Why RPA Is Driving 10X ROI For Clients: CPP’s Pat O’Dell

CPP Associates Managing Partner Pat O’Dell says his company’s breakthrough robotic process automation solutions are driving as much as a whopping 10 times return on investment for customers.

RPA Solutions Are Making Customers ‘Raving Advocates’ Of CPP Associates

CPP Associates’ ability to deliver as much as 10 times ROI with breakthrough RPA solutions is making customers “raving advocates” of the CRN Solution Provider 500 superstar, said CPP Associates Managing Partner Pat O’Dell.

“That magnitude of 5X or 10X savings we are seeing with RPA is like what customers saw with EMC in the early days, with VMware when you went from 50 servers to 10 servers and with public cloud where ROI at the beginning was astronomical,” said O’Dell in an interview with CRN. “That type of savings is exciting. It moves the needle.”

CPP Associates, Clinton, N.J., No. 411 on the 2022 CRN Solution Provider 500 list, is hiring new talent to build out its RPA practice in wake of the off-the-charts ROI, said O’Dell. He said he was “shocked and excited” to see the quantifiable ROI numbers from projects with customers.

“The only reason I started in this business 35 years ago and still remain in it is to continue to help clients in a way that makes them raving advocates,” said O’Dell. “That is why I do this.”

A large fast-growing services company that CPP is working with is expected to save more than $2 million over a three-year period by automating invoicing, said O’Dell. The RPA solution is allowing the company to meet rising customer demand without hiring as many as six new employees in a tight job market.

An RPA solution that CPP delivered for a large multinational bank, meanwhile, is saving the customer more than $1 million on a $200,000 initial investment, said O’Dell. That RPA solution is saving cost avoidance in errors and even potential fines.

Finally, a global investment bank is looking at saving astronomical sums by reducing the amount of work on deals done by junior investment bankers in a game-changing solution that could automate 80 percent of the work those junior dealmakers were doing and in the process save the customer multiple millions of dollars, said O’Dell.

RPA is a “no-brainer” for CEOs, CIOs and CFOs looking for tighter business-IT alignment, said O’Dell. “I feel that any CFO that gives me 15 minutes to talk about RPA and what we are doing will find it is time well spent,” he said. “We are giving CFOs cost savings, efficiency gains and more options. We are saving them hundreds of thousands of dollars per year and helping them utilize the resources they have more efficiently.”

How did you feel when you saw the ROI customers were getting from robotics process automation solutions?

I was shocked and excited when I saw the five and 10 times return on investment that we are making possible for customers with RPA.

The only reason I started in this business 35 years ago and still remain in it is to continue to help clients in a way that makes them raving advocates. That is why I do this. I feel now the same way I felt when I was helping IT leaders save one day out of seven days with intelligent faster storage back at EMC in the ’80s and ’90s. I want the people who work with us to be raving advocates for CPP. I want them to say, ‘CPP saved me a lot of money.’

When I can see a 5X or a 10X ROI on an IT investment that excites my clients, that excites my team and that excites me.

That magnitude of 5X or 10X savings we are seeing with RPA is like what customers saw with EMC in the early days, with VMware when you went from 50 servers to 10 servers and with public cloud where ROI at the beginning was astronomical. That type of savings is exciting. It moves the needle.

What kind of game-changer is this RPA technology for C-level executives?

I don’t know any CEO or CFO that would not trade a six-figure investment for a seven-figure savings.

I feel that any CFO that gives me 15 minutes to talk about RPA and what we are doing will find it is time well spent. We are giving CFOs cost savings, efficiency gains and more options. We are saving them hundreds of thousands of dollars per year and helping them utilize the resources they have more efficiently.

The cost savings are not just about eliminating people. You can redeploy your talent and make people happier. People want good work that is substantive. They don’t want to be collecting data off websites or checking errors. They want to do something more. We are giving CFOs choices and options. We are helping CFOs use their resources more efficiently.

What are some of the most striking examples you are seeing in terms of RPA ROI?

We implemented an RPA solution using Automation Anywhere for a large multinational bank doing loan reconciliation. That’s an area where errors and omissions can be very costly and you face stringent regulations and potential fines. That customer is looking at seven figures in savings for a several-hundred-thousand-dollar investment. There isn’t a CFO who wouldn’t make that investment.

We are working with a large services company that was going to have to hire as many as six new employees to add thousands of new invoices to their monthly workflow. We are saving that company more than seven figures on a $100,000 investment. Instead of having to hire new people, they can do more work for less cost. They can either keep the cost savings, hire more strategically or redeploy people into higher-level positions. Anything that is rote and that is repetitive probably isn’t something people are dying to do when they have job options.

This is giving customers options to give people more creative work. It’s about letting the repetitive, robotic, rote work be handled with RPA. So you get a huge ROI and have happier people on your team at the same time. That is what I want to sell. And I believe with all my heart that there is not a CFO in the country—if they really listen to the returns we are seeing—that would not want to look into this more closely.

Can you provide more detail on the RPA solution you did for the multinational bank?

That client was paying junior bankers to go to the internet to do research for senior investment bankers making seven-plus figures. Sixty percent of what those junior bankers were providing could be automated. If we can automate even half of what those junior bankers are doing, we can save the company costs and at the same time make sure the company has a better chance of keeping those executives by giving them higher-level work.

The ROI there is massive. Think about it—if you have 15 junior investment bankers making about $200,000 a year, that is $3 million a year. If you can automate half of what they are doing, you can either save $1.5 million or redeploy those people to do higher-level work. We are giving the CFO options. We are not advocating to cut people. We are advocating to give people higher-level work so you can keep them.

Money isn’t the only thing that makes people want to stay with a company. The value of the work they are doing and the experience they are getting is very important.

How about some more detail on the work you are doing with the services company on invoicing?

In that case, we were able to allow a company to meet rising demand by automating invoicing. That saved them from hiring an additional six people in a tight job market. Now they are doing more work with less for less cost. The projected savings over a three-year period is more than $2 million.

Anything that is rote and repetitive isn’t something people are dying to do, particularly in a market where they have job options. This is allowing customers to give people more creative and higher-value work with the repetitive robotic, rote stuff being handled by RPA.

This is all about giving customers a huge ROI and at the same time making for happier employees. That is what we are providing customers.

Is the automation explosion taking hold because of the pandemic, the Great Resignation and the difficulty finding talent?

Yes. I think it would have happened anyway because business and IT have been aligning for some time. CFOs, COOs and CIOs are becoming more integrated in process. This would have happened without the pandemic. But certainly the fact that everyone has to pay more for good talent—as much as 20 percent to 30 percent more depending on the skill set and the market—and that people are more willing to walk away from jobs is having an impact.

How big is this RPA opportunity?

This opportunity is massive. It is the biggest opportunity right now. It’s the biggest opportunity since public cloud appeared and grabbed 25 percent of the [IT] market.

It’s similar to the huge opportunity that VMware brought to the channel with virtualization.

I’ve been in this business since the ’80s. EMC’s intelligent cache of storage revolutionized IT. VMware revolutionized IT with server virtualization. Public cloud with AWS and Azure have revolutionized IT. RPA, automation and analytics is the next wave.

When I was at EMC, we increased the performance on data transfer for storage as much as 50 percent on some jobs. That could save the IT team one day out of the week or more. You could quantify the dramatic savings from that. It could be hundreds of thousands of dollars a month or even a week depending on how big your IT team was.

With VMware, IT customers were able to do the same amount of work with 10 servers rather than 50 servers and you saved the cost of the other 40 servers.

With public cloud you used to have backup data centers with companies that would invest several million dollars on a data center and then $1 million to $1.5 million for a backup data center. In some cases, you still need that. But many customers are now doing all their backups in the cloud. They are archiving to the cloud.

What’s the percentage of complex high-value business processes that have been automated?

In my experience, when you look at the Fortune 1000 less than 20 percent of mission-critical business processes have been automated. In the commercial enterprise and SMB, it’s even less.

What is driving the RPA opportunity?

I think the marrying of IT with lines of business over the last five years is driving this. Business unit leaders have become much more integrated with IT. That has increased the focus on ROI and business processes. IT is being viewed now as a strategic weapon, not a cost center. As businesses link IT more into their business strategy, it is easier to talk ROI.

As business and IT gets more and more integrated every year, RPA and automation in general is going to be much, much bigger. I see it as the fastest-growing market right now.

What kind of investments is CPP making to capitalize on the RPA opportunity?

We are hiring new talent as part of building the team and also resourcing existing talent, focusing them on automation and RPA. We are also partnering with the vendors who all have their individual consultants, whether they are badged or 1099s.

How has CPP used automation to power its business forward?

We have our own homegrown automation tool that enables us to do our infrastructure anywhere assessments for customers. That allows us to collect and report data much faster. We do those assessments for less than $10,000 and in less than two weeks. That’s because we have automated the process, collecting the data, integrating it and then reporting on it.

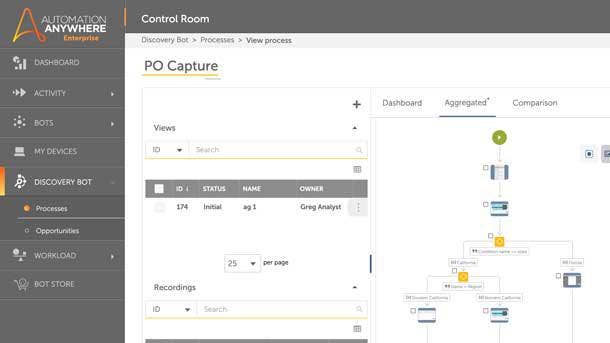

We are also using Automation Anywhere to automate our own internal marketing processes. We are now putting out three times as many marketing campaigns than we used to. We are also now three times quicker with these campaigns.

Furthermore, automation has saved our sales reps about 10 percent of the time they used to spend on internal reports, including sales funnel reporting. That 10 percent is a big cost savings. That is all a result of Automation Anywhere.

Talk about the Automation Anywhere relationship.

We looked at a lot of machine learning and AI tools, but the ROI was harder to quantify with them.

RPA and the work we are doing with Automation Anywhere starts with the basics. It is basically, ‘Let’s take out the errors. Let’s automate the easy stuff that has an ROI that is quantifiable.’ We quantify everything in ROI dollars.

We looked at many, many tools and we use many tools for machine learning and analytics. We found Automation Anywhere was the easiest to quantify a large return on investment.

That’s why we decided at this point from an RPA standpoint to focus on Automation Anywhere. We love our relationship with them. They have been a great partner. They have tools that are cloud-native. We felt the fact that most of the analytics are being done in the public cloud gives them an advantage. They have been really good about training us and they have a deep bench of 1099 consultants that we have been able to interface with.

What other RPA tools have you looked at?

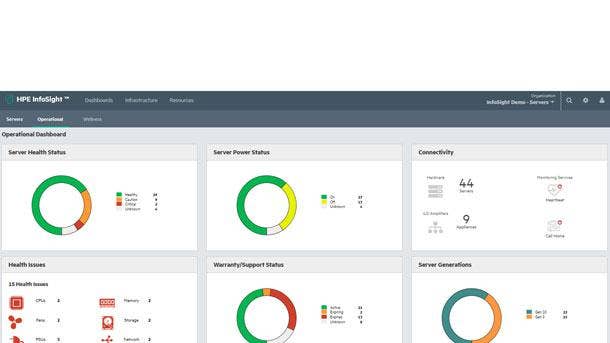

Certainly, HPE InfoSight is an analytics tool from HPE that all our clients are very familiar with. We use it all the time. We have used some other tools from HPE—CloudPhysics. We also use CloudGenera as part of the suite of tools we use for our assessments.

We have looked at Zebrium for root cause analysis. We have looked at Kore.ai for sentiment analysis. We looked at Datarobot, MapR, BlueData and some voice recognition technology.

The business ROI with Automation Anywhere is very easy to quantify.

What is the Automation Anywhere advantage from your perspective?

Automation Anywhere provides very low-cost, very efficient and very flexible bots and they combine that with services either through their partner or internally that makes it easier for customers to use. There is an element of software and services here that is critical. That is something that we do as the integrator.

What is the sales cycle and how long are the engagements?

The sales cycle is certainly several months or longer because we are teaching IT new ways to think about ROI and we are also making new relationships in the C-suite from a finance and operations standpoint. It takes some time to get everyone on the same page. As far as the implementation, it is several weeks to multiple months depending on the complexity. Typically, customers start with a proof of concept. As they expand it, they grow into it. This is a relatively new market with new vendors. So it’s an education process. There is a trust that has to be built.

What are you seeing among CIOs and business alignment and why the time is right for RPA?

Over the last several years, whenever we speak with a CIO or senior VP level they are speaking more like the CFOs or COOs. They want to know about cost savings and cost avoidance. They want to know what the ROI is on a project. They want to know will it help them sell more or increase profits. They are speaking less like the old VP of information technology from the ’80s, ’90s and early 2000s and more like CFOs, COOs and the business unit leaders.

The world moves too fast and is too competitive to have disparity within an organization. You can no longer have operations, finance and IT working against each other. You will not survive as a company. CEOs have understood that for many years, and now all executives are rowing in the same direction. That means I can speak to IT people about ROI, cost avoidance, cost savings and productivity gains and they are interested.

Ultimately what is going to be the economic impact on the channel from RPA?

Forward-thinking VARs need to get involved with RPA. We all know about supply chain constraints, hardware costs are going up, supply is less predictable, and we also know clients are more solution-oriented and more focused on ROI and integrating with business.

It is very, very difficult to get 5X or 10X ROI with hardware and software anymore. It has to be a total solution encompassing everything. That is where we see RPA coming into the picture.

We are working hard with our team to identify the right IT, analytics and process automation tools. We are working hard to quantify the ROI. When we quantify the ROI, that’s when we get the attention of senior business leaders and IT people.

RPA with Automation Anywhere is the easy stuff. If you are a trainer and you are working with someone that has never exercised before, you don’t put them right into Crossfit. First you give them the basics. You work with them first on changing their diet and getting them to do light exercise. If you do a good job there, then you move on to more complex workouts.

That is how we feel about RPA and Automation Anywhere. If we save you $1 million by spending $100,000, don’t you think you would listen to the next thing I asked you to do with RPA?

What we are doing is showing the business ROI and helping customers be more efficient, automated and analytical through a variety of tools. This is the way that we make clients lifelong customers that are raving advocates for us with lifelong trust. That is the only reason I am in this business.