The Best Tech Stocks (And The Worst) For Q1 2021

Here is a look at the 10 tech company stocks that recorded the biggest gains in the first quarter of 2021 – and the 10 that saw the biggest declines.

Many Tech Stocks Rebound As The Pandemic Recedes

After stock prices took a big hit in early 2020 at the start of the COVID-19 pandemic, stocks were generally on the rise for the rest of the year – including many technology company stocks. And those increases have largely continued into the first quarter of 2021 with about two-thirds of the 45 tech stocks on the CRN tech stock watch list recording price gains through March 31.

But 16 of the 45 tech stocks saw the value of their shares decline in the first quarter – several by double-digit percentages.

The Dow Jones closed at 32,981.55 on March 31, up 7.76 percent from its 30,606.48 close on Dec. 31, 2020. The tech-heavy Nasdaq closed at 13,246.87 on March 31, up 2.78 percent from its 12,888.28 close on Dec. 31, 2020.

Here‘s a look at the biggest stock price winners and losers in the first quarter of 2021. We start with the 10 biggest winners, counting down to the IT vendor with the biggest stock price gain during the quarter. Then we list the 10 companies whose stock price declined the most, concluding with the IT vendor with the biggest loss. The rankings are based on stock closing prices on Dec. 31, 2020 and March 31, 2021.

Best No. 10: Fortinet

CEO: Ken Xie

Dec. 31, 2020 Close: $148.53

March 31, 2021 Close: $184.42

Change: +24.16%

Platform security vendor Fortinet has been aggressively pushing into the market for SD-WAN technology with its FortiGate Secure SD-WAN product. In February CEO Ken Xie vowed to overtake its two biggest SD-WAN competitors and become the market share leader within a few years.

In March Fortinet acquired cloud and network security startup ShieldX. That came on the heels of Fortinet’s acquisition of network monitoring tech developer Panopta in December.

For all of 2020 (ended Dec. 31) Fortinet reported revenue of $2.59 billion, up 20 percent from $2.16 billion in 2019. The company reported net income of $488.5 million for the year, up 47 percent from $331.7 million one year earlier.

The increase in Fortinet’s stock price boosted the company’s market cap by nearly 25 percent to $30.10 billion as of March 31 from $24.11 billion on Dec. 31, 2020.

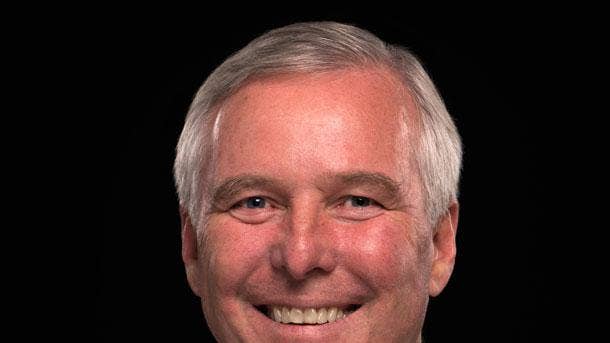

Best No. 9: Extreme Networks

CEO: Ed Meyercord

Dec. 31, 2020 Close: $6.89

March 31, 2021 Close: $8.75

Change: +27.00%

For the first six months (ended Dec. 31, 2020) of its fiscal 2021 Extreme Networks report revenue of $477.9 million, down nearly 9 percent from $523.0 million in the first six months of fiscal 2020. The company reported a net loss of $11.9 million for the first six months of fiscal 2021 compared to a $61.3 million net loss one year before.

The increase in Extreme Networks’ stock price boosted the company’s market cap by nearly 28 percent to $1.08 billion as of March 31 from $847.56 million on Dec. 31, 2020.

Best No. 8: BlackBerry

CEO: John Chen

Dec. 31, 2020 Close: $6.63

March 31, 2021 Close: $8.43

Change: +27.15%

BlackBerry has increasingly focused on its security and IoT offerings following its February 2019 acquisition of cybersecurity company Cylance.

For its fiscal 2021 (ended Feb. 28) BlackBerry reported revenue of $893 million, down 14 percent from $1.04 billion in fiscal 2020. The company reported a net loss of $1.10 billion for the year compared to a loss of $152 million one year before.

The increase in BlackBerry’s stock price boosted the company’s market cap by nearly 28 percent to $4.75 billion as of March 31 from $3.71 billion on Dec. 31, 2020.

Best No. 7: Intel

CEO: Pat Gelsinger

Dec. 31, 2020 Close: $49.82

March 31, 2021 Close: $64.00

Change: +28.46%

On Jan. 13 Intel announced that it had hired VMware CEO Pat Gelsinger to be Intel’s new CEO, effective Feb. 15. His hiring is seen as a big step toward Intel’s efforts to regain momentum – especially against resurgent rival AMD.

Gelsinger replaced Bob Swan who had served as CEO for two years. Before moving to VMware Gelsinger had previously worked at Intel for some 30 years in a number of positions.

Gelsinger has vowed to make Intel a leader in every product category in which it competes, execute flawlessly, accelerate innovation and focus on culture to attract the best engineers and technical talent.

For all of fiscal 2020 (ended Dec. 26) Intel reported revenue of $77.87 billion, up more than 8 percent from $71.97 billion in fiscal 2019. Net income for the year was $20.90 billion, down 0.7 percent from $21.05 billion one year before.

For its 2021 first quarter (ended March 27) Intel reported revenue of $19.67 billion, down 1 percent from $19.83 billion in the first quarter of 2020. Net income for the quarter was $3.36 billion, down nearly 41 percent from $5.66 billion one year earlier.

Intel’s March 31 stock closing price put the company’s market cap at $260.63 billion, up 27.7 percent from $204.16 billion on Dec. 31, 2020.

Best No. 6: HP Inc.

CEO: Enrique Lores

Dec. 31, 2020 Close: $24.59

March 31, 2021 Close: $31.75

Change: +29.12%

In January HP hired Xerox executive Tolga Kurtoglu to be the company’s new CTO. In February the company named Marie Myers, who had been serving as acting CFO and chief transformation officer since October 2020, as the company’s chief financial officer.

In February HP acquired HyperX, the gaming division of Kingston Technology.

For the first quarter (ended Jan. 31) of fiscal 2021 HP reported revenue of $15.65 billion, up 7 percent from $14.62 billion in the first quarter of fiscal 2020. Net earnings for the quarter were $1.07 billion, up 57.5 percent from $678 million one year before.

HP’s March 31 stock closing price put the company’s market cap at $39.58 billion, up 24.8 percent from $31.71 billion on Dec. 31, 2020.

Best No. 5: Hewlett Packard Enterprise

CEO: Antonio Neri

Dec. 31, 2020 Close: $11.85

March 31, 2021 Close: $15.74

Change: +32.83%

On Dec. 1 Hewlett Packard Enterprise announced that the company is moving its headquarters to Houston.

In February HPE acquired CloudPhysics, developer of AI-based hybrid cloud assessment tools.

For the first quarter (ended Jan. 31) of fiscal 2021 HPE reported revenue of $6.83 billion, down 1.7 percent from $6.95 billion in the first quarter of fiscal 2020. Net earnings for the quarter were $223 million, down 33 percent from $333 million one year before.

HPE’s March 31 stock closing price put the company’s market cap at $20.48 billion, up 33.6 percent from $15.33 billion on Dec. 31, 2020.

Best No. 4: Quantum

CEO: Jamie Lerner

Dec. 31, 2020 Close: $6.12

March 31, 2021 Close: $8.33

Change: +36.11%

Quantum shares began trading on the New York Stock Exchange in 2020 and the price of the data storage tech company’s stock has steadily increased over the last year.

In February Quantum issued 13,138,686 shares of its common stock at $6.85 per share with gross proceeds in the range of $90 million.

For the first nine months (ended Dec. 31) of fiscal 2021 Quantum reported revenue of $257.1 million, down more than 18 percent from $314.7 million in the first nine months of fiscal 2020. The company reported a loss of just under $18 million for the first nine months of fiscal 2021 compared to a $1.4 million loss one year before.

Quantum’s March 31 stock closing price put the company’s market cap at $472.0 million.

Best No. 3: McAfee

CEO: Peter Leav

Dec. 31, 2020 Close: $16.69

March 31, 2021 Close: $22.74

Change: +36.25%

Cybersecurity software developer McAfee went public for the second time in its history as the company’s shares began trading on the NASDAQ exchange on Oct. 22, 2020.

In March McAfee announced a deal to split its consumer and enterprise operations and sell the enterprise security business to private equity firm Symphony Technology Group for $4.0 billion.

For all of 2020 McAfee reported revenue of $2.91 billion, up more than 10 percent from $2.64 billion in 2019. The company reported a $289 million net loss for 2020 compared to a $236 million loss one year before.

The company will announce its 2021 first quarter results on May 4.

McAfee’s March 31 stock closing price put the company’s market cap at $9.76 billion.

Best No. 2: Lumen Technologies

CEO: Jeff Storey

Dec. 31, 2020 Close: $9.75

March 31, 2021 Close: $13.35

Change: +36.92%

In September 2020 communications service provider CenturyLink changed its name to Lumen Technologies.

For all of 2020 Lumen reported revenue of $20.71 billion, down 3.5 percent from $21.46 billion in 2019. The company reported a net loss of $1.23 billion for the year compared to a $5.27 billion net loss in 2019.

The company will announce its 202 first quarter results on May 5.

Lumen Technologies had a market cap of $14.64 billion as of March 31, up nearly 37 percent from $10.70 billion on Dec. 31, 2020.

Best No. 1: Lenovo Group

CEO: Yang Yuanqing

Dec. 31, 2020 Close: $18.69

March 31, 2021 Close: $28.58

Change: +52.92%

Lenovo recorded the biggest share price gain in the first quarter of 2021 among all the IT vendors on the CRN watch list.

Lenovo has enjoyed surging demand for its PCs amid the shift to work-from-home because of the COVID-19 pandemic. The company’s Intelligent Devices Group recorded sales of $14 billion in its fiscal 2021 third quarter (ended December 31, 2020), up 27 percent year over year, while the Data Center Group reported revenue of $1.63 billion.

For the third fiscal quarter Lenovo reported revenue of $17.25 billion, up 22 percent from $14.10 billion in the third quarter of fiscal 2020. Profit for the quarter was $395 million, up 53 percent from $258 million one year before.

On April 1 Lenovo launched a new Solutions and Services Group, a dedicated services organization aimed at driving services sales.

The increase in Lenovo’s stock price boosted the company’s market cap by more than 52 percent to $17.39 billion as of March 31 from $11.27 billion on Dec. 31, 2020.

Worse No. 10: Palo Alto Networks

CEO: Nikesh Arora

Dec. 31, 2020 Close: $355.39

March 31, 2021 Close: $322.06

Change: -9.38%

In February Palo Alto Networks announced a deal to acquire Bridgecrew, a developer of tools used to enforce infrastructure security standards throughout the application lifecycle, for $156 million. (The acquisition was completed March 2.)

For its fiscal 2021 second quarter (ended Jan. 31) Palo Alto Networks reported revenue of $1.02 billion, up nearly 25 percent from $816.7 million in the second quarter of fiscal 2020. The company reported a net loss of $142.3 million for the quarter compared to a $73.7 million loss one year earlier.

Palo Alto Networks’ March 31 closing price put the company’s market cap at $31.32 billion, down 8.99 percent from $34.41 billion on Dec. 31, 2020.

Worse No. 9: Cloudera

CEO: Robert Bearden

Dec. 31, 2020 Close: $13.91

March 31, 2021 Close: $12.17

Change: -12.51%

For the fourth quarter (ended Jan. 31) of its fiscal 2021, big data platform developer Cloudera reported revenue of $226.6 million, up 7 percent from $211.7 million in the fourth quarter of fiscal 2020. The company reported a net loss of $54.8 million for the quarter compared to a $64.3 million loss one year earlier.

For all of fiscal 2021 Cloudera reported revenue of $869.3 million, up more than 9 percent from $794.2 million in fiscal 2020. The company reported a $162.7 million loss for fiscal 2021 compared to a $336.6 million loss one year earlier.

Cloudera’s March 31 closing price put the company’s market cap at $3.55 billion, down 11.08 percent from $3.99 billion on Dec. 31, 2020.

Worse No. 8: CrowdStrike

CEO: George Kurtz

Dec. 31, 2020 Close: $211.82

March 31, 2021 Close: $182.51

Change: -13.84%

On Feb. 18 cybersecurity company CrowdStrike agreed to buy log management startup Humio for $400 million. The Humio technology will extend CrowdStrike’s capabilities to identify threats and vulnerabilities using machine-generated data.

For the fourth quarter (ended Jan. 31) of its fiscal 2021 CrowdStrike reported revenue of $264.9 million, up 74 percent from $152.1 million in the fourth quarter of fiscal 2020. The company reported a loss of $19.0 million compared to the $28.4 million loss reported one year before.

For fiscal 2021 CrowdStrike reported total revenue of $874.4 million, up nearly 82 percent from $481.4 million in fiscal 2020. The company reported a net loss of $92.6 million for fiscal 2021 compared to a $141.8 million loss one year before.

CrowdStrike’s March 31 closing price put the company’s market cap at $40.86 billion.

Worse No. 7: Advanced Micro Devices

CEO: Lisa Su

Dec. 31, 2020 Close: $91.71

March 31, 2021 Close: $78.50

Change: -14.40%

AMD’s shares nearly doubled in value in 2020 – the biggest gain among all IT companies on the CRN watch list – so investors might have decided to cash out some profits in the first quarter of this year.

AMD has generated significant momentum in the last year with its new Ryzen and EPYC processors. And the company is closing in on completing its $35 billion acquisition ofprogrammable chip developer Xilinx, a move that’s expected to strengthen AMD’s competitive position in high-performance computing systems. AMD and Xilinx shareholders both approved the acquisition deal April 7.

For the first quarter (ended March 27) of 2021 AMD reported revenue of $3.45 billion, nearly double the $1.79 billion revenue reported for the first quarter of 2020. Net income for the most recent quarter was $555 million, more than three times the $162 million net income one year earlier.

AMD’s March 31 closing price put the company’s market cap at $95.09 billion, down 13.89 percent from $110.43 billion on Dec. 31, 2020.

Worse No. 6: FireEye

CEO: Kevin Mandia

Dec. 31, 2020 Close: $23.06

March 31, 2021 Close: $19.57

Change: -15.13%

On Dec. 11, 2020, FireEye closed a $400 million strategic investment led by Blackstone Tactical Opportunities with ClearSky, a cybersecurity-focused investment firm, as a co-investor.

In December FireEye was very much in the news as it was the first to report the state-sponsored cyberattack that targeted multiple IT companies and U.S. government agencies, including the Department of State and the U.S. Treasury.

On April 7 FireEye named John Watters as the company’s president and chief operating officer

For its 2021 first quarter (ended March 31) FireEye reported revenue of $246.3 million, up nearly 10 percent from $224.7 million in the first quarter of 2020. The company reported a $50.6 million net loss for the quarter compared to a $76.3 million net loss one year earlier.

AMD’s March 31 closing price put the company’s market cap at $4.67 billion, down 13.66 percent from $5.41 billion on Dec. 31, 2020.

Worse No. 5: Datto

CEO: Tim Weller

Dec. 31, 2020 Close: $27.00

March 31, 2021 Close: $22.91

Change: -15.15%

Data storage and backup service provider Datto went public on the New York Stock Exchange on Oct. 21, 2020.

On March 10 Datto said it had acquired cyber threat detection tech developer BitDam in a move to boost the cybersecurity services it offers MSP and SMB customers.

For all of 2020 Datto reported revenue of $518.8 million, up 13 percent from $458.8 million in 2019. The company reported net income of $22.5 million for 2020 compared to a $31.2 million loss one year before.

Datto’s March 31 closing price put the company’s market cap at $3.76 billion.

Worse No. 4: Check Point Software Technologies

CEO: Gil Shwed

Dec. 31, 2020 Close: $132.91

March 31, 2021 Close: $111.97

Change: -15.76%

For the first quarter of 2021 (ended March 31) Check Point Software Technologies reported revenue of $507.6 million, up more than 4 percent from $486.5 million in the first quarter of 2020. Net income for the quarter was $182.9 million, up more than 2 percent from $178.7 million one year before.

Check Point’s March 31 closing price put the company’s market cap at $15.70 billion, down 15.76 percent from $18.63 billion on Dec. 31, 2020.

Worse No. 3: Nutanix

CEO: Rajiv Ramaswami

Dec. 31, 2020 Close: $31.87

March 31, 2021 Close: $26.56

Change: -16.66%

Former VMware executive Rajiv Ramaswami was hired in December as Nutanix president and CEO, replacing co-founder and CEO Dheeraj Pandey who unexpectedly announced his retirement in August.

For the company’s fiscal 2021 second quarter (ended Jan. 31) Nutanix reported revenue of $346.4 million, flat with $346.8 million in the second quarter of fiscal 2020. The company recorded a $287.4 million loss for the quarter compared to the $217.6 million loss one year before.

Nutanix’s March 31 closing price put the company’s market cap at $5.43 billion, down 15.52 percent from $6.42 billion on Dec. 31, 2020.

Worse No. 2: Snowflake

CEO: Frank Slootman

Dec. 31, 2020 Close: $281.40

March 31, 2021 Close: $182.51

Change: -18.52%

Snowflake made a big splash when the company went public in September 2020 and the data cloud service provider’s stock hit a high of $390 per share on December 8. The company’s share price declined to around $300 by year’s end and continued to drop through February and March. (It has rebounded somewhat in April to above $200 a share.)

For the fourth quarter (ended Jan. 31) of fiscal 2021 Snowflake reported revenue of $190.5 million, up 117 percent from $87.7 million in the fourth quarter of fiscal 2020. The company’s net loss for the quarter was $198.9 million compared to a net loss of $83.3 million one year earlier.

For all of fiscal 2021 the company reported revenue of $592.0 million, up nearly 124 percent from $264.7 million in fiscal 2020. The net loss for the fiscal year was $539.1 million compared to the $348.5 million net loss in fiscal 2020.

In March Snowflake acquired an equity stake in business analytics software developer ThoughtSpot through a $20 million investment.

Snowflake’s March 31 closing price put the company’s market cap at $50.50 billion.

Worse No. 1: Splunk

CEO: Doug Merritt

Dec. 31, 2020 Close: $169.89

March 31, 2021 Close: $135.48

Change: -20.25%

Splunk, a developer of machine data management software, experienced a slowdown in its deal closing rate in 2020, which executives attributed to economic uncertainty from the COVID-19 pandemic and customers’ financial difficulties. But the deal close rate rebounded in the fourth quarter, CEO Doug Merritt said during the company’s fourth-quarter earnings call in March.

For the fiscal 2021 fourth quarter (ended Jan. 31) Splunk reported revenue of $745.1 million, down nearly 6 percent from $791.2 million in the fourth quarter of fiscal 2020. The company reported a net loss of $139.5 million for the quarter compared to a $22.7 million loss reported one year earlier.

For all of fiscal 2021 (ended Jan. 31) Splunk reported revenue of $2.23 billion, down 5.5 percent from $2.36 billion in fiscal 2020. The company reported a $908.0 million loss for the year compared to a $336.7 million loss one year before.

On April 5, after the period covered by this stock price analysis, Splunk hired Teresa Carlson for the newly created post of president and chief growth officer. She started in the job on April 19, reporting to president and CEO Doug Merritt. Carlson “will lead and work closely with Splunk’s sales, customer success and marketing leaders to align and drive the company’s ongoing business transformation across Splunk’s go-to-market business segments,” according to the company.

Splunk’s March 31 closing price put the company’s market cap at $21.91 billion, down 20.25 percent from $27.48 billion on Dec. 31, 2020.