5 Google Cloud Takeaways From The House Antitrust Report

“As remote work became commonplace during the COVID-19 pandemic, Google attempted to manipulate users into using its Google Meet videoconferencing tool instead of upstart competitor Zoom,” according to the report by House Judiciary Antitrust, Commercial and Administrative Law Subcommittee.

Google Cloud allegedly tried to “manipulate” its customers into using its Google Meet videoconferencing tool instead of competitor Zoom and stifled competition by acquiring multi-cloud solutions and making them compatible only with its cloud infrastructure, according to a new federal report.

That’s according to a congressional panel’s report that attacks the market power of Google – along with fellow tech giants Amazon, Apple and Facebook – and targets them for antitrust reforms including increased vetting of its acquisitions and potentially breakups of their businesses.

The report points to Google Cloud as a core platform that Google is heavily investing in with acquisitions, “positioning itself to dominate the ‘internet of things,’ the next wave of surveillance technologies.”

The House Judiciary Antitrust, Commercial and Administrative Law Subcommittee, chaired by U.S. Rep. David Cicilline (D-RI), released its 450-page “Investigation of Competition in Digital Markets” report Tuesday after a 16-month investigation that included testimony by Sundar Pichai, CEO of Google and parent company Alphabet.

“Whether through self-preferencing, predatory pricing or exclusionary conduct, the dominant platforms have exploited their power in order to become even more dominant,” the report states. “To put it simply, companies that once were scrappy, underdog startups that challenged the status quo have become the kinds of monopolies we last saw in the era of oil barons and railroad tycoons. Although these firms have delivered clear benefits to society, the dominance of Amazon, Apple, Facebook, and Google has come at a price. These firms typically run the marketplace while also competing in it -- a position that enables them to write one set of rules for others while they play by another or to engage in a form of their own private quasi-regulation that is unaccountable to anyone but themselves.”

In a statement, Google said it competes “fairly in a fast-moving and highly competitive industry” and disagrees with the subcommittee’s findings, “which feature outdated and inaccurate allegations from commercial rivals about Search and other services.”

Click through to read about Google Cloud’s allegedly manipulative videoconferencing moves, what the House subcommittee’s report says about Google Cloud’s market dominance and how its acquisitions allegedly limit competition -- along with Google’s full response.

Google Meet And Zoom

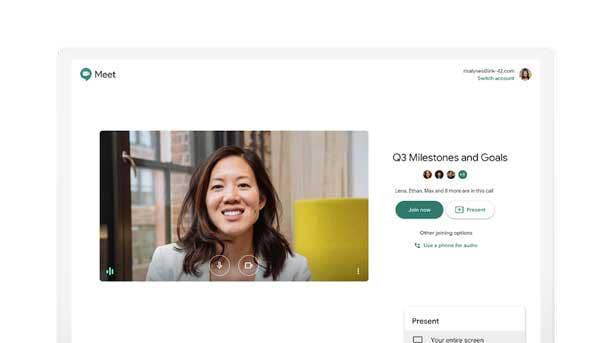

As remote work became more commonplace during the coronavirus pandemic, Google Cloud allegedly attempted to manipulate users into using its cloud-based Google Meet videoconferencing tool instead of competitor Zoom, according to the House subcommittee report.

As Zoom emerged as the market leader during the early stages of the pandemic, Google Cloud introduced a new widget for Meet inside Gmail, the report states.

“A similar message could be found inside Google Calendar, which prompted users to ‘Add Google Meet video conferencing’ to their appointments,” the report states. “For people with the Zoom Video Communications Inc. extension on their (Google) Chrome browsers, the prompt sits directly above the option to: ‘Make it a Zoom Meeting.’”

‘One Of The Technology Sector’s…Most Lucrative Businesses’

Cloud computing is critical to many of the digital markets investigated by the subcommittee, the report said, as it provides the infrastructure and storage and computational power for online commerce, social media and networking, digital advertising, voice assistants and digital mapping.

“As a result of the convenience and cost savings associated with the ability to scale up or down on demand, cloud computing has grown into one of the technology sector’s largest and most lucrative businesses,” the report said. “It has enabled the growth of enterprise businesses such as Netflix, Airbnb, Lyft, Slack and the Weather Channel, as well as new startups that are not yet household names.”

The subcommittee report noted that the U.S. cloud computing market is consolidating around Amazon Web Services, Microsoft Azure and Google Cloud Platform (GCP), which have benefited from “early-mover advantages” coupled with network effects and high switching costs that lock-in customers.

According to the report, an internal Google strategy document from 2010 entitled “Where Industry is Headed in 5 Years” stated there would be some concentration in the market within five years, with “cloud service providers consisting of Google, Amazon, Microsoft and a hybrid of Cisco and VMware.”

In a subsequent 2018 strategy document, Google emphasized the importance of Amazon’s and Microsoft Azure’s “first-mover” advantage in the space.

“AWS and Azure have had more years to gain customers, and cloud customers typically grow [in] scale over time,” the internal Google document states.

To enter the market and reach the economies of scale needed to compete with the incumbents, infrastructure providers must invest significant capital and be able to offer competitive prices to lure customers, the panel’s report states. Compliance certifications and reputation also are barriers, it noted, specifically citing the U.S. government’s costly and time-consuming Federal Risk and Authorization Management Program (FedRAMP) authorization.

“When a customer chooses to use cloud computing, they must trust that their data will be secure and available to access quickly,” the report states. “The leading cloud infrastructure providers are major technology companies that handled massive amounts of data and run large technical operations before offering managed services.”

AWS, Microsoft Azure and Google Cloud each has taken its own approach to building its platform, but all of their approaches involve acquisitions, in-house software development and the use of open-source software, the report notes.

Google Cloud and Microsoft Azure also have relied on their companies’ existing products, with Google Cloud leveraging its collection of APIs and Microsoft leveraging its Office 365 line, according to the report.

Growing Through Acquisitions

Amazon, Apple, Facebook and Google owe part of their dominance to mergers and acquisitions: They have collectively purchased more than 500 companies since 1998.

Nine of Google’s products -- Android, Chrome, Gmail, Google Search, Google Drive, Google Maps, Google Photos, Google Play Store and YouTube -- have more than a billion users each.

“In several markets Google established its position through acquisition, buying up successful technologies that other businesses had developed,” the report states. “In a span of 20 years, Google purchased well over 260 companies -- a figure that likely understates the full breadth of Google’s acquisitions, given that many of the firm’s purchases have gone unreported.”

The House subcommittee’s staff reviewed internal Google documents that outline its plans to invest significantly in acquisitions. To bolster Google Cloud, its acquisitions to date have included Orbitera in 2016, 1501 Cask Data and Velostrata in 2018, Elastifile in 2019 and the $2.6 billion purchase of Looker this year.

“In some instances, Google acquired firms that were multi-cloud solutions but, after acquisition, Google made them compatible only with Google’s cloud infrastructure, at times integrating them into first-party PaaS and SaaS offerings only available through the Google Cloud portal,” according to the report.

The report references a CRN article about Google Cloud’s 2019 acquisition of data migration startup Alooma. At the time, a Google Cloud spokesperson told CRN that it would no longer accept new AWS and Microsoft Azure customers for the data pipeline service.

“We are now only accepting new customers that are migrating to Google Cloud Platform,” the Google Cloud spokeswoman said.

Future Acquisitions

Google, Apple, Amazon and Facebook have recently focused on acquiring startups in the artificial intelligence and virtual reality space, according to the report.

“Ongoing acquisitions by the dominant platforms raise several concerns,” it states. “Insofar as any transaction entrenches their existing position or eliminates a nascent competitor, it strengthens their market power and can close off market entry. Furthermore, by pursuing additional deals in artificial intelligence and in other emerging markets, the dominant firms of today could position themselves to control the technology of tomorrow.”

It‘s unclear whether U.S. antitrust agencies are presently equipped to block anticompetitive mergers in digital markets, according to the report, which said the records of the Federal Trade Commission and U.S. Justice Department show “significant missteps and repeat enforcement failures.”

The report points to the Justice Department’s February approval of Google’s acquisition of Looker – “despite serious risks that the deal would eliminate an independent rival and could allow Google to cut off access to rivals.”

“To address this concern, subcommittee staff recommends that Congress consider shifting presumptions for future acquisitions by the dominant platforms,” the panel said. “Under this change, any acquisition by a dominant platform would be presumed anticompetitive, unless the merging parties could show that the transaction was necessary for serving the public interest and that similar benefits could not be achieved through internal growth and expansion.”

Google’s Potential Anticompetitive Conduct

Based on interviews with market participants and Google’s internal documents, Google employs two strategies that “raise concerns about potential anticompetitive conduct,” according to the report.

“First, Google appears to leverage its dominant business lines, including popular APIs such as Google Search and Maps, along with machine learning services, to attract customers to its platform through discounts and free-tier services,” the report states.

According to internal Google documents, in 2018, Google launched a program with its Google Play team to provide GCP credits to game developers based on their Google Play store spending to increase focus on Play and incentivize migrations to GCP.

“By harnessing Google’s advantages in existing markets, GCP is undermining competition on the merits,” the report states.

Google’s internal documents also noted the company is considering bundling its popular machine learning service with other services that Google is seeking to promote.

“One recent Google Cloud pricing strategy document explains, ‘the question that we need to think about is whether we use our entry point with BigQuery to get a customer to use all the services such as Dataproc, Dataflow, as a suite and give them a price break on the Analytics suite, because it will be much harder for them to migrate away from us if they use all the other services,’” according to the report.

The 2018 document also describes potential discounts and a plan to have “a pricing model that makes it advantageous for customers to put 80 percent of their workload on GCP.”

“…Absent interventions, the barriers to entry and network effects in this market mean there is a high potential for single-homing and an overall concentrated market,” the House subcommittee report states. “As Google grows in this space, regulators and enforcers should be watchful for potential anticompetitive conduct.”

Google’s Response

A spokesperson for Google referred CRN to a blog post published Tuesday that included its statement on the report.

In the post, Google said its free products including Search, Maps and Gmail help millions of Americans, and it’s invested billions of dollars in research and development to build and improve them.

“We compete fairly in a fast-moving and highly competitive industry,” Google said. “We disagree with today’s report, which feature outdated and inaccurate allegations from commercial rivals about Search and other services.”

Americans don’t want Congress to “break” Google’s products or “harm” the free services they use, according to Google.

“The goal of antitrust law is to protect consumers, not help commercial rivals,” it said. “Many of the proposals bandied about in today’s report -- whether breaking up companies or undercutting Section 230 -- would cause real harm to consumers, America’s technology leadership and the U.S. economy -- all for no clear gain.”

President Donald Trump has called for a repeal of Section 230 of the Telecommunications Act of 1996 or Communications Decency Act, which provides protections for private blocking and screening of offensive material. Section 230 stipulates that “no provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider." That means it protects online platforms and internet companies such as Google from being liable for material posted by their users. It allows them to, in “good faith,” moderate and remove user-generated content that it or a user considers to be “obscene, lewd, lascivious, filthy, excessively violent, harassing or otherwise objectionable, whether or not such material is constitutionally protected.”

Google, meanwhile, said it supports Congress focusing on “areas where clearer laws would help consumers.”

“Google has long-championed the importance of data portability and open mobile platforms,” said the company, which referred to its case against Oracle that was before the Supreme Court today. Google is arguing for the “important principle of software interoperability” in the case, which centers on approximately 11,500 lines of code used by Google to build its Android mobile operating system.

“And we have urged Congress to pass comprehensive federal privacy legislation,” Google said. “We look forward to engaging with Congress on these and other issues moving forward.”