Nutanix’s Dheeraj Pandey Willing ‘To Walk On Fire’ To Build $3 Billion Company

In an interview with CRN, Nutanix CEO Dheeraj Pandey talks about Nutanix stock, container plans with IBM and Red Hat, coronavirus impacts and momentum with Hewlett Packard Enterprise.

Dheeraj Pandey: ‘You Have To Walk On Fire To Really Build A Large Business’

Nutanix CEO Dheeraj Pandey isn’t worried about his company’s recent stock drop. The co-founder and IT innovator is determined to build Nutanix into a $3 billion business regardless of any stock market speed bumps.

“You have to walk on fire to really build a large business,” said Pandey in an interview with CRN. “Where we are with our $2 billion to go to $3 billion, we’ll be crossing yet another chasm. I don’t bemoan this.”

The San Jose, Calif.-based hyperconverged infrastructure pioneer turned software and subscription star recently reported second fiscal quarter software and support revenue of $338 million, up 14 percent year over year. The company’s software and support billings reached $420 million, up 12 percent compared with second-quarter 2018. However, due to concerns of the coronavirus and a faster-than-expected transition to subscription, Nutanix slightly lowered its current fiscal year revenue guidance, which caused its shares to plummet.

In an interview with CRN, Pandey talks about his company’s future, container plans with IBM and Red Hat, momentum with Hewlett Packard Enterprise, and how the channel needs to be “reinvented.”

Why do you think Nutanix’s stock dipped so much in after-hours trading right after earnings?

First of all, in after-hours trading, the volumes are very low. These things restore to balance over the course of the next three or four weeks. Most of the news that you see is bot-generated. It’s not CRN in-depth writing, for example. It’s computers going in and doing that. A lot of the selling also is happening by computers and bots, algorithmic selling. I would actually wait for the next few weeks where people look at this a little bit more closely and double-click on our narrative where we’ve constantly talked about how the business is robust. We had a really good second quarter. At the same time, this is the first time we’re facing an environment that is murky at best and we have to be cautious at least for the next three to six months.

Do you get upset or nervous about the stock market’s reaction to Nutanix earnings?

One of my favorite words in life is a Japanese word called ‘gaman.’ It means endurance and perseverance and patience. A business building and a company building is all about that. Our subscription transition, getting out of the hardware business, going upmarket to our large customers—all these things are part of the journey in building a very large business.

At the end of the day, if you look back at all these other companies that went on to become larger over time, they had to go through this. Look at Microsoft’s stock from 1991 to 1994—it basically hovers around $1.70 to $2.95 per share in those three years. Look at Adobe’s stock from 2010 to 2014. Look at Red Hat’s stock from 2010 to 2014. You have to walk on fire to really build a large business. Where we are with our $2 billion to go to $3 billion, we’ll be crossing yet another chasm. I don’t bemoan this. I think it is all par for the course. Most of the world should be, by definition, a naysayer because they’re like, ‘How could you become a larger company over time?’ We just have to keep our heads down, work on things that are in our control and not worry about what we’re not in control of.

How bullish are you on Nutanix’s growth in 2020 and why channel partners should double down with you this year?

Last year, we were growing revenue between negative 1 percent to 1 percent [year over year]. Then we saw 3 percent growth and then 5 percent growth [year over year]. Now we’re talking about 12 percent and 14 percent growth [year over year]. The next two quarters that we are guiding for in the fourth quarter of 2021 is 25 percent growth at the midpoint of the consensus. So this transition was very important for Nutanix to go through. We had to go through the belly of the fish, as they call it, in regards to subscription.

Partners should really feel good about our large customer business and, at the same time, we are coming back with a bang in the commercial space with HPE and with our partners. There are some great incentives for our partners, not just rebates, but also managed services and cloud services. So I would say this is the best time for Nutanix because we feel like we are really a multi-cloud, multi-product company.

Just how much traction are you seeing with the new HPE partnership?

Our HPE DX related business is continuing its strong performance and accounted for 117 new customers in the second quarter alone. Customers clearly see the value of working with two world-class technology partners and together we’re winning competitive deals. Nearly one-quarter of our new customers in the commercial segment purchased Nutanix software in HPE servers.

Both companies are bringing customers to each other and learning how to co-sell and co-market. For example, in a win worth more than $4 million, a Global 2000 health-care company took advantage of subscription licensing to run our cloud services on HPE servers. We also saw another $4 million subscription deal this quarter with HPE at a Fortune 100 financial services customer who has spent more than $23 million lifetime with us. … So our synergy with HPE is strong.

Red Hat

Are you going to do more with IBM and Red Hat this year?

The last couple of years we’ve actually partnered with IBM on the OpenPower platform and AIX virtual machines, and how do you really modernize the AIX platform running on OpenPower. We have done a lot of good work with IBM GTS [Global Technology Services] as well.

I think containers is a strategy that will actually bring us closer to IBM and Red Hat. We’re doing a lot of work on containers and for Red Hat the big strategy is OpenShift. This is a space that we should watch out for. It’s early days. I’m not going to speculate. We’ve done a lot of good work together to help customers modernize out of not just physical infrastructure, but also virtual machine infrastructure.

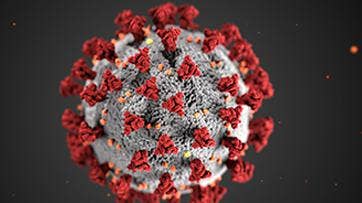

Do you have any big concerns around the coronavirus?

We really believe that the next six months, we have to be watchful, especially in APJ [Asia-Pacific and Japan]. We have been cautious about it. Otherwise, America and Europe are pretty positive in their outlook, but APJ we don’t know. Japan has a fiscal close in March and we have some very large deals that we are tracking there and we have to be cautious about it.

We’ve had great momentum in large deals. We’ve really gone deep with large customers, especially the Global 2000 and beyond. New products are doing a good job—about 31 percent of our new deals actually have new products attached with them, up from 21 percent a year ago. In the last quarter alone, we’ve had 52 deals greater than $1 million, 11 deals greater than $3 million, and three of them greater than $5 million deals. Some of them have HPE in there as well. So some really good traction with HPE both in commercial as well as in the large enterprise space.

What is your vision for the channel?

If you take a step back, the channel has to be reinvented for cloud. A lot of this is not going to be about big, hardware box selling. It’s about selling subscription. Channel partners have to learn the same jargon of total contract value, annual contract value and renewals, and things of that nature. We’ll be one of the companies to really carry the torch of this channel reinvention.

The fact that we take the same software to the public cloud means we make our channel partners ready for lift and shift. Channel partners need to look at professional services, managed services and cloud services—all three of these are very important in this new world. The way we are dealing with sales compensation is to really coach our salespeople to think about total contract value, annual contract value, subscription-based selling and how do you make money on that. Just in the last six months alone, we’ve seen a strong uptick in partner-led deals—that’s because they’re also seeing the value of subscription, but more so because we have more feet on the ground in the commercial space. We think the way for them to not just survive, but thrive in the world of cloud is to think hard about lift and shift. If they can help with the lift and shift, they can also compete with global systems integrators.

How do you feel about this year and why should partners be pumped?

All in all, we feel great about the business. We have transitioned faster than anticipated to subscription with almost 80 percent of our business now subscription. We had previously expected to come to that 80 percent number by December 2021. I would say we’re 18-months-plus ahead of plans. I think our channel partners should look at that as a very positive thing. The fact that we can take our software anywhere, not just on-premises but on any server, any hypervisor, also take it to the public cloud as well—that’s going to be a big, big thing for our channel partners to become cloud partners and cloud service providers. It’s going to be a great year for us and our partners.