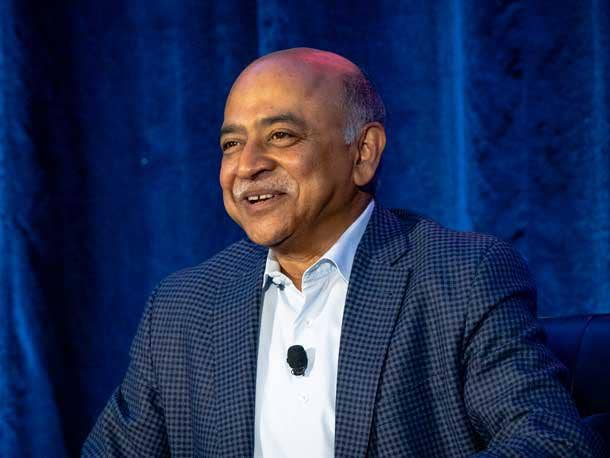

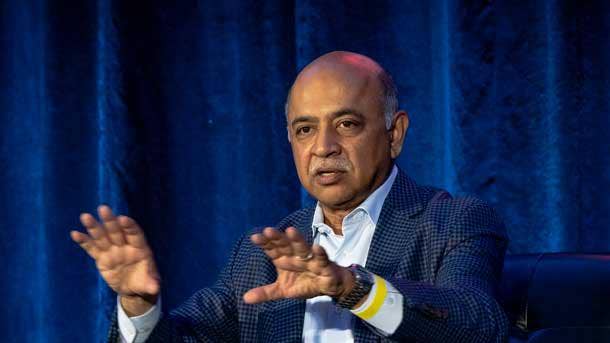

IBM CEO Arvind Krishna’s 10 Boldest Statements From Best Of Breed 2021

IBM CEO Arvind Krishna talked Red Hat integration plans, supply chain issues, partner opportunities, and took aim at VMWare during a Q&A onstage at the Best of Breed Conference 2021.

Krishna Takes Center Stage

IBM CEO Arvind Krishna has his sights set on doing more business with the channel. In fact, the tech leader wants to double IBM’s channel business over the next four years.

That’s because IBM can’t focus on all the innovation needed on top of its massive product portfolio, Krishna said Monday at the 2021 Best of Breed (BoB) Conference in Atlanta, hosted by CRN parent The Channel Company. That’s where the channel comes in.

Hybrid cloud is the biggest area of opportunity Krishna sees for both IBM and its channel partners. The company is actively competing against others, including VMWare, for cloud computing and virtualization dominance, ever since Big Blue’s acquisition of open-source software leader Red Hat two years ago. And as customers seek out more flexible, multi-cloud solutions that include public and private environments, security becomes an even bigger play for partners.

Krishna talked Red Hat integration plans, supply chain issues, partner opportunities, and took aim at VMWare during a Q&A onstage at the Best of Breed Conference on Monday, moderated by The Channel Company’s Executive Chairman Robert Faletra and CRN News Editor Steve Burke. Here’s what he had to say that solution providers need to know.

On how the channel can invest with IBM

Hopefully, we’ll convince you that we’re dead serious about [the channel]. So, let’s just back up a little bit [and] let’s acknowledge that it has to be an economic equation for our partner and for us. And by the way, only the client really gets a victory. So, it has to be a win, win, win. Meaning it has to be a win for IBM, a win for the partner and a win for the client. So, to begin with that perspective, we’re not coming into it and saying, “hey, all the monies and all the profits are going to IBM.” It’s got to be mutual. Then you got to say, where is it to be able to find differentiation? We don’t do everything. With Red Hat in the portfolio, with Cloud Paks, and we’ve agreed not to compete with the channel, we’ve got a portfolio that’s impressive [for] the price. So that means there is money in it for all of us. So now, we talk how to help [partners] make money in addition to what we do on rebates, and market development funds and all that. I just wanted to put a big enough down payment, that people understand the seriousness and that it’s not a minor investment, or an “oh, by the way.”

To reach the vast majority of the market, it’s got to be through [partners]. The amount of innovation that’s needed on top of the products we built is so massive. As we begin to talk through the various pieces, I have to come down and say that I’d like to see that over the next four years, we double the business that we do with the channel. If you want to double what we do in four years, that’s going to be an 18 percent growth. That means less direct and more channel.

On VMWare’s comments on IBM’s “monolithic architecture”

It’s interesting. I don’t know whether [VMWare President Sumit Dhawan ] is looking in a mirror. Which one is more monolithic? With Red Hat, you can go buy Ansible, you can buy Linux, you can get OpenShift … but I’m not surprised. Apparently, we have a target on our back.

I’ll go back to the original thesis on the money piece. So, two, three years ago, I said the world is not going to go to singular public cloud. The world is going to multiple [clouds]. Why multiple? because of resilience, and where the footprint is. There are multiple public and private clouds — that’s where the enterprise is going to be. You’re going to have multiple public [clouds] for resilience. And local or private for all the reasons of regulation or laws … Enterprises might say, “For some workloads, I need to be flexible. I need to have the ability go across a few public [clouds] or the private, and them if I’m on public and something changes, I might want to be back in private, and that’s the space we’re going to play in. That’s the opportunity we’re going after. Maybe, as I said, if someone is looking in the mirror, with monolithic, non-open source [offerings], or you can say, “Hey, Linux is already the operating system that really cares about containers, and can go across both private and public, and get into the catalogues of all the big public guys. For example, Red Hat sits in the catalogs of both Amazon and Microsoft. You can put things on top and let’s go give people this ability to go process this environment.

On IBM’s Red Hat integration and keeping separate channel programs

I have to have two programs, because Red Hat is neutral. And we committed to that when we brought them in. They work with five thousand different hardware providers and all the chipsets on the planet. All of that has to be maintained. How I preserve that independence and that neutrality? So, it’s not so much a program approach. When I think about the footprint of the market, the use cases, The Red Hat partner has to have the ability to say, “No, I’m neutral. I can take whatever I want.” That’s how I think Linux has taken over as the de facto operating system in the world. But we will take it under advisement. Can we do more in terms of maybe combining the morals, I’ll call it, but not necessarily the actual partner go to market. I have to leave that choice to the market.

On partnering with public cloud leaders

Do customers really understand the full economics of public cloud and the true cost of public cloud? It’s not a surprise — if it’s a business with a 50 percent margin, that means 50 percent of the budget is going to the provider of public cloud. There is a number in which it makes more sense to do it yourself. I actually believe that is the flexibility of where you want to place it and you cannot put all your eggs in one basket because if at some point, [the cloud provider] stopped innovating and you get locked in and takes you forever to get out. In terms of where you want to go here, it’s got to be about flexibility.

Amazon and Microsoft — of course they are partners. On a hyperscale level, they’re going to be a part of the infrastructure for every one of our clients. Why would I want to compete with that? That’s going to be a beast.

On supply chain challenges

The semiconductor shortage is real and it’s not just in consumer electronics and autos. It’s true for us in high end servers. We may see massive shortages, if we could see more supply for storage systems, we could probably opt for supply side for storage by about 20-30%. I think [supply chain issues being fixed] by 2022 is an optimistic thing. I think it’s more likely 2023-2024.

It’s not the labor cost. It’s actually more much more about permissioning and governance. I think it’s essential to get 30, 40, or 50 percent of onshore capacity [for semiconductors].

On potentially raising the prices for computing

I think there’s always been a question of raising prices. But you got to think through. If you think about Moore’s law, it said every 18 or 24 months, you get a doubling [of price/performance/value produced by semi-conductors]. You’re no longer going to get twice the capacity at the same cost. However, I think there is going to be price variations as the labor cost goes [up]. But I think it’s more like 5-6 percent, not 20, 30 or 40 percent.

On how IBM’s technical teams are working with the sales teams

The answer to that is we actually grew first quarter, second quarter, and you’ll see when the third quarter comes out next week. So, if we can grow, and we weren’t getting growth before, I think that’s one outcome. Why did we make these changes? In today’s world, I can go the website, I can go read Reddit, I can ask a friend. If you think that a kindergartner has lack of attention — most people just start using their new phone without reading the 10,000-page book. Then if you like it, you can ask a friend about the next new feature … that’s kind of how we want to work together to get stuff done.

Just last week I said we are now 44 percent software. We are 30 percent consulting, we’re 18 percent hardware, and I would say the two things we want to be known for is technology and consulting.

On IBM Security

How many security events do we monitor? Close to 150 billion events a day right now. It was 75 billion three years ago, so you can see how that’s growing. So, when you’re doing 150 billion events a day, you’d ask yourself if maybe we learn a little bit from one event and how we can apply it to another one. And really put all that into intelligence and cloud-based software and infrastructure s we can take it out and scale it to everyone. [People really care about] the value of the data, so you have to help your clients protect their data.

We offer security intelligence, threat management, incident response, along with all the monitoring you can do to make sure that you’re getting intelligence from everyone, not just yourself. I think that is the value of the portfolio. And we are hard committed to never misses anyone’s data. So that’s a piece of the promise. We’re not going to [lose] someone’s data and give it to somebody else by accident. Or if government forced you to give [data], we do not do it.

On the customers that partners can target with IBM

For the Fortune 500, we like to be more direct on the products of that set. But one example is a partner that build a healthcare interoperability dashboard that they can take anywhere, even into the lower end of the Fortune 1000 — that’s not what we’re going to do.

The moment [a partner] is building value on top of a solution, we aren’t going to come in with that at all in any segment. Except for that top part, everywhere else is wide open space.

On whether Krishna is satisfied with IBM’s channel strategy

I said I want to double the revenue in the channel over the next four years. But the answer is no, I’m not getting what I want. But I think we need to step forward and have our hand out and say this is what we do. We’re going to invest in education, incentives, marketing funds, and an investment team to build solutions to go to an investment team to build solutions. Now let’s go grow the business together.

Here are the three areas we’re going after: number one, hybrid cloud/private cloud, Cloud Paks is number two, which is kind of required. Yes, there is an opportunity around power and storage, but I think the opportunity around software is so much more.