Citrix’s Hector Lima On How Partners’ Voices Will Be ‘Amplified’ With Channel Program Revamp

‘What are the things that are moving well? What are the things that we have to prioritize? I go back to nine months ago when I first took this role. ... We wanted to simplify the way that partners did business with Citrix. We wanted to make it more profitable and predictable,’ Citrix Chief Customer Officer Hector Lima tells CRN.

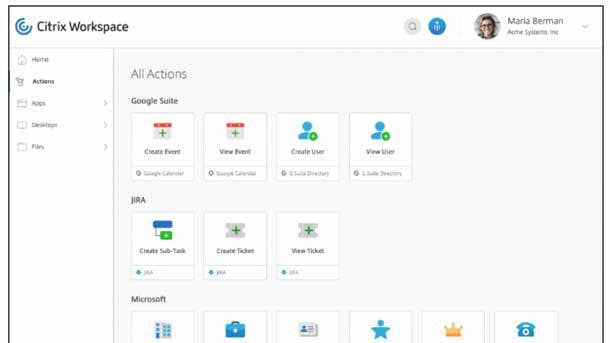

Rethinking its channel chiefs structure, moving channel functions into the greater sales function and making incentives available to partners throughout the sales life cycle are some of the ways Citrix Systems is investing in its partner program.

Hector Lima, Citrix’s executive vice president and chief customer officer, outlined the upcoming changes to the virtualization and cloud vendor’s partner program in an interview with CRN. Mark Palomba—or more formally, the company’s senior vice president of worldwide partner sales and ecosystems—will stay in his role through the acquisition, Lima said. After that, Palomba may transition into a new role or leave the company.

“A lot of what we’re doing now, candidly, I’m doing it to plan for 2023,” Lima told CRN. “This is a big, established business for us. And anytime that we’re going to make any strategic changes, it takes time. So I’m really doing this now because I want to hit the ground running come 2023, but definitely we’ll see things start to change this year.”

[RELATED: Citrix To Be Acquired, Taken Private And Merged With Tibco In $16.5B Deal]

As a recap of Citrix’s recent odyssey, after weeks of rumors that Citrix was in negotiations to be acquired by Vista Equity Partners and Elliott Management, the company confirmed in January that the private equity firms want to buy publicly traded Citrix in an all-cash deal valued at $16.5 billion and combine it with data integration and analysis software developer Tibco Software.

In October, Citrix Systems President and CEO David Henshall stepped down and was replaced with Bob Calderoni, chairman of the board of directors, as interim president and CEO.

In November, during a quarterly earnings call, Calderoni said that Citrix had made “some missteps” in its go-to-market strategy and forecasting. He said the company “ introduced far too many overlays over the last 12 to 18 months,” with “too many people getting compensated on the same deal.”

He promised “to shore up our channel programs and put in place the right incentives for our channel partners. And we need to focus sales investments on direct selling quota-carrying individuals and eliminate excess investments in overlays and shared commissions.”

Ray Wolf, CEO of Southlake, Texas-based Citrix partner A2K Partners, told CRN that he is happy with the investments Citrix is making. Although A2K is not yet a Tibco partner, Wolf is interested in how the two companies stitch themselves together.

“Now that it’s starting to reveal itself, what the future looks like and the focus on where the investment is going to go—we’re pretty jazzed about it,” Wolf said. “We’re fired back up. I’ll say we’re pre-pandemic fired back up about Citrix.”

Lima and his team have been addressing partners’ concerns and planning for the future. Here’s what you need to know.

What are some upcoming changes to Citrix’s channel partner program?

We’re making two big changes. … The first is we are moving all of our field partners’ resources—what we call PAMs—our partner account managers.

Today, they roll up into the centralized channel function under [channel chief] Mark Palomba. Even though they’re widely dispersed, we’re going to move those individuals and those teams into the sales organizations. So they’ll report into each of the geography vice presidents that basically are the GMs for those businesses.

So that’s a big move for us. It’s a material number of people and teams. … The second thing that we’re doing is that we’re integrating all of the global partner functions—things like operations, go-to-market programs, marketing—and those types of items.

Today, they roll up into a centralized channel function. We want to have a much more embedded and integrated process. So we’re going to move those teams into the respective broader global teams that do those functions—not just for the channel but for all of sales within the organization.

So again, a big move for us because it is a bit of decentralization, but also moving these teams to be really tightly integrated across the entire supply chain of our business.

Why is Citrix making these changes?

Let’s take them both individually. So the first one I’d want to cover is the moving of the field resources.

So if you think about the markets that we play in and the solutions that we develop, they’re changing rapidly. There’s greater innovation every day. There’s much more competition. And candidly, a lot of these dynamics actually manifest themselves at the field level.

And there’s a lot of changes in dynamics where, for example, there’ll be certain countries in EMEA that may be different than here in the United States. And definitely as you move to Asia-Pacific and Japan, they greatly vary in terms of priority of what customer needs are.

So a lot of it is dictated in the field and that comes back into the centralized function. Not only that, a lot of these changes are happening fast. So you have to adapt really fast to these changes. That’s why for us, we think it’s critical to move the empowerment, to move that decision-making for all of these channel resources and initiatives out to the edge.

That’s the key message for us—how can we move more empowerment out to the edge? And we think this move … also ensures that the partner integration is really tightly aligned with the strategy for each of the sales functions.

So it’s all about alignment, moving that decision-making out to the edge and really making sure that for our partners and in all types of routes to market, they are really integrating and working with one Citrix team as opposed to maybe multiple teams. That’s key for us.

The second one is, as I mentioned, we’re integrating those global functions into the greater operations and go-to-market teams that we have in the organization.

So why do we think this is important and why are we making the move? Our entire global go-to-market strategy will benefit greatly by having the channel embedded in it from day one.

Whereas the first one, it’s all about the edge—this is really day one planning. How do we ensure that everything we do from the planning to execution has the channel embedded from day one into each of those functions?

And today, there’s great working relationships between the two teams, but it’s still two separate teams. And we’re seeing more and more that it just slows down our efficiency.

Making sure that we plan with all of our channels and routes to market from the beginning is something that we tend to continue to go back and try to readdress. I think if we start with that from the beginning and have the channel embedded, we’ll have a much better flow of all of our go-to-market strategy, our programs, our incentive plans and so on and so forth.

When will Citrix partners see the results of these changes?

I think from a field perspective, they’ll start to notice it probably sooner—and they’ll notice it sooner because obviously those are the people that they interact with on a daily basis.

But a lot of what we’re doing now, candidly, I’m doing it to plan for 2023. This is a big, established business for us. And anytime that we’re going to make any strategic changes, it takes time. So I’m really doing this now because I want to hit the ground running come 2023, but definitely we’ll see things start to change this year.

These are Citrix-specific changes, correct? We’re not talking about Tibco?

The changes that I’m describing here today are specific to the Citrix channel and partner ecosystem teams, for sure. I expect you know, as soon as we get into kind of the acquisition with this, then Elliott [Management] will definitely look at what are the synergies between the Tibco team and ours, for sure.

What’s your advice to partners during these changes?

I think their voice definitely will be amplified now because we’re moving that empowerment to the field.

So I think it’s important to reach out to your partner account managers to get a sense of why we’re making this change. And then I think it’s really time—it always is—but I think it’s another opportunity for us to hear their voice. What are the things that are moving well? What are the things that we have to prioritize?

I go back to nine months ago when I first took this role. We set out to do a couple of things with the channel. We wanted to simplify the way that partners did business with Citrix. We wanted to make it more profitable and predictable.

And we wanted to integrate and embed ourselves into their business. One example is with what we call CSP—our Citrix Service Provider business—it’s one of the fastest growing lines of businesses that we have, and it’s because our technology and solution is embedded into so many partners across the globe.

So they’re not selling Citrix. They’re selling their solution that—oh, by the way—just happens to have our technology within the stack. And I think that is just a much better relationship not just only for us but also for our partners.

So that idea of embedding more of ourselves into their business I think is key for us.

We did a couple of things that I think were pretty big. We did make changes to our incentive programs over the last six months that we rolled out at the beginning of the year. We made our most profitable incentives tied to our SaaS strategy so it aligns to what we’re doing as a business. We simplified the quoting process for our transition and trade up—our TTUs—so it’s much easier for partners to quote.

We also introduced auto-approvals—what we call the ‘spark’ incentives—spark for us is when a partner brings an opportunity to Citrix, they’ve ‘sparked’ that deal.

So we pay higher incentives for that. But while it was great that we had these incentives, partners were saying, ‘Hey look, the approval process, if we’re going to get it or not, sometimes it’s ambiguous.’ So we put some auto-approval processes in place. That way, it has predictability.

So I think we’ve done quite a few things in a short amount of time that scale—add that simplicity, add that profitability. Now, I think we’ve got to get more to the strategy around how do we build tighter integration with go-to-market, and then how do we really empower the field. And I think these two changes are a nice evolution of that.

These changes are positive for partners of all sizes?

Definitely partners of all sizes. We’ve been in the channel business now for decades, but we continue to mature the business.

And we definitely treat the different types of channel partners or ecosystem partners differently based on their business needs and really where they are in the market.

A GSI [global systems integrator] for us is still very different from a value-added partner and then our CSP partners as well, slightly different.

So we do specialize to their needs to ensure that we have the best relationship for each partner type. For us there is no one-size-fits-all. It just doesn’t work.

Will we see changes in the channel partner leadership?

That’s probably one of the ripple effects of the change. A lot of what I’m talking about here is decentralizing what we have now as a centralized channel function.

So as part of this, actually, Mark Palomba (pictured)—who’s the current head of partners and channel ecosystems—he will be moving on [from his role]. But these are big changes. And as I mentioned, they’re not going to happen overnight. So Mark will stay on with us to help us make sure that we transition these teams properly.

Is there an end date to his role?

Not specifically yet. He will probably be here at least through the acquisition. And then from there, we’ll see.

Was Mark’s role always an interim one?

It was not. We think about Mark’s history, he was brought in to be the COO of the sales and services team. He then grew his scope to include channels.

And going back to when I named him the channel chief, I actually split those two roles, and I wanted him to focus on channels.

And we were able to accomplish some of the things that we did before, some of these really instrumental things that scale around ease of use, ease of doing business and incentives.

Now, I’ve got to get the broader team, as I said, moving fast at the edge. And it’s just the evolution of these teams. And I’m sure you see it in many companies. There’s this constant ebb and flow of centralization and decentralization. And I think we’re just going through one of those periods.

Is he staying with Citrix?

That’s TBD.

Will there be a search for Palomba’s replacement? Maybe a promotion from within?

Still to be determined. What I think happens now—because we are decentralizing some key functions on the role—I think it gives us a greater opportunity to actually bring on board or promote channel chiefs that are specific to channel types, much like we talked about maybe two minutes ago. We’re debating whether that is a more effective approach to make sure that we tailor to each partner type. That’s what we’re thinking about now.

But, still to be determined. … There are different types of ecosystem partner categories, and they’re all a little bit slightly different with their particular needs and benefits … and we’re going to embrace that.

You think we’ll see channel chiefs by industry? Or geography?

We do have channel chiefs by geo. So each geo does have a set of channels. Those individuals—based on this change—they will report into basically the GM of each geo. So we do have geographic channel chiefs today. What we will see moving forward is we may have individuals that are specific to partner types and routes to market. I think that’s where we’re headed.

What other key executives are in Citrix’s channel hierarchy?

We have presence and ownership of the channel in each of the three major geos. In the Americas, it’s Mike Fouts, who I know is a veteran of the channel and people know.

In APJ it’s Kathy Chen. And in EMEA it’s (Mike Tankard). … And they are the point of contact for each of the three geos as it relates to programs, escalations, enablement, all things channel roll up to those three individuals. … Michelle Senecal de Fonseca, she runs basically our system integrators, our ISVs and also the work that we do with our marketplace and hyperscalers and she does that at a global level. They all report to me.

The way we’re set up, so I run what we call now the customer organization. It’s all the go-to-market and sales. And the way that that’s set up is I’ve got three geo teams for the three major geos. I have the channel. And I have go-to-market and strategy, and then I have operations.

What are your goals with all these changes in Citrix’s partner program?

There’s been a ton of change at Citrix. ... So what that has done is it’s really put our focus on what does our portfolio of products need to look like moving forward?

And then specifically for my role—what does that mean from a go-to-market strategy? And to me, I think the key piece is Vista and Elliott [Management] see our channel and our channel strategy as vital to the success of Citrix moving forward. And it is actually one of the key reasons they were so interested in our organization. … When we spoke last, there were three key things that I wanted to make sure that we embraced as part of improving our channel community and in our interaction with the channel.

One was enhancing the experience. So how do you make it easier to transact? How do you make it easier to quote? Streamline the process as much as possible. So that was the first priority.

The second one … how can you simplify the programs? There were way too many programs. Way too many incentives. … Candidly, there’s a ton of other partners that transact with many other customers or entities. And for them to be up to speed on so much complexity and programs makes it very difficult. So I want to make sure that we increase simplicity in the program specifically.

And then last but not least was the rewards—so what are the financial rewards for the partners? And make sure that as we as a company move to SaaS, those rewards follow that life cycle as well. It’s not all front-end-loaded or back-end-loaded. It’s across the entire journey.

So those are the three key themes that not only myself but the channel organization was looking to improve. … I do believe this is probably a multiyear journey to improve those three catalysts.

Tell me more about the changes already introduced to the partner program.

The thing we’re kind of most proud of and excited about is we’ve simplified our trade-up and transition quoting process for our partners.

That may seem very tactical, but actually it’s very important to our joint business and our ability to scale. So I won’t give you all the gory details, but in the past, you really had to have a Citrix expert from Citrix sitting down with a partner to quote.

We’ve streamlined that process. Now partners can create their own quotes. They can look at a customer’s existing assets—what will they be in the new world?—and create that quoting process on their own. … If I look at simplification of the programs, we’ve done just that—simplifying incentives down to just a handful of incentives across the ecosystem, really also collapsing the differentiation that we have in the different channel types.

And that continues. That’s something that we look at on a quarterly basis, and I think we’ll do even more.

And then last but not least, if I look at rewards … the partners were not happy, candidly, about what changes we made with renewals.

So we’ve introduced to address that in particular a renewal rebate that’s tied to our SaaS business. So that aligns not only with what we want as a company to make sure that we enhance our SaaS business but also brings our partners along for that journey, because now it protects their profitability and their predictability of their financial model as long as it’s within our SaaS business.

A couple of things on making it easier and making sure that the partners realize the financial value.

One key change that we did this year has to do with actually our ‘spark’ approval. So our deal registration that happens up front, we basically introduce an automated process in order to get those done. So again, to speed up the acceptance of those spark incentives so that way the partner knows right up front if they’ve qualified or not.

So in the past, what used to happen is that those had to be manually approved by the seller in that particular territorial region. Now, it does go through that step, but if they’re not approved after a 72-hour period, it automatically gets approved. So, again, speeding up that process.

Any changes to solution architecture?

From an enablement standpoint, from a technology standpoint, that’s twofold.

As part of the restructuring that we did at the end of last year, in the November time frame, we definitely made a decision to move away from human-led enablement to more automated self-paced enablement, not only for ourselves as employees, but also for our partners.

So more of our investment comes from an automation standpoint. So we’re investing dollars in POC [proof of concept] enablement, we’re investing dollars in … new architecture and how the process flows from from POC to implementation or what have you. All of that we’re definitely investing in for our partners. And the more that we can do, in my opinion, in an automated fashion, the more efficient it’ll be not only for us but for them.

Any data yet that shows how the changes have been helpful?

In terms of technology help, we definitely track our probability close by different categories. And one of the highest probability to close is by far those that have technical validation, either by a POC or by a field architect, a sales engineer, validating the technology solution prior to the sale.

It jumps our close rate plus 10 percent across the line. So when our partners aren’t able to do that, and they bring that technical expertise, we also see those close rates increase.

Are more vendor partnerships part of the strategy ahead for Citrix?

Absolutely. In fact, we’re doing quite a bit of work with the three major hyperscalers in the ecosystem with Amazon, Microsoft and Google—across their platforms. That’s still key to our strategy for sure.

I really do believe the better part of this year is kind of business as usual. And as it relates to technology, our strategy is to partner with these platforms. That has not changed. As our customers migrate to the cloud, our ability to integrate is going to be more vital now than ever, and we want to make sure that we enable that transition.

And that’s going to come through those partnerships, enhanced functionality, integration, so on and so forth, not only at a commercial level, but very much at a technology level as well.

Do you want to see more partners join Citrix? Or are you thinking more about deepening the relationship with existing partners?

My first priority is always to deepen the relationship and extend the reach with the partners we already have.

I think we’ve got a huge partner ecosystem. I would like to make those transactions and those interactions bigger. And I think that’s the No. 1 priority. Now, obviously, we always add to the ecosystem. I think that’s part of the motion, especially when you have new technologies that you’re bringing to market that may be addressed by different types of partners.

So that’s always there. But in the grand scheme of things to me, it’s about making our existing relationships better.

What’s the pitch to potential partners interested in working with Citirx?

First, you have to look at the technology landscape. So you may be an existing Tibco partner, but not necessarily Citrix. There’s logical synergies there.

You start thinking about new technologies that Citrix is bringing to bear, specifically in a SaaS-first environment. If that is your niche, if that’s what you’re accustomed to, if you’re a born-in-the-cloud type of partner, there may be of interest there for Citrix.

So I think those are two key things that you should be evaluating if you’re a partner looking to get into this business.

If you’re doing —whether it’s managed DaaS [desktop-as-a-service or hybrid DaaS—and work in those three hyperscalers that we talked about, you’re going to see customers asking you about the added value of having Citrix and those solutions.

Should Citrix partners think about additional vendor relationships to get more out of their relationship with Citrix?

There’s multiple ways to do it. But I think many partners, what you’ll see is that they’ll have a platform strategy in terms of what are the key vendors that basically create the backbone of their platform.

Then they have basically infrastructure vendors, if you will. And then maybe end-user applications, devices and things of that nature.

That’s oversimplification, but if you think about it in those tiers for us, if the partner is just, ‘Hey, we’re Citrix, and that’s what we do day in and day out.’ That’s great. We have many partners like that, and they’re successful.

Those partners that really grow and scale their business are those that find logical adjacencies to our technology. So many of them say, ‘Look, not only do I make money on selling Citrix solutions and then managing those solutions, but there are these other logical technologies that I can add around them that allow me to increase that wallet share with that customer.’

That’s what you typically see with those best partners that are maximizing returns for themselves.

Customers tell me all the time that Citrix is a pull technology for them. Once they have that as one of their beachheads, it pulls a lot of other solutions that they can bring to the table to their customers, and that’s really what they look for as they try to round out the portfolio products.

What other changes should partners notice?

As we make our transition to SaaS, it’s not just about that initial sale, but it’s helping customers realize value across that life cycle.

And we’re definitely choosing and partnering with those partners that help us drive that value.

You’ll see that’s why we have rebates and incentives that are back-end-loaded. That’s why you also see things that are triggered based on adoption across that customer life cycle. Because we want to ensure that partners are not just there—and I know many of them don’t— but they’re not just there for the transaction fees, they’re also helping that customer realize that value.

It’s best for everybody. It creates loyalty with that customer. it creates incremental dollars and opportunities for that partner as they manage those environments.

And then selfishly for both parties, I think it sets the stage to be able to sell more products. And whether it’s new technologies or broader scale within existing technologies, it just sets the table for that. And our incentives are tied, it’s split across what happens up front, what happens during that journey, and then what happens at the place of renewal so the partner can participate across the entire landscape.

Are there any underutilized tools within Citrix that you’d like to see more partners pick up?

By and large, for those existing customers that have grown accustomed to using our technology on-premises, when they make the decision to move over, I think it’s important that we help our customers transition to the cloud.

So I think that’s a broad statement—as soon as the decision has been made, having that business plan to move them over. I think that’s key that they help them do that.

We have brought in new technologies, like the secure private access that we’re going to launch next quarter. Analytics is, percentagewise, the highest-growing piece of our portfolio.

So those are new technologies that our customers are embracing. Helping them adopt that quickly is just going to set the stage.

How many channel partners are working with Citrix cloud products?

We’ve definitely gotten to the tipping point where the majority of our business is now SaaS business. It’s a majority of our new bookings … and partners are participating in upwards of 70 percent of those transactions. So I think we’ve made that turn to SaaS.

Now, the question is, how do you expand that portfolio? I think that’s the next piece. One thing is to transition your customers accustomed to using this setup of services and technology from Citrix. Now, let’s do that in the cloud. I think that’s great. And we’ve crossed that bridge. The second one is, well, how do you add those adjacencies? Those are the things we are adding to the portfolio.

How important has the channel been for Citrix?

This is my 22nd year at Citrix, so that’s almost analogous to the history of Citrix.

In this role I’ve been here nine months now it’ll be at the end of the quarter. Throughout that time, the channel has been a key part of our success.

Just looking at the metrics, the channel across the globe basically transacts over 70 percent of all of our business globally, and they directly manage and interact with probably half of that business where they’re running everything in the sales cycle from a sales perspective.

So it is a huge part of our business and will continue. I think what we’re seeing now is it’s how do you evolve that business … how it’s best for them and how that transition happens not just on a technology side but also on a go-to-market side on how you transact and how you monetize at a different level.

Me personally, as well as the team, is committed to ensuring that this is still the most profitable business for our channels, our channel partners, even in this new SaaS world.

How important will the channel be for Citrix?

Customers, even though they’ve become more self-sufficient and self-serve, the partner still is a vital component because they tie all this stuff together.

They also help clear up any doubts or questions that customers have. So I think that the puck has definitely moved to this SaaS, marketplace, hyperscale world.

The partners plug right into that in making sure that those solutions make sense and that they’re integrated properly.

So I think that’ll continue and, as a result, the importance and reliance that we have on partners continues.