2014 Best (And Worst) States To Start A Solution Provider Business

Worst To First: How Business-Friendly is Your State?

With the economy finally kicking into a higher gear and demand for IT services on the rise, some who work for IT vendors or solution providers are thinking about striking out on their own and starting their own solution provider business. The question is, where is the best place to do it?

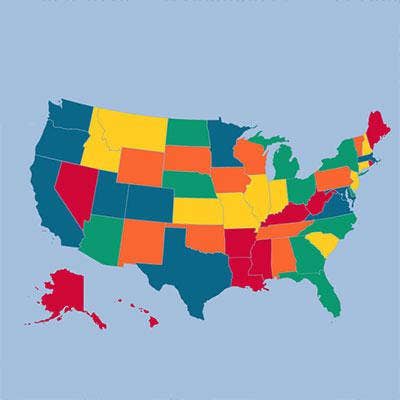

The following ranks all 50 states, from the worst (No. 50) to the best (No. 1) for launching a solution provider business. It's based on a CRN Research analysis of a wide range of data, including the education and experience level of a state's workforce, labor and business costs, and tax and regulatory burden. States are also ranked for innovation and growth potential and business opportunities.

Also, be sure to use our interactive map for state-specific details.

No. 50: Rhode Island (No. 42 in 2013)

Solution Provider 500 Companies: 3

Rhode Island was ranked No. 49 for its business opportunities with low scores for economic climate (including job, income and gross state product growth) and the low number of small and midsize businesses. The state also ranked No. 45 for its high labor costs (including high unemployment insurance taxes), and No. 48 for high corporate taxes and a "business-unfriendly" regulatory environment.

Rhode Island did rank No. 18 for the education and experience levels of its workforce.

The Ocean State has been slow to recover from "The Great Recession" and had a 7.7 percent unemployment rate in July -- below only Mississippi and Georgia, according to the U.S. Bureau of Labor Statistics.

No. 49: Mississippi (No. 46 in 2013)

Solution Provider 500 Companies : 4

Mississippi scored dead last (No. 50) among the states in the workforce education and experience criteria. And its low rankings for overall innovation and growth (No. 46) and for business opportunities (No. 45) didn't help much. In July the state's 8.0 percent unemployment rate was the highest in the country.

The Magnolia State does have low labor costs going for it: It was No. 5 for overall labor and employment costs. And it was in the middle of the pack (No. 25) for taxes and regulations, due to its relatively low corporate income and franchise tax rates.

No. 48: Maine (No. 44 in 2013)

Solution Provider 500 Companies : 1

Maine scored last (No. 50) among the states in the business opportunity criteria, given its low scores for economic climate, job growth and the number of SMB and enterprise customers that provide a potential customer base for a solution provider. The Pine Tree State also ranked poorly in taxes and regulations (No. 45) and innovation and growth potential (No. 42).

Maine does fairly well in terms of offering an educated and experienced workforce (No. 15), although its labor and employment costs are higher than in many states (No. 32).

No. 47: Arkansas (No. 47 in 2013)

Solution Provider 500 Companies : 0

Arkansas was ranked No. 1 for having the lowest labor and employment costs. But it's a case of getting what you pay for with its No. 47 rank for workforce education and experience.

The Natural State was No. 50 in innovation and growth with low scores for the number of engineers and scientists within its workforce and the number of patents awarded to businesses within the state. The state was ranked No. 33 in both business opportunity and in taxes and regulations.

No. 46: West Virginia (No. 50 in 2013)

Solution Provider 500 Companies : 0

West Virginia was at the bottom of our state rankings last year, so this year's ranking marks an improvement. This year it received better scores for workforce education and experience (still low at No. 45), and for overall business opportunities (No. 38). But its ranking for innovation and growth remained an abysmal No. 49.

The Mountain State remained in the middle among all states for labor employment costs (No. 24) and taxes and regulation (No. 29).

No. 45: Hawaii (No. 49 in 2013)

Solution Provider 500 Companies : 0

Hawaii also improved its standing in this year's analysis. But the Aloha State remains a very expensive place to do business with its No. 49 ranking for labor and employment costs (second only to New York). It also has poor rankings for innovation and growth potential (No. 47) and business opportunity (No. 44).

Hawaii does offer relatively low corporate tax rates, a major reason the state is ranked No. 8 in the taxes and regulations category.

No. 44: Alaska (No. 37 in 2013)

Solution Provider 500 Companies : 1

With a population density of 1.3 residents per square mile (compared with 1,210.1 residents per square mile in New Jersey), the business opportunities in Alaska are going to be limited. This year Alaska was ranked No. 48 in business opportunity, ahead of only Rhode Island (No. 49) and Maine (No. 50).

Alaska was the only state that recorded a GDP contraction (by 2.5 percent) in 2013, according to the U.S. Department of Commerce. The Last Frontier State did improve its rankings in this year's CRN analysis in IT worker education (No. 16) and taxes/regulations (No. 32). But the state's labor costs remain high (No. 42), making it an expensive place to do business -- if you can find the opportunities.

No. 43: Louisiana (No. 37 in 2013)

Solution Provider 500 Companies : 3

While Louisiana scores No. 2 for its low labor costs, it's a case of getting what you pay for with the state ranking No. 49 (behind only Mississippi) in worker education and experience.

This year the Pelican State drew lower scores in innovation and growth (ranked No. 45) and in taxes and regulations (No. 21) than in 2013. But the state's rank for business opportunities did improve to No. 22.

No. 42: Kentucky (No. 43 in 2013)

Solution Provider 500 Companies : 5

Kentucky is just a couple of spots behind Louisiana in the labor force education and experience criteria (No. 46). The state's rankings for business opportunity (No. 37), labor costs (No. 29) and innovation and growth (No. 39) were the same or little changed from last year.

But this year's analysis gave the Bluegrass State lower scores for taxes and regulations, including property taxes, resulting in a No. 23 ranking.

No. 41: Nevada (No. 29 in 2013)

Solution Provider 500 Companies : 0

Nevada's overall rank for business opportunity tumbled to No. 36 this year, while the state improved its ranking for taxes and regulations to No. 3. And the state still ranks near the bottom for workforce education and experience (No. 48), behind only Louisiana and Mississippi.

The Silver State's rankings for labor/employment costs (No. 35) and innovation and growth (No. 27) were on par with last year. In July the state's 7.7 percent unemployment rate was tied (with Michigan and Rhode Island) for third highest in the country.

No. 40: New Mexico (No. 40 in 2013)

Solution Provider 500 Companies : 1

New Mexico held steady in its overall ranking despite significantly improving its scores for taxes and regulations (ranked No. 22 this year) from 2013.

The state (nickname: "The Land of Enchantment") otherwise received middle-of-the-road scores for most of the CRN analysis criteria, as it did in 2013. The exception is business opportunity (rank No. 47) where it continues to do poorly because of the relative dearth of small and/or fast-growing companies in the state.

No. 39: Alabama (No. 34 in 2013)

Solution Provider 500 Companies : 4

Alabama's labor and employment costs are among the lowest in the country (No. 7). But while its worker education and experience ranking improved to No. 34 this year, that's still pretty low. And the state's tax and regulations burden has apparently gotten a little heavier based on its No. 14 ranking (it was No. 2 in 2013).

The Yellowhammer State's ranks for innovation (No. 33) and business opportunity (No. 41) remain low.

No. 38: Wyoming (No. 48 in 2013)

Solution Provider 500 Companies : 1

Wyoming moved up significantly in our rankings this year, improving its scores in the taxes and regulatory environment criteria (No. 19), innovation and growth (a still low No. 43) and business opportunity (ditto at No. 40). The latter improvement may be a result of the economic growth occurring in the upper Plains states because of the oil exploration boom.

Wyoming remains a tough place to find educated, experienced workers, however (No. 33,) and its labor costs are in the middle among the states (No. 26).

Solution Provider 500 Companies : 8

Wisconsin suffered lower scores this year in many of the analysis criteria. The state's rankings for innovation and growth (No. 37 this year) and business opportunity (No. 27) were both down from 2013. Its innovation and growth ranking (No. 37) took a hit from the state's below-average 1.7 real GDP growth in 2013, a lower score for awarded patents, and a No. 30 rank for economic climate.

The Badger State did improve its ranking in labor costs (No. 27).

No. 36: Iowa (No. 33 in 2013)

Solution Provider 500 Companies : 2

Iowa is known for having some of the highest corporate taxes in the U.S. (No. 49 in our ranking) as well as high property taxes (No. 38). That brought the state's ranking in the taxes and regulatory environment criteria down to No. 41 this year and hurt the state's overall ranking.

The Hawkeye State did improve its rankings across most of the other criteria used in this year's analysis, including labor costs (No. 10), worker education and experience (No. 31), and business opportunity (No. 26).

No. 35: Tennessee (No. 33 in 2013)

Solution Provider 500 Companies : 5

Tennessee's rankings in this year's Best States criteria fluctuated a fair amount, both up and down, leaving the state about where it was last year. The Volunteer State improved its labor costs ranking to No. 16 and its business opportunity ranking to No. 24, for example. But the state didn't fare as well in worker education and experience (No. 42) and in taxes and regulations (No. 24)

One factor in Tennessee's improved scores for labor costs was the elimination last year of a 0.6 percent addition to the unemployment insurance premiums, enacted in 2009, that businesses paid to the Tennessee Department of Labor & Workforce Development.

No. 34: South Dakota (No. 45 in 2013)

Solution Provider 500 Companies : 0

South Dakota moved up in our rankings this year, in part by boosting its scores for taxes and regulatory environment (No. 6), and for business opportunities (No. 30). The latter may be due to the fact that the northern Plains states are experiencing an economic boom because of the explosion of oil production there.

But the Mount Rushmore State is still a difficult place to run a solution provider business, as evidenced by its low rankings for its workforce education and experience (No. 48) and for its environment for innovation and growth (No. 48).

No. 33: Pennsylvania (2013 Rank: 23)

Solution Provider 500 Companies : 17

Pennsylvania's overall ranking took a hit this year from its low ranking (No. 44) for taxes and regulations, due largely to poor scores for property taxes (No. 43) and corporate taxes (No. 46) -- the latter due to its high (9.99 percent) corporate income tax.

The Keystone State does have high labor and employment costs (No. 41), but its workforce runs about average for education and experience (No. 24). And the state ranked No. 16 for business opportunity, despite relatively anemic GDP growth of 0.7 percent in 2013.

No. 32: Oklahoma (No. 36 in 2013)

Solution Provider 500 Companies : 3

Oklahoma can be an inexpensive place to do business, based on its No. 3 ranking in labor and employment costs and No. 4 ranking in overall taxes and regulations. But the education and experience level of those workers was ranked only No. 44 in the CRN analysis.

While Oklahoma was in the middle of the pack (No. 25) in terms of business opportunities (it improved its state economy score this year), it was ranked only No. 44 for its culture of innovation and growth.

No. 31: Vermont (No. 32 in 2013)

Solution Provider 500 Companies : 0

Vermont was ranked No. 1 in the overall education and experience of its workforce this year (up from No. 6 last year). But the downside is that the Green Mountain State was No. 49 in taxes and regulations, due to its high property taxes and relatively high corporate taxes.

Vermont was ranked No. 46 in business opportunities -- not so surprising given that the small state is only No. 48 in the number of SMB companies that operate in the state and No. 49 in enterprise businesses.

No. 30: Kansas (No. 26 in 2013)

Solution Provider 500 Companies : 9

Kansas scored ahead of many states for the overall education and experience levels of its workforce (No. 19) and for the labor and employment costs of hiring those workers (No. 20).

But the Sunflower State ranked fairly low for taxes and regulations (No. 34), business opportunity (No. 32) and innovation and growth (No. 29).

No. 29: South Carolina (No. 38 in 2013)

Solution Provider 500 Companies : 2

South Carolina is one of the more business-friendly states, ranked No. 12 for overall taxes and regulatory environment and No. 13 for its relatively low labor costs.

The Palmetto State moved up nine spots in this year's overall ranking, largely due to improved scores for labor costs and overall business opportunity (No. 20 this year). But the state's rank for worker education and experience remains low at No. 40.

No. 28: New Hampshire (No. 25 in 2013)

Solution Provider 500 Companies : 6

New Hampshire is ranked at the bottom of all states (No. 50) in business taxes and regulations, thanks to its high corporate income tax (8.5 percent) and the business enterprise tax (0.75 percent), a form of gross receipts tax.

The Granite State scores well (No. 15) on the personal cost-of-living criteria because it has no sales tax or personal income tax (it does have a 5 percent tax on interest and dividends). New Hampshire also ranks very high (No. 6) for its educated, experienced labor pool.

No. 27: Montana (No. 41 in 2013)

Solution Provider 500 Companies : 0

Montana offers low labor costs (No. 8) and low taxes and a favorable regulatory environment (No. 13). But it remains in the bottom 10 states for business opportunity (No. 42) and innovation and growth (No. 40).

The Treasure State improved many of its scores this year and moved up in the overall rankings by 14 spots. It may be benefiting from the economic boom created by oil drilling in the upper Plains states.

No. 26: New Jersey (No. 15 in 2013)

Solution Provider 500 Companies : 26

New Jersey remains an expensive place to start and grow a business with its poor rankings for taxes and regulations (No. 47), personal living costs (No. 46) and high labor/employment expenses (No. 40).

The Garden State's overall position took a hit this year from a markedly lower ranking for business opportunity (No. 34), largely due to lower scores for its state economy (No. 47).

No. 25: Indiana (No. 31 in 2013)

Solution Provider 500 Companies : 3

Indiana has some of the lowest personal living costs in the country (No. 4), low taxes (No. 9) and relatively low labor and employment costs (No. 14)

But the Hoosier State doesn't have much to brag about with its No. 38 rankings for worker education and for overall innovation and growth, or its No. 29 ranking for business opportunity.

No. 24: Connecticut (No. 21 in 2013)

Solution Provider 500 Companies : 9

Connecticut ranks No. 5 for its educated, experienced workforce. But it's one of the most expensive states to hire and retain workers (No. 46). And it's No. 43 ranking for taxes and regulations doesn't help its overall ranking.

The Constitution State is ranked No. 14 for overall innovation and growth, but only a mediocre No. 31 for business opportunity.

No. 23: Illinois (No. 19 in 2013)

Solution Provider 500 Companies : 31

Illinois ranks near the bottom among all states for its taxes and regulatory environment (No. 46) and its high labor costs (No. 43). The education and experience of its labor force (No. 11) almost cracks the top 10.

The Prairie State does provide a good environment for business opportunity (No. 21) and innovation and growth (No. 15).

No. 22: Idaho (No. 24 in 2013)

Solution Provider 500 Companies : 1

Idaho is one of the most business-friendly states in the country with its No. 5 ranking for taxes and regulations. It's also one of the cheapest places to live, with its low personal cost of living (No. 3).

But the Gem State's business opportunity ranking is a low No. 43. Overall labor costs are relatively low (No. 18), while the education and experience level of the state's workforce (No. 35) is nothing to brag about.

No. 21: Missouri (No. 20 in 2013)

Solution Provider 500 Companies : 6

Missouri ranked No. 2 for its low taxes and business-friendly regulatory environment, second only to Utah. Labor and employment costs are also low (No. 6)

The Show Me State is otherwise in the middle of the pack in most other criteria, including workforce education (No 30), business opportunity (No. 23), and innovation and growth (No. 32).

No. 20: Nebraska (No. 30 in 2013)

Solution Provider 500 Companies : 3

Nebraska has low labor and employment costs (No. 4), but ranks a surprisingly poor No. 38 for taxes and regulations, and surprisingly high No. 9 for business opportunity.

The Cornhusker State's higher business opportunity rank this year, along with an improved rank for workforce education and experience (No. 26 this year) gave the state a boost in its overall ranking.

No. 19: Arizona (No. 6 in 2013)

Solution Provider 500 Companies : 9

Arizona has a lot going for it, including respectable scores for innovation and growth (No. 11) and business opportunity (No. 18), and relatively low labor costs (No. 17).

But the Grand Canyon State was ranked No. 49 in personal cost of living and quality of life criteria -- second from the bottom only to New Mexico. The state dropped 13 spots this year because of declines in its worker education and business opportunity scores.

No. 18: Ohio (No. 22 in 2013)

Solution Provider 500 Companies : 8

Ohio ranks No. 9 for its comparatively low labor and employment costs, but only No. 29 for the education and experience level of its available workforce.

The Buckeye State, otherwise, has respectable scores in other criteria, including taxes and regulations (No. 18), business opportunity (No. 19) and innovation and growth (No. 24).

No. 17: North Carolina (No. 12 in 2013)

Solution Provider 500 Companies : 4

North Carolina was ranked No. 6 for business opportunity, likely boosted by the state's healthy 2.3 percent growth in GDP in 2013.

But the Tar Heel State otherwise posted middle-of-the-road scores for the other criteria in the CRN analysis, including ranking No. 25 for innovation and growth, No. 27 for worker education and experience, and No. 28 for taxes and regulations. The state ranked No. 19 in labor and employment costs.

No. 16: Michigan (No. 17 in 2013)

Solution Provider 500 Companies : 15

Michigan ranks No. 2 for overall personal cost of living and quality of life criteria, behind No. 1 ranked Wyoming.

The Great Lakes State, however, gets otherwise mixed grades. It has relatively high labor costs (No. 36) while its workforce education is ranked No. 23. And business opportunities are somewhat limited (No. 35). But its taxes and regulatory environment give it a No. 17 rank and the state is No. 13 in innovation and growth.

No. 15: Florida (No. 16 in 2013)

Solution Provider 500 Companies : 9

Florida offers a promising environment for starting and growing a solution provider business with a No. 12 ranking for innovation and growth and No. 17 for business opportunity. And it has low taxes: It's ranked No. 11 for both corporate taxes and personal taxes/personal cost of living.

But the Sunshine State's workforce education and experience is ranked only No. 43 among the states. And the cost of those workers is moderately high with the state ranking No. 30 in overall labor and employment costs.

No. 14: Delaware (No. 18 in 2013)

Solution Provider 500 Companies : 1

Delaware's workforce education and experience is in the top 10 among all states (No. 9) and the state has the same rank for innovation and growth. And at No. 22, the state's labor and employment costs are reasonably competitive.

But the First State's tax and regulatory burden is relatively high (No. 35) and its overall grade for business opportunity (No. 28) is only middle of the road.

No. 13: New York (No. 13 in 2013)

Solution Provider 500 Companies : 44

New York is a very expensive place to do business. It has the highest labor and employment costs of any state (ranked No. 50). The state is No. 47 for personal cost-of-living costs. And it's No. 36 for taxes and regulations.

Is it worth it? The Empire State is ranked No. 5 for innovation and its workforce is ranked No. 8 for education and experience. And yet the best New York can do for business opportunity is No. 14.

No. 12: Georgia (No. 8 in 2013)

Solution Provider 500 Companies : 19

Georgia's rankings for workforce education and experience (No. 36), taxes and regulations (No. 16) and business opportunity (No. 11) were all down from last year's analysis, dropping the state out of the top 10 states overall.

The only criteria where the Peach State improved on last year was in labor/employment costs, where this year's No. 25 ranking was up three spots from 2013.

No. 11: North Dakota (No. 28 in 2013)

Solution Provider 500 Companies : 1

North Dakota moved up this year's list of Best States more than any other, likely the result of the oil exploration boom and the economic surge that has followed. The state's business opportunity ranking rocketed to No. 15 this year from No. 43 in 2013, not surprising given that North Dakota's GDP grew 9.7 percent in 2013 -- the most of any state.

The Peace Garden State's taxes remain low (No. 7) and the education and experience level of the workforce has risen to No. 21 as more people move to the state seeking work. But the demand for workers is apparently exceeding the supply as the state's ranking for labor and employment costs ranking went from No. 5 last year to No. 23 in this year's analysis.

No. 10: Minnesota (No. 14 in 2013)

Solution Provider 500 Companies : 16

Minnesota was ranked No. 2 for business opportunity in the CRN analysis. That may be due to the state's proximity to North Dakota and the economic boom in the northern Plains states fueled by the oil rush. Minnesota's GDP was 2.8 percent in 2013.

But the North Star State can be an expensive place to do business. It was ranked No. 44 for labor costs and No. 40 for taxes and regulations. On the plus side, its educated and experienced workforce was No. 13 among the states and the state ranked No. 17 for overall innovation and growth.

No. 9: Oregon (No. 10 in 2013)

Solution Provider 500 Companies : 3

Oregon scores well for both business opportunity (No. 13) and innovation and growth (No. 16). And it offers the educated, experienced workforce (ranked No. 17) to make those business and growth opportunities possible.

The Beaver State's labor costs are relatively high (No. 33) while its ranking for taxes and regulations (No. 27) is in the middle of the pack among all states.

No. 8: Maryland (No. 5 in 2013)

Solution Provider 500 Companies : 21

Maryland's workforce is ranked No. 2 for education and experience, second only to Vermont's workforce. But at No. 47, Maryland's labor and employment costs are among the highest in the country.

The Old Line State is No. 4 for overall innovation and growth and No. 12 for business opportunities -- being part of the fast-growing Washington, D.C., area is a plus. But the state's personal cost-of-living ranking (No. 43) makes it among the more expensive areas of the country to live.

No. 7: Texas (No. 11 in 2013)

Solution Provider 500 Companies : 22

Texas has had one of the fastest-growing economies in recent years -- GDP growth in 2013 was 3.7 percent -- and that led to the Lone Star State having the highest ranking (No. 1) for business opportunity. And it's ranked No. 8 for innovation and growth.

Texas has relatively low labor costs (No. 21), but the education and experience levels of its workforce are quite low (No. 39).

No. 6: Massachusetts (No. 9 in 2013)

Solution Provider 500 Companies : 12

Massachusetts has some of the most educated, experienced workers in the country (No. 4), but it also has some of the highest labor and employment costs (No. 48). The Bay State is ranked No. 2 for innovation and growth, second only to California.

And while Massachusetts is ranked No. 10 for business opportunity, its No. 42 ranking for taxes and regulatory environment can give entrepreneurs pause. Massachusetts, for example, recently raised its minimum wage to $9 per hour in 2015 -- highest among all the states. But the state also lowered its unemployment insurance rates.

No. 5: California (No. 7 in 2013)

Solution Provider 500 Companies : 33

California is considered the technology mecca of the country and that's reflected in its No. 1 ranking for innovation and growth and No. 8 ranking for business opportunity.

But doing business in California isn't cheap. It's ranked No. 38 for employment and labor costs and No. 42 for personal cost of living. And the Golden State's No. 26 rank for taxes and regulations puts it in the middle of the pack.

No. 4: Washington (No. 4 in 2013)

Solution Provider 500 Companies : 6

Washington is ranked No. 12 for the overall education and experience level of its workforce -- not surprising given that it's home base for Microsoft and other software developers. The state is also ranked No. 3 for overall innovation and growth.

The Evergreen State scores well for business opportunity (No. 7). But it's more expensive than many states in terms of labor (No. 28) and taxes and regulations (No. 30).

No. 3: Utah (No. 1 in 2013)

Solution Provider 500 Companies : 1

Utah, last year's No. 1 state in the CRN Best States analysis, is still a great place to start and grow a solution provider business. It's ranked No. 1 for its low taxes and business-friendly regulatory environment and No. 4 for business opportunity.

The education and experience of the Beehive State's workforce is ranked No. 28 and the state's overall ranking for innovation and growth is No. 9, both down a number of spots from 2013.

No. 2: Colorado (No. 3 in 2013)

Solution Provider 500 Companies : 15

The Front Range area is one of the fastest-growing regions of the country and Colorado had GDP growth of 3.8 percent in 2013. So it's not surprising the state is ranked No. 3 for business opportunity.

The Centennial State is ranked No. 6 for innovation and growth and its workforce is ranked No. 7 for its high education and experience levels. The state's tax and regulatory burden is ranked No. 20 while labor and employment costs are ranked No. 31.

No. 1: Virginia (No. 2 in 2013)

Solution Provider 500 Companies : 46

With a business opportunity rank of No. 5 and an educated workforce ranked No. 3, Virginia tops this year's CRN analysis of the best states to start and grow a solution provider business.

The Old Dominion State, which was No. 2 in the 2013 state rankings, also boasts an environment that fosters innovation and growth (No. 7) and places a relatively light tax and regulatory burden on businesses (No. 10).

One potential downside: As the Washington D.C./northern Virginia area becomes an increasingly expensive place to live and work, Virginia's already mediocre rating for labor and employment costs (No. 34) could become increasingly uncompetitive.