2020 around a variety of markets including security, SD-WAN and Kubernetes.

One of its most significant acquisitions was Nyansa, a fast-growing innovator of AI-based network analytics. VMware is now leveraging Nyansa to accelerate the delivery of end-to-end monitoring and troubleshooting capabilities for LAN and WAN deployments in its SD-WAN, and further VMware’s ability to enable self-healing networks.

VMware also acquired SaltStack, a pioneer in building intelligent, event-driven automation software, that helps customers to automate ITOps, DevOps, NetOps or SecOps functions. SaltStack will be leveraged to boost VMware’s automation capabilities including software configuration management, network automation, and infrastructure automation.

VMware purchased Lastline, whose solutions allow customers to visualize, detect and contain sophisticated cyberthreats on-premise or in the cloud. By leveraging Lastline, VMware is adding new capabilities for network detection and response/network threat analysis that will span across NSX and SD-WAN offerings.

Datrium specializes in a cloud-native disaster recovery with VMware looking to expand on its existing VMware Sit Recovery DRaaS solution with a cost-optimized option. The Datrium DRaaS solution delivers an end-to-end cloud driven user experience in VMware Cloud on AWS today. The innovative, cost-optimized approach leverages native cloud services, and provides forever incremental point-in-time copies that are encrypted, deduped, and stored efficiently in AWS S3.

VMware’s purchase of Kubernetes startup Octarine will be discussed later on CRN’s list.

In July, VMware completed its acquisition of Blue Medora’s True Visibility Suite business unit, which provides IT monitoring integration solutions via management packs, to expand VMware’s vRealize Operations’ self-driving management scope and support for packaged applications, middleware, data center infrastructure and public clouds.

3. Successful SaaS And Subscription Transformation

One of VMware’s biggest success stories of 2020 has been its big sales gains in subscription and software-as-a-service (SaaS).

For the first time in the company’s history, subscription and Software-as-a-Service (SaaS) revenue is now surpassing on-premises licensing sales as VMware continues to double down on areas like VMware Cloud on AWS and hybrid cloud management. In its most recent third fiscal quarter, VMware generated $676 million in SaaS and subscription revenue, up a whopping 44 percent compared to $470 million one year ago. VMware’s SaaS and subscription sales now make up 24 percent of the company’s total revenue, a figure that continues to climb quarter after quarter.

“VMware will continue to invest in and focus on further expanding our Subscription and SaaS portfolio, which we believe will drive company growth, customer satisfaction and shareholder value,” said VMware CFO Zane Rowe, during the company’s third quarter earnings report.

The VMware businesses generating subscription and SaaS sales includes VMware Cloud on AWS, Wavefront, Heptio, Pivotal Software, Carbon Black, VeloCloud, AppDefense and some end-user computing (EUC) sales, to name a few.

2. New Channel Chief; Revamped Partner-First Culture

VMware hired a new worldwide channel chief this year in Sandy Hogan, a longtime Cisco veteran with more than two decades of executive experience.

Hogan quickly began spreading the message that VMware will be “incredibly doubling down on is creating a partner-first culture,” she told CRN this year. She hit the ground running in May be investing in the channel after speaking with channel partner from across the globe.

Through the leadership of Hogan, VMware built a new team centered on boosting partner lifecycle services and capabilities. Hogan spearheaded efforts to create a global partner advisory council that will enable channel partners to have more involvement with product development. The company also hired industry veteran Tracy-Ann Palmer as its new vice president of partner programs and experience.

Hogan replaced Jenni Flinders who quietly left VMware in May after two years.

Hogan said her objective is to unleash all aspects of partner capabilities and look to solution providers as the delivery mechanism for digital transformation for VMware customers. “If you think of VMware as that digital foundation, I want to unleash every opportunity for partners to deliver that value to the customers,” Hogan told CRN in October.

1. 2020: The Year Of Kubernetes For VMware Tanzu

Arguably the largest crank of the innovation engine this year was VMware injecting Kubernetes everywhere it could including VMware Cloud on AWS, vSphere and VxRail. VMware is hoping to dominate the Kubernetes market with its VMware Tanzu platform of services designed to deliver enterprise-grade Kubernetes at scale.

VMware injected Kubernetes into the new vSphere 7 launched this year, providing an easy way for vSphere’s 500,000 customer base to get started with Kubernetes and modernize the 70 million-plus workloads currently running on vSphere. vSphere with Tanzu allows customers to configure enterprise-grade Kubernetes infrastructure with their existing network and block or file storage in less than an hour.

Other significant products that were injected with VMware Tanzu this year is the new VMware Cloud Foundation version 4.1 as well as the world’s most popular hyperconverged infrastructure offering VxRail. The new VMware Tanzu on Dell EMC VxRail integrations provide multiple, fully integrated HCI options to enable customers to build, run and manage Kubernetes container-based applications.

VMware also acquired Kubernetes startup Octarine, which offers a cloud-native security platform for the complete lifecycle of applications running on Kubernetes.

On the innovation front, VMware this year added to its Tanzu portfolio the Tanzu Application Service, its centralized management platform Tanzu Mission Control, as well as Tanzu Kubernetes Grid that enables customers to run a multi-cluster Kubernetes environment on any infrastructure with built-in security.

On the hiring front, VMware attracted a stellar list of new Kubernetes executives including former Red Hat and Docker channel sales executive Roger Egan, who is now leading VMware’s Tanzu sales charge.

All in all, VMware significantly expanded its Kubernetes market presence and capabilities to make it a force to be reckoned with in 2021.