T-Mobile-Sprint Merger Is Finally Approved: 5 Things To Know

Sprint and T-Mobile have the regulatory permission they need to close their $26.5 billion mega-merger. Here are five things to know about the biggest telecom merger we've seen so far in 2019.

Making It Official

T-Mobile and Sprint, the third and fourth largest wireless carriers in the country, respectively, last week received the long-awaited approval from the regulatory bodies to join forces in a $26.5 billion mega-merger.

The deal was hard-fought between the two companies; it was their third attempt at coming together. The Department of Justice had plenty of reasons for holding out on approving the deal, while the Federal Communications Commission granted its go-ahead in May. Still, there are plenty who still oppose the deal and the two companies won't be making their merger official just yet.

With a lot of moving parts to the T-Mobile-Sprint union, here are five things we know right now about the biggest telecom merger of 2019 so far.

Terms And Conditions

The conditions of the T-Mobile-Sprint merger dictate that once combined, the new company must divest Sprint’s prepaid business, Boost Mobile—and its roughly 9 million customers—and its 800MHz spectrum assets to Dish Network, which the satellite TV provider is buying for $5 billion. The "New T-Mobile," which is the name the newly combined company is going by for now, must give Dish wireless customers access to its network for seven years and offer standard transition services arrangements to Dish during a transition period of up to three years. Dish will also have an option to take on leases for certain cell sites and retail locations that are decommissioned by the "New T-Mobile," but Dish will also have to build out its own 5G network for customers.

The Justice Department's Concerns

After nearly a year of back and forth and a lengthy negotiation process, the Justice Department finally gave Sprint and T-Mobile the green light to come together last week.

The Justice Department initially wasn’t keen on the mega-merger because it had concerns that by combining two of the largest carriers, competition would decrease and that could mean price hikes for consumers. The Justice Department had been holding out on approving the deal unless a fourth carrier could be created to remedy its antitrust concerns. Reports in July of Sprint and T-Mobile selling off wireless assets were thought to potentially have been put in play to help the merger gain approval from the Justice Department.

What The FCC Said

Improving rural connectivity was the main motivator for the Republican-led FCC to grant its approval.

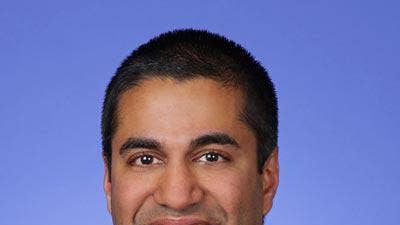

FCC Chairman Ajit Pai said in May that the FCC would grant the two companies permission to merge under the condition that Sprint and T-Mobile deploy a 5G network that could cover 97 percent of the U.S. population—including rural America—within three years and 99 percent within six years after the merger is closed. The newly combined company also had to agree to give 90 percent of Americans access to mobile broadband service with at least 100 Mbps and 99 percent with access to at least 50 Mbps, to which the companies agreed.

What Happens Next

So far, 14 state attorneys general have come forward this week, citing the same concerns the Justice Department had been voicing for the past year—that the deal reduces competition, even with the divestiture the companies made to Dish and the conditions that Sprint and T-Mobile agreed to in order to get the deal to close.

The states, led by New York and California, already filed suit to block the deal. The states, as well as the District of Columbia, will now have to show that the assets sold off to Dish may not result in a successful fourth carrier before Sprint and T-Mobile can close their merger, which the two companies already agreed to hold off until a judge grants approval.

The Fourth Carrier

The T-Mobile-Sprint tie-up will certainly change the landscape of the U.S. wireless market. Critics of the deal are concerned that Dish won't be a viable fourth wireless carrier option for consumers and that the satellite TV provider won't have what it takes to realistically compete with AT&T, Verizon and the “New T-Mobile.” There's also doubt that Dish will be able to create and operate a 5G network.

Dish Network, for its part, said during its second-quarter earnings call Monday that it already has plans for how it will take on the three wireless leaders. Dish founder and Chairman Charlie Ergen said that by acquiring Boost Mobile, the company won't be starting from scratch. Ergen also expects to ask for help from third-party providers in building out its own wireless network infrastructure.