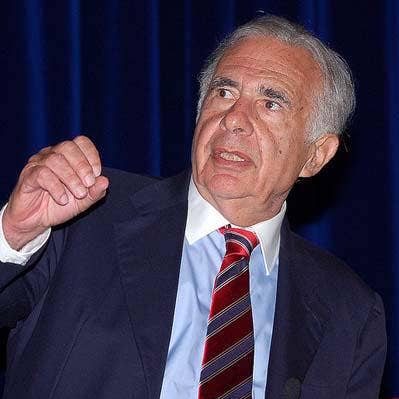

What You Need to Know About Carl Icahn’s Attempted Board ‘Takeover’ Of Conduent

A board member appointed by activist investor Carl Icahn resigned suddenly this week and filed a four page letter to the SEC in which he outlined a laundry list of grievances. Conduent said before the letter was filed, Icahn attempted to use it as leverage to get Conduent Board Chairman William Parrett to step down.

Icahn Stirs More Corporate Drama

The sudden resignation of Conduent board member Michael Nevin – a financial analyst with Icahn Enterprises -- and his four page letter excoriating the company’s board and management, was used as leverage by Carl Icahn over the weekend as he tried to get board chairman William Parrett to resign, offering to withhold the letter’s public release in exchange for Parrett’s departure, the company said in its own public filing.

“Mr. Icahn also expressed his desire that Mr. Parrett resign from the Board and that a new director chosen by Mr. Icahn be added to the Board. We believe Mr. Nevin’s “noisy resignation” and these related discussions represent an attempt to take control of the Company’s Board.”

Conduent was spun off from Xerox, which a year ago, waged its own proxy war with Icahn. The business process outsourcing (BPO) provider is largely made up of the parts of the company that Darwin Deason sold to Xerox.

Deason was Icahn’s partner in their fight with Xerox to scrap a potential sale to Fujifilm, and replace then CEO Jeff Jacobson and several board members. Deason and Icahn won that fight, installing a new board and a new CEO, though Fujifilm has filed a billion dollar lawsuit in U.S. District Court for breach of contract.

With Xerox a board member resigned in December 2017, which was accompanied by a public letter from Icahn. This fight with Conduent is beginning in a similar fashion, with an Icahn appointed board member leaving amid a public spat.

Why Did Nevin Resign?

Nevin resigned on April 8, and in a letter filed with an 8-K on April 11, he accused chairman of the board Parrett of being “asleep at the switch.”

“I believe the main roadblock to meaningful change has been the company’s Chairman, Bill Parrett. Every company needs a strong chairman who is willing to do the heavy lifting that is often necessary to rein in the natural autocratic proclivities of management – especially when the company is underperforming to the extent Conduent is. In my view, Bill has simply been asleep at the switch while the company has lost almost 50 percent of its market value.”

Nevin later added:

“My most important grievance with Bill, which I consider to be a major problem for the board and all shareholders, is that he seems uninvolved and appears to be willing to recommend that the board rubber stamp whatever management proposes – even though management has made a number of very disturbing and costly decisions over the last year,” Nevin wrote. “Chairman Parrett, and sad to say certain other members of this board, are the quintessential example of one of the biggest problems in corporate America today – too many directors simply do not give a damn.”

Conduent Denies Nevin's Accusations

In its own 8-K filing Conduent said since the company was spun off from Xerox seven out of the nine members of the Board, including Mr. Nevin, have served as directors. And during that time, “virtually every decision by the Board and its Committees has been unanimously approved.”

“We are highly engaged and fully focused on taking actions that are in the best interest of the Company and all of its shareholders. Since Conduent’s inception as a public company 28 months ago in January 2017, our Chairman, William G. Parrett, along with the entire Board, has guided the execution of the Company’s three-year transformation program.”

“Under the Board’s oversight, the Company is focused on expanding margins, executing investments into the business to modernize enterprise applications and technology stack, improving client engagement and delivering quality services, in order to enhance its position for future value creation," Conduent said. "Over the last 28 months since becoming a publicly-traded company, the Company has achieved a number of milestones, including key divestitures, completing a $730 million cost saving program, paying off almost $500 million of the Company’s 10.5 percent Senior Notes and the settlement of litigation with the State of Texas that was inherited at the time of Conduent’s spin-off from Xerox Corporation.”

Conduent CEO Serves On Kroger’s Board

Nevin pointed to a few specific gripes in his letter, including that CEO Ashok Vemuri was offered and, with the board’s approval, accepted a spot on the Kroger board of directors, which Nevin called an “ill-advised decision.”

“Ashok, with Chairman Parrett’s acquiescence, determined to take this board seat only a few short months after negative disclosures by Conduent resulted in the evaporation of almost half the company’s stock market valuation in a matter of weeks,” Nevin wrote in the letter. “How Bill could have missed or ignored this glaringly obvious red flag is a mystery. The only answer that makes any sense to me is that he was asleep at the switch, as he has been in so many instances during his tenure, or perhaps he was distracted by his myriad other responsibilities as a director of Oracle, Blackstone, Eastman Kodak and UBS Americas.”

The Search For A COO

Nevin blamed the “the failed processes at Conduent” to find a Chief Operations Officer, on Parrett as well. He said part of the chairman’s responsibility is to ensure the company has a succession plan in place, and a COO would be a part of that. As yet, the company has not found one, Nevin said.

“This important search has been going on for way too long. However, despite the length of the search, the only candidate whom I was given the opportunity to meet is the one that my fellow independent director Courtney Mather recommended to the company. This flies in the face of the many assurances I received from Chairman Bill Parrett that the whole board would be involved in the process of deciding on this critical hire. In addition, I believe the chances of the board selecting the one candidate with the qualifications to become Conduent’s next CEO, if necessary, are being blocked – despite the board’s clear mandate to bolster succession planning.”

“This is unquestionably a situation that screams out for Chairman Bill Parrett to assert his leadership position to prevent yet another hasty and ill-thought-out proposal from being rammed through. And yet he remains silent, allowing this important process that is so crucial for the future of Conduent to become a travesty.”

The Acquisition That Never Happened

Nevin then turned to an internal matter, Conduent’s attempted $200 million acquisition of a company that works in government contracts, which he called “extremely dangerous” and carried the potential for Conduent to lose its entire investment.

“The proposed acquisition was far too large, aggressive and imprudent relative to Conduent’s battered enterprise value and in an area where the company has never operated or proven able to extract synergies,” he wrote. “Most importantly, a large portion of the target company’s earnings came from its ability to qualify for government contracts under a small business program. When asked to stay on for a period following the acquisition to ensure that the company would continue to qualify for these contracts, the CEO of the target company refused, making it clear that purchasing this company would be bordering on ridiculous.”

Settling A Texas Lawsuit

Since it was spun off Conduent has been under fire by the state of Texas in a sweeping lawsuit that accused the company of Medicaid fraud and sought $2 billion in damages. Nevin said it was he and another board member that stepped in and forced the company to reach a settlement. He said Conduent had already spent $18 million in legal fees fighting the suit.

“While (Parrett) should have been leading the board in taking an extremely active role to remove this albatross, there seemed to be no settlement in sight until I and certain of my fellow directors inserted ourselves into the process,” Nevin wrote. “Once we did so, we insisted that serious settlement negotiations be initiated immediately. Within weeks, we achieved what couldn’t be accomplished in almost a decade – a $236 million settlement which removes this overhang, as well as the high legal fees that have seemed to be an annuity for the law firms handling the case.”

“My simple question is this: why couldn’t Chairman Bill Parrett have gotten this done? Part of the reason became painfully apparent to me once I began digging in to the situation – Bill simply did not have a good handle on the facts or issues involved in the case. Again, unfortunately the answer is clear in my view, which is that our Chairman has been asleep at the switch.”

Is Carl Icahn Barred From A Proxy Fight With Conduent?

According to Conduent’s filing with the SEC, Icahn is prohibited from waging a proxy fight over the company’s leadership.

“The Icahn Agreement, which includes customary standstill provisions, remains in effect. In accordance with the agreement, Carl Icahn and his affiliates are prohibited from running or supporting a proxy contest at the Company’s 2019 Annual Meeting of Shareholders and are required to support all directors nominated by the Company,” Conduent wrote.

Conduent did not respond to an email with follow up questions about Icahn’s alleged take over.