Leslie Maher On The ‘Phenomenal’ HPE ProLiant Security Advantage

Hewlett Packard Enterprise North America Hybrid IT Compute Vice President Leslie Maher says HPE’s ProLiant servers have a ‘breadth’ of security features anchored by the ‘silicon root of trust’ that sets the portfolio apart from any and all competitors.

Getting More Aggressive In Server Share Battle

Hewlett Packard Enterprise Vice President North America Hybrid IT Compute Leslie Maher says HPE is getting more aggressive to grab share in the intensely competitive server market.

“We are very much leaning in and making the right investments to result in share gains and displacements of other vendors,” said Maher, the driving force behind HPE’s “Inner Circle” ProLiant strategy session this week aimed at driving ProLiant sales gains with 41 of HPE’s top partners.

“We're sharing with partners the things that really set us apart—our real differentiation,” said Maher. “We look at these ProLiant servers and sometimes people refer to them as volume servers. But the reality is there's a tremendous amount of value in those volume servers, and it's going to help our partners and HPE win.”

As part the stepped-up ProLiant sales blitz, HPE recently slashed its Smart Buy Express ProLiant server pricing —its biggest price cut on the ready-to-ship ProLiant offerings in years. HPE also recently relaunched new aggressively priced versions of the SMB workhorse ProLiant DL160 and the build-to-order DL180 servers as part of an SMB market-share grab.

The ProLiant sales charge includes a commitment to lean in and compete aggressively for new logos and competitive displacements, said Maher. That includes a more aggressive HPE stance on special-bid pricing decisions.“We’re looking at any opportunity that requires an investment and we make a decision on the spot,” she said.

What is the mission for the partners gathered here at the ProLiant Partner Summit?

We want partners to be really charged up to seize the opportunity. I think we are really poised right now. We've got a fantastic portfolio that's really differentiated, but we also have the right organization structure here in North America. And we're really clear in our priorities. Our priority is we want to be aggressive in the market. We want to win in the segments we play in and be very aggressive.

We're sharing with partners the things that really set us apart—our real differentiation. We look at these ProLiant servers and sometimes people refer to them as volume servers. But the reality is there's a tremendous amount of value in those volume servers, and it's going to help our partners and HPE win. So we're really excited. We think partners are energized and charged up about it.

What is the big story right now on ProLiant in terms of the feature set?

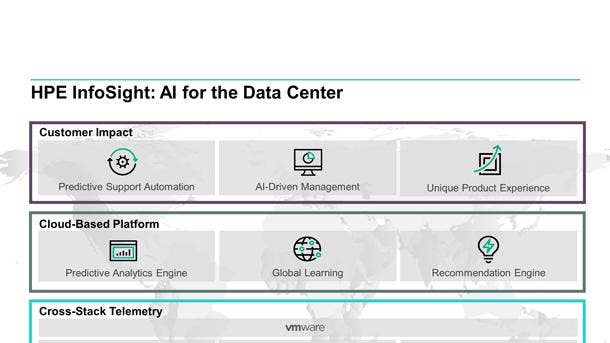

If you look at our servers, we have a phenomenal security story and security matters right now. A few years ago we introduced the silicon root of trust [with ProLiant]. We refer to ProLiant as the industry’s most secure industry-standard server. Now we talk about the end-to-end ProLiant security story. It’s so much broader than that. There is the prevention that silicon root of trust provides. There is also detection and recovery. There is the ability to use InfoSight to understand behaviors. Our servers have a breadth of security now that differentiates us. When customers truly understand what we have for security, they recognize the value in the ProLiant brand. Customers are benefiting both from the security capabilities and from InfoSight, which is making the systems more manageable by constantly monitoring system parameters and telemetry.

We have also expanded the portfolio. We have refreshed with Intel’s latest processor and have AMD servers. That is really resonating with customers as well.

What is the big difference between HPE and the competition in the server market?

First and foremost, it is price/performance—the value of the overall ProLiant server. The history of reliability—the latest capabilities with performance and innovation. Customers know that when they are buying an HPE ProLiant server they are going to have the latest state-of-the-art technology currently and going forward. That is certainly a differentiator.

The other one is security. There are a number of platforms in the market that are not as secure. We believe we are the most secure industry-standard server. Security matters. We have had customers who have wanted to see the security difference between our platform and other platforms, and we have done some demos that show that differentiation.

Then there is the openness and the breadth of the portfolio. We are the best-destination infrastructure platform for workloads in the industry. We support the broadest set of workloads. That is the other reason why customers turn to ProLiant.

How big a game-changer is the AI predictive capabilities on ProLiant with InfoSight?

InfoSight is a huge deal. It started with Nimble and went through the storage line and now into servers. We are featuring that here with live demos that capture for partners how they can build a business and a practice around InfoSight.

There are thousands of data points and system parameters 7x24. That data provides so much more insight and intelligence to help customers. There is an opportunity around how partners can help customers improve their data center experience using InfoSight.

The whole goal here is how do we help partners potentially build a service or solution around that. We are very excited to see what they want to do with InfoSight.

We are seeing very rapid monthly adoption of servers under InfoSight—thousands of servers. Customers are really responding to it. It’s a no-brainer: Install some software and you start to get insights into your server environment that weren’t available before. Customers are absolutely responding. It makes so much sense. Customers get so much value from this. We have seen very good adoption. We want to work with the channel community to accelerate that.

Can you talk about the ProLiant SMB sales offensive and the recent price cuts?

SMB is one of our priority focus areas. We want to grow in the SMB with our transactional business. So we reintroduced some new products—the DL160 and DL180. Those are products with the right performance and manageability at the right price points. We brought those back to the market and we have gotten great feedback on that. And then we also took some very aggressive pricing actions.

So we went and made sure that not only do we have the right products, but that we are very competitive in the everyday pricing with Smart Buy Express. We had pretty aggressive pricing actions both in February and April.

We're also launching a marketing campaign to really support the SMB space as well, giving that air cover for our partners to talk about our SMB hybrid IT solutions. We think all of this is going to really energize our partners.

We’re going to be listening to partners versus doing all the talking at this event. If our partners think that we need to do more to support them, we’ll respond. We’re really excited to get that feedback. That is one of the outcomes we want here at the Summit. We want to be very transparent about where we’re going.

Does this represent a new commitment to compete more aggressively for that bread-and-butter ProLiant business?

We never turned away from our ProLiant base. It is an enviable base in terms of our rack and tower servers. But as we started to message other products like our storage portfolio and Synergy and SimpliVity, I think we needed to amplify and really remind everyone how important the ProLiant installed base is.

We are very much leaning in and making the right investments to result in share gains and displacements of other vendors. We have seen that pay off in the first half. We have won some new customers as a result of our more aggressive posture.

We have been telling our channel that we want to work together for the right opportunities. Both myself and Dan Belanger—who runs the North America business—have been very receptive to the right kind of investment proposals. We think that is really going to result in share gain.

What is the message in terms of competing for the bread-and-butter volume server business?

We made some decisions last year, and we are looking at all those with fresh eyes. If a partner comes forward and says, ‘I think we can do something big here together,’ we are very much willing to entertain all those conversations. So we are very much leaning into the opportunity.

Can you about the Nutanix announcement, which puts the Nutanix software stack on ProLiant?

Partners and customers are pretty excited that they now have an option to run Nutanix on a ProLiant platform. That has received a very positive response, particularly from our partners.

When we talk about hyper-converged, we want to start the conversation with understanding the customer requirements. We think a lot of those requirements can be met with SimpliVity but, if they can’t, customers now have a choice.

If customers prefer Nutanix, we want to ensure that we are the best infrastructure they are going to run Nutanix on. Because of things like the security and performance of ProLiant there are a lot of customers who wanted that option. Now they have that option. Partners are excited about that because they have been hearing customers ask for an HPE ProLiant platform for the Nutanix software. And then you wrap it with GreenLake, which really gives customers a hybrid cloud solution. Our partner community sees the opportunity for sure.

Our ProLiant servers have such a fantastic reputation with our customers. As we broaden our relationships like the Nutanix announcement and continue to work with companies like VMware with vSAN, we are giving customers choice. Customers want to be running those workloads on ProLiant. The message we have for our partners is we are expanding our workloads, being aggressive and focusing on markets where there is growth.

How big an opportunity is therefor partners to make money in the SMB and midmarket with ProLiant?

Rack servers are still by far the bulk of the x86 market. Ultimately, customers don’t pick a server type—they start with a workload. The rack servers and the ProLiant servers run virtually every workload customers care about. They care about Hadoop. We have a large population of our Hadoop environments running on ProLiant. We have hyper-converged environments that run on ProLiant. Even big data workloads run on ProLiant. So some of the hottest applications that people want to run run incredibly well and are optimized on our ProLiant base. So there is still continued growth for really critical, value workloads.

Are you seeing public cloud repatriation?

We do see that. There are costs that customers are waking up to and they are looking to repatriate, whether it is on a ProLiant server or Synergy or SimpliVity hyper-converged. It’s not necessarily just ProLiant. The breadth of our portfolio supports the workloads as they get repatriated.

What are the goals in terms of market share when you look at the specific market segments?

We have been doing well in our classic enterprise segment. Some of the aggressive posture we have taken is to continue supporting what we have been doing there. We have also set our sights on ensuring that we are driving the same kind of growth in the SMB and midmarket segments. That’s why we have talked about the right products and the right pricing there. We think there is a real share opportunity for HPE in those markets.

Can you talk about the sales market alignment for ProLiant in North America?

Our North America field organization is really aligned around market segments [SMB, midmarket, enterprise], which lets us really fine-tune the go-to-market. That allows us to really be specific with our offers. So our approach with our channel for SMB is different than what we might do in our large enterprise accounts. We have got a really fine-tuned go-to-market model and a strong channel organization led by [North America Channel Chief Terry Richardson, who is an outstanding leader. The time is right. Seize the day.

What are some of the key opportunities for ProLiant at this point in time?

We have some initiatives we are partnering on whether it is by accounts or market opportunity like the Windows Server 2008 end of support [which ends on Jan. 14, 2020].That is a great mutual opportunity for us. Aligning with us on those with partners providing their own capabilities to support that is huge.

We want partners working with us when it gets tough and competitive. We have encouraged every partner for the right opportunities to make sure they have HPE’s ear. We want to support them.

How big a deal is that ability for HPE to respond quickly to competitive situations?

We have seen a marked difference with a huge effort from us to be flexible and responsive. What I mean by being flexible is when we learn something is not working the way we intended it to, we make decisions and we make them fairly quickly. You can see that with some of our pricing actions. We took a look at the pricing, decided it was not where we wanted to be, and we made some changes.

We have the ability and are empowered to review the right opportunities and make decisions that day on the spot. That typically involves myself and Dan Belanger. The idea here is the market is not going to wait for us, so we are going to ensure that we review it, make a decision, and get it done.

What are the key messages for the ProLiant market-share match?

We have three key messages for the partners: One, be aggressive in the market. Two, it’s not just about price. It is also about value of the volume servers. Those differentiate and provide unique value to our customers. We want to win more with the value of the platform, not just necessarily on price. And three, how we grow in the transactional space. Each one of those has a set of actions. We think each one of those represents opportunities for partners to have a specific [sales] plan. As we run those plays—many of which we are running today—we can provide feedback to the partners on how they are doing overall and how they are participating with us.

How does it feel to get more aggressive on ProLiant?

I’m loving it. When we discussed putting this together, it was all about amplifying the message. It has always been there. There is tremendous innovation and the platform has the features, capabilities and performance. We just wanted to amplify the message because there is a lot of great technology and innovation coming out of HPE. I wanted to make sure that we weren’t taking ProLiant for granted. It is an enviable installed base. Anyone would love to have our installed base and our technology. We wanted to make sure our partners know that this is a really important part of the portfolio. And there is a tremendous amount of innovation. I think they are going to leave here very excited about the things they hear and see around security, InfoSight, partnerships and our road map.

We are really thankful our partners took this time to come to spend with us. We are really excited and charged up. We are so well positioned right now. We are aligned to the market and the channel needs. We have tremendous energy behind us.

How do you feel about the road ahead for ProLiant?

We are already seeing some really positive momentum. Now it’s a matter of taking it up another couple of notches. We are going to be that strong server leader now and going forward. We have got the road map. We have shown the innovation. We have got the right partnerships.

What has been the reaction to the price cuts?

Partners were very much taken aback that we went as aggressively as we did. The pricing changes were not small incremental changes. We made some pretty large adjustments because we felt that was where we needed to be in the market to be competitive. I think we signaled to the partners that we will do the right thing to be aggressive in the market.

Is this a case of HPE getting back into the server share race?

I never felt we weren’t in it. I think we are being loud and proud. We are amplifying because there is a lot of tremendous momentum and success. We value our installed base, but we are also looking very much for new logo capture.