The 10 Biggest Cisco News Stories Of 2019

Cisco Systems had a jam-packed year with plans to enter the silicon market and several game-changing acquisitions, as well as major restructuring and movement within its leadership movement. Check out the ten news-making Cisco announcements of 2019.

Read All About It

From major business unit restructuring and leadership changes, to acquisitions and new product announcements, no one can accuse Cisco Systems of sitting still in 2019.

The year was full of ups and downs for the San Jose, Calif.-based tech giant. Cisco reshuffled several of its leaders when it revealed a major business unit restructure impacting its enterprise networking, data center, and cloud business units. The company said goodbye to several high-profile, longtime leaders and cut upwards of 500 jobs in two of its California offices. Toward the end of the year, Cisco unveiled perhaps its most important product launch of the year when it ripped the sheet off of its new networking silicon architecture, Cisco Silicon One, which the company claims will power the future of the internet for the next ten years.

Here are the 10 biggest Cisco news stories of 2019.

Get more of CRN's 2019 tech year in review.

10. Cisco Buys Singularity Networks

Cisco in February closed its acquisition of Singularity Networks, Inc., a privately-held network infrastructure analytics company based in Denver. The deal Boosted Cisco's analytics chops, supplying the tech giant with real-time infrastructure and traffic analytics across cloud and premises-based environments.

Singularity Networks' customer base included enterprises as well as service providers and managed service providers with a security practice. Together with Cisco, Singularity Networks' technology is giving these providers actionable information across their entire network 24/7, according to Cisco.

The two companies did not disclose the financial terms of the deal, which was first announced in January.

9. Chambers Poaches Cisco Executive Palumbo

Cisco in December revealed it would losing Frank Palumbo (pictured), Cisco's senior vice president of global data center sales. Palumbo, a Cisco veteran, worked at the company for 27 years.

Palumbo has since revealed he has taken a role as the Chief Revenue Officer of Pensando Systems, an edge computing startup founded by ex-Cisco engineers and backed by former Cisco Chairman and CEO John Chambers, who touted the move on Twitter.

8. Cisco Takes Aim At Cradlepoint, Enters New Market With Meraki Cellular Gateway

Cisco in November revealed it was plugging a longstanding hole in its portfolio with the introduction of a cellular gateway.

At Cisco Partner Summit 2019 the company unveiled the Meraki Gateway MG21. The Meraki Gateway is a wireless WAN cellular gateway that connects cellular and wireless technology, including LTE and Wi-Fi 6, and gives businesses one place to provision and manage their connectivity. The MG21 is built on the Cisco Meraki dashboard for simplicity for partners and end users, according to Cisco.

Many partners and end customers, prior to the MG21 had to rely on Cradlepoint cellular gateways. Todd Nightingale, Cisco Meraki's senior vice president and general manager, predicted at Partner Summit that the product would be the “fastest-launching Meraki product” of all time.

7. Cisco Announces Plan To Acquire Acacia Communications For $2.6 Billion

In July, Cisco revealed plans to scoop up one of its suppliers, Acacia Communications, a manufacturer of optical interconnect products, for $70 per share in cash in a $2.6 billion deal on a fully diluted basis.

Buying the Massachusetts-based publicly traded company was aimed at boosting Cisco's networking portfolio. The technology will help cloud and service providers and data center operators meet increasing demands for data. It will help Cisco make networks smarter, simpler and more secure, Cisco said regarding the deal.

The two companies expected the deal to close during the second half of Cisco’s fiscal 2020, which ends Jan. 31, 2020.

6. Cisco Launches SMB Revival

Cisco took to its 2019 Partner Summit in Las Vegas in November to unveil Cisco Designed for Business, a curated portfolio that includes traditional products, such as Meraki and WebEx, and other offerings that have been specifically created and priced for small business customers.

While popular with enterprise customers, Cisco has struggled to attract small business customers with its offerings. The vendor purchased Linksys in 2003 for $500 million as a networking option for the SMB market but sold the assets to Belkin in 2013. Cisco said that this time, its SMB portfolio is different because it developed a "holistic" strategy instead of trying to make its enterprise-grade products fit into the SMB market.

‘We used to joke that we had an enterprise mini-me strategy. We would take enterprise products and paint them a different color. In this case, we have purpose-built solutions,’ Cisco CEO Chuck Robbins told CRN at the annual Partner Summit.

5. Cisco Channel Leader Nirav Sheth Departs

Cisco veteran Nirav Sheth, who served as vice president of worldwide sales and systems engineering for the tech giant's Global Partner Organization and right-hand man to global channel chief Oliver Tuszik, announced in November that he was leaving the company.

Sheth, who spent nearly 20 years at Cisco, joined Google Cloud in November in a U.S. partner sales leadership capacity.

Oliver Tuszik, senior vice president of Cisco's Global Partner Organization, assumed the day-to-day responsibilities for Sheth's role until the company finds the right candidate to fill Sheth's shoes, Cisco told CRN at the time.

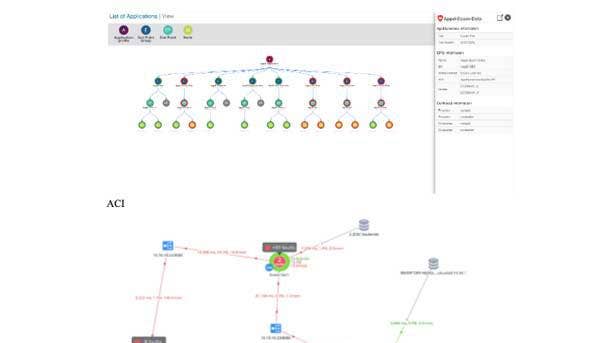

4. Cisco AppDynamics Makes Significant Channel Gains

Cisco Systems' application performance monitoring software arm, AppDynamics, had a big year. The business is now bringing in 70 percent of its business through partners as channel deal registration grew 60 percent year-over-year and partner-sourced business increased 154 percent, according to Gardner Johnson, AppDynamics' vice president of worldwide channel.

Four years ago, 80 percent of AppDynamics' business was direct to business customers. By the end of 2019, the APM software provider changed that dramatically.

Cisco acquired AppDynamics for $3.7 billion in 2017 but AppDynamics still keeps its own channel program separate. However, the two share many mutual partners and being a part of Cisco is helping AppDynamics and its partners land more deals, Johnson said.

3. Cisco Deepens Partnership With Amazon Web Services

At AWS re:Invent 2019, Cisco announced deeper tie-ins between Cisco’s Application Centric Infrastructure (ACI) technology for cloud environments, and Outposts, Amazon’s on-premise service for running applications. Via the partnership, Cisco ACI Anywhere is now available on AWS Outposts.

By supporting AWS Outposts, business customers’ policy models can be translated into consistent on-premise and cloud-native constructs that are deployed across AWS applications. The combination not only gives end users one place to configure, monitor, and operate multiple environments across data centers and AWS, but it can also reduce complexity and save businesses money, Cisco said.

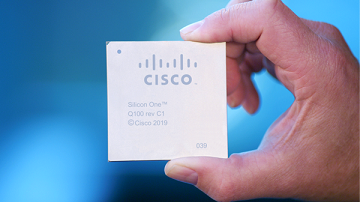

2. Cisco Intros Silicon One To Power Internet Of The Future

In another massive shakeup for the tech giant, Cisco in December revealed it was entering the silicon market and outlined its roadmap for the next decade. In the process, the company revealed a major shift in its networking strategy with the introduction of a new networking silicon architecture called Cisco Silicon One.

Cisco said that the new chip will bring performance up to 25 terabits per second and will be available to third-party companies looking to add high-performance networking to their infrastructures, including cloud and service providers. The move is laying the foundation for Cisco's long-term goal, which is to support future applications and services that will emerge onto the scene once 5G has been widely adopted, according to Cisco.

1. Cisco Restructures Business Units To Better Take On The Competition

An internal email surfaced in November that laid out the tech giant's plans to revamp several of its business units in a move that the company hopes will help it better address how customers are buying its networking and cloud products.

Specifically, Cisco's enterprise networking and data center networking units will be combined. Cisco renaming its existing cloud computing business to Cloud Strategy and Compute and expanding the segment to include server products. The restructure also moved Cisco's network orchestration products, which were part of the Cloud Platforms and Solutions group, to the company's Service Provider Business.

Cisco said it was not changing any of its products in these segments as a result of the re-shuffling.

The restructuring also included several executive reassignments.

The new enterprise and data center networking unit is now being led by Cisco's Senior Vice President and General Manager of enterprise networking, Scott Harrell, who spent the last two years leading the enterprise networking business unit and has an 18-year tenure with Cisco. Liz Centoni, a 19-year Cisco veteran and senior vice president and general manager of IoT is now heading up the new Cloud Strategy and Compute business unit for Cisco. Cloud computing's former leader, Kip Compton, has also moved to Cisco’s Networking and Security Business group.

Perhaps the biggest change-up at the time was Cisco's Dave Ward, chief technology officer of engineering and chief architect, who said he is stepping down to take a new role inside the company. Roland Acra, senior vice president and general manager of Cisco’s Data Center business unit, is his replacement, Cisco said.