The 10 Hottest Networking Startup Companies Of 2021

With hybrid cloud, edge networking, and SASE top of mind in 2021, here are 10 enterprise networking upstarts that made their mark during a time of rapidly changing networking requirements.

The New Networking

See the latest entry: The 10 Hottest Networking Startups Of 2022

The time to be an IT startup was 2021. The networking industry learned a few lessons from the past two years that changed the course of many product development road maps for the incumbent players, but upstarts had all the answers to the test. Networking startup companies didn’t have to make a big pivot to start embracing a hybrid cloud or completely cloud-based approach, and they were certainly familiar with the new ways that businesses are looking to buy IT, including subscription-based networking services models.

Networking startups are giving some of the largest vendors a run for their money, while other established companies, such as Aruba Networks and Microsoft, are choosing to team with startups because of their fresh takes on private 5G, managed networking offerings and next-generation connectivity options. Some startups are focusing on filling holes in the market around consumption-based or managed network offerings, as well as edge networking, next-generation data center networking, and Secure Access Service Edge, or SASE, all while tapping the channel on the shoulder for help getting the word out on the news ways to handle networking requirements.

From those specializing in hybrid cloud-based offerings and managed networking services, to connectivity and 5G, here 10 of the hottest enterprise networking startups of 2021.

Alkira

CEO: Amir Khan

Cloud Networking-as-a-Service startup Alkira emerged from stealth mode in 2020 with its consumption-based Cloud Services Exchange (CSX), a unified, on-demand offering that lets cloud architects and network engineers build and deploy a multi-cloud network in minutes. Since then, the company has unveiled a close collaboration with the Microsoft for Startups program, as well as a deeper relationship with Amazon Web Services, whose Marketplace includes Alkira CSX.

San Jose, Calif.-based Alkira in October announced a $54 million Series B funding round led by Koch Disruptive Technologies, raising its total funding to $76 million to date. The three-year-old startup is going to market primarily though channel partners, Alkira told CRN.

Aviatrix

CEO: Steve Mullaney

Hybrid cloud network upstart Aviatrix Systems is making a name for itself by offering visibility into complex, multi-cloud networks for enterprises asking for cloud-native networking offerings that support new ways of accessing applications. It’s the company’s opinion that the longtime networking incumbents won’t be winning in the “new world” of IT environments, the company told CRN.

The Santa Clara, Calif.-based company is looking to go to market with partners, especially those solution providers that aren’t tied to the on-premises world. Aviatrix in September raised $200 million in Series E funding, which it’s using to scale worldwide sales and support operations, the company said. Aviatrix’s long list of customers include VMware, Netflix and NASA.

Cato Networks

Founder and CEO: Shlomo Kramer

Cloud networking and security specialist Cato Networks, which does 100 percent of its business through the channel, comes to market with a cloud service that integrates edge SD-WAN, a global network backbone and network security services.

The six-year-old Tel Aviv, Israel-based company secured its largest round of financing yet in October, bringing its total funding to date to $532 million. Cato Networks has about 400 employees today and is currently valued at $2.5 billion. In 2019 the company launched a global program for partners of all kinds, including master agents, subagents, VARs and MSPs.

Celona

CEO: Rajeev Shah

Enterprise 5G startup Celona emerged on the scene in 2020 with its platform that will make LTE and 5G a reliable and viable wireless option for enterprise connectivity. In addition to the platform, the two-year-old company also revealed a channel program and a strategic partnership with Aruba Networks for the reselling of Celona’s cellular products.

Celona, based in Cupertino, Calif., was founded by a team that have been part of companies like Qualcomm and Cisco and have experience building products, such as chipsets, cloud-based software, and Wi-Fi and cellular offerings. The company has been actively pursuing the channel as its primary route to market and now has a strong base of partners making private LTE and 5G networking a reality for enterprises, the company told CRN in March.

Infiot

CEO: Parag Thakore

Edge networking startup Infiot came out of stealth mode in 2020 with a new approach to edge networking and connectivity. The company is offering a cloud-delivered intelligent thin wireless edge access platform that supports wired, wireless and cellular connectivity. Infiot’s platform brings together connectivity, zero-trust security and edge-computing for remote users, sites and devices anywhere in the world, according to the company.

Founded in 2018 by networking and SD-WAN industry veterans, the company in 2020 announced $15 million in a Series A funding round backed by Lightspeed Venture Partners, Neotribe Ventures, Westwave Capital and Harpoon Ventures. The Menlo Park, Calif.-based startup in October launched its ZETO Remote Access solution, a software client that combines zero-trust security and SD-WAN.

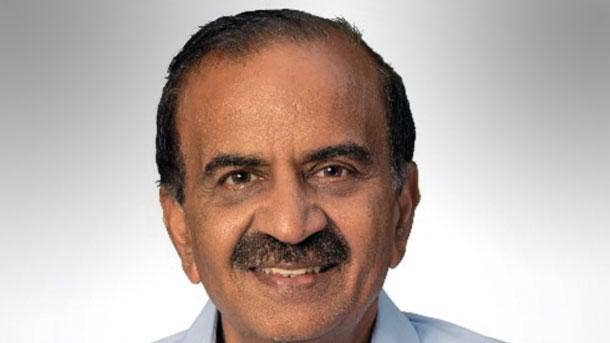

Pensando

Co-Founder and CEO: Prem Jain

Edge computing startup Pensando Systems is coming to market with its system that is based on a custom programmable processor optimized for edge computing. The offering is powering software-defined cloud, compute, networking, storage and security services to transform existing architectures into secure and fast environments that are being required by next-generation applications, according to the four-year-old company.

The Milpitas, Calif.-based company brought in additional funding from its Series C round in August totaling nearly $35 million, the company told CRN. The latest funding was led by Ericsson Ventures, Qualcomm Ventures and Liberty Global Ventures, the global investment arm of Dutch telecom giant Liberty Global.

Perimeter 81

CEO: Amit Bareket

SASE specialist Perimeter 81 has spent most time focused on cloud-based networking and security, but the company this year entered the SASE arena. Three-year-old Perimeter 81’s offerings can replace legacy and open-source VPN offerings.

The Israel-based company brought on Bob Kilbride as its first channel chief to boost business done through the channel from less than 10 percent today to eventually becoming a channel-first company, the company told CRN in February. In March, Perimeter 81 launched a channel partner program for MSPs.

Prosimo

CEO: Ramesh Prabagaran

Founded in 2019, enterprise infrastructure disruptor Prosimo emerged from stealth mode with its Application eXperience Infrastructure (AXI) platform that’s modernizing and simplifying application delivery and experience across multi-cloud environments. The Prosimo platform can coexist with existing vendors in a customer’s environment or can be used to replace certain tools and features, such as zero-trust or cloud peering, according to the Santa Clara, Calif.-based company.

The startup, which is focused on collapsing multi-cloud networking, security and application performance, is backed by $25 million in Series A funding. The company in October updated its platform to target multi-cloud applications in transit.

Rockport Networks

Co-Founder and CEO: Doug Carwardine

Data center networking startup Rockport Networks emerged from stealth mode in October with its new switchless network architecture that can provide customers with the performance and scalability necessary for demanding computing workloads, such as high-performance computing technologies, AI and ML. Rockport Networks says its switchless offering can deliver an average of 28 percent reduction in workload completion times under load and 3X decrease in end-to-end latency compared with traditional networks.

The Ottawa, Ontario-based company has raised a total of $18.8 million in funding over four rounds, with the latest funding round raised in 2019 from a Grant round.

Trustgrid

Co-Founder and CEO: Joe Gleinser

Five-year-old TrustGrid offers a platform that combines SD-WAN, edge computing and zero-trust remote access that lets operators and cloud software providers manage and support distributed application environments from the cloud to the edge. The platform lets users managed and support hundreds of networks on one interface, the company said.

The privately held, Austin, Texas-based provider goes to market through channel partners. TrustGrid in February revealed that its connectivity platform now extends to one in five banks and credit unions in the U.S.