10 Cool Tech Companies That Raised Funding In April 2022

Next-generation technology developers in Zero Trust cybersecurity, data management and data science, cloud product distribution and software product demonstration reported new rounds of funding.

Follow The Money

Startup companies pushing technology boundaries in the realms of cybersecurity and big data continue to dominate our monthly list of companies that are attracting significant amounts of venture funding.

Grafana Labs, a developer of open-source data observability and visualization software tops the April list with an impressive $240 million funding round. Other companies in the big data space with funding rounds include data catalog developer Data.World, data science/machine tool vendor dotData and data engineering platform provider Ascend.io.

Two companies on the April list, ThreatLocker and Twingate, are focused on Zero Trust security while Coro builds an all-in-one cybersecurity platform. OSF Digital, which raised $100 million, provides digital transformation solutions and services.

Pax8, which operates a cloud commerce marketplace for buying, selling and managing cloud solutions, boosted its valuation with a $185 funding round. Also on the April roundup is Demostack, which develops a demonstration experience platform for creating tailored software product demos for online sales pitches.

Grafana Labs

Headquarters: New York

CEO: Raj Dutt

Funding: A $240 million Series D funding round.

Investors: The round was led by GIC, Singapore’s sovereign wealth fund, with participation from new investor J.P. Morgan. Also participating were all other existing investors including Sequoia Capital, Coatue, Lightspeed Venture Partners and Lead Edge Capital.

What company does: Grafana Labs develops open-source observability and data visualization software used to collect metric, log and trace data generated by IT infrastructure, networks, cybersecurity tools and other systems and build data dashboards and visualizations.

CEO Quote: “Our plans are simple: aggressively deliver on our product roadmap and our commitment to embracing the big tent — enabling our users to compose and visualize data from any source — while continuing to build out modern observability capabilities across metrics, logs, tracing, and more. We are committed to the continual release of impactful open-source software, bringing many new capabilities to market, and constantly listening to the community and our customers to drive innovation.”

Pax8

Headquarters: Denver

CEO: John Street

Funding: The $185 million funding raised Pax8’s valuation to $1.7 billion.

Investors: The round was led by new investor SoftBank Vision Fund 2 with additional contributions from existing investors Catalyst Investors, Sageview Capital, Blue Cloud Ventures and Liberty Global Ventures.

What company does: Pax8 operates a cloud commerce marketplace for buying, selling and managing cloud solutions for channel partners, including providing billing, and automated provisioning and integration services.

CEO Quote: “As we continue to evolve our technology and marketplace to meet the needs of SMBs, the new investment will provide capital to accelerate innovation and continued expansion into new global markets. This strong funding round reflects the powerful work Pax8 is doing to enable and grow SMBs through our partners, employees, technology, education, and support.”

ThreatLocker

Headquarters: Maitland, Fla.

CEO: Denny Jenkins

Funding: The $100 million in Series C funding puts ThreatLocker on track for a $1 billion valuation.

Investors: The round was led by General Atlantic with participation from existing investors Elephant VC and Arthur Ventures.

What company does: Cybersecurity tech provider ThreatLocker develops a Zero Trust endpoint security solution.

CEO Quote: “This is going to allow us to continue to improve our products and to grow our customer base,” said ThreatLocker co-founder and CEO Danny Jenkins. “We’re just scratching the surface from an MSP perspective. This year we’re hoping to add 3,000 more MSPs.”

OSF Digital

Headquarters: Quebec City

CEO: Gerard Szatvanyi

Funding: A $100 million Series C round.

Investors: The round was led by Sunstone Partners with participation from existing investors Delta-v Capital and Salesforce Ventures.

What company does: OSF Digital provides commerce and digital transformation services and solutions developed for specific markets and vertical industries.

CEO Quote: “This investment represents a great opportunity for our employees, customers, and company. We are at a very exciting time in OSF‘s history. We look forward to expanding our service offerings, expanding into additional geographies, and strategically acquiring more companies.“

Coro

Headquarters: New York

CEO: Guy Moskowitz

Funding: The $60 million Series C round brings the company’s total funding in the last six months to $80 million.

Investors: The round was led by Balderton Capital with participation from existing investor Jerusalem Venture Partners.

What company does: Coro builds an all-in-one cybersecurity platform aimed at mid-market companies, providing functions to monitor devices, users, email, networks, data and applications and remediate malicious activity.

CEO Quote: “Faced with limited security expertise, staff, and budgets, mid-market companies are forced to choose between impossibly expensive and labor-intensive enterprise solutions or piecemeal off-the-shelf solutions that cover only a small portion of their attack surface – and neither of these options offers true protection. With this latest round, we will further enable mid-sized companies to operate in the midst of an increasingly sophisticated and aggressive cyber landscape with genuine peace of mind and refocus critical resources on running successful businesses instead of on managing cyber security.”

Data.World

Headquarters: Austin, Texas

CEO: Brett Hurt

Funding: The $50 million Series C funding round brought the company’s total financing to $132.3 million.

Investors: The round was led by the Growth Equity business within Goldman Sachs Asset Management. Additional investors included Prologis Ventures, Shasta Ventures, Vopak Ventures and Sandbox Insurtech Ventures, along with individual investors Paul Albright, Rick Braddock, Zachary Karabell, Dave Liu and Scott Stephenson.

What company does: Data.World develops an enterprise data catalog system, incorporating knowledge-graph technology, for managing data discovery and data governance tasks.

CEO Quote: “Leaders understand the importance of extracting key insights from their data to drive their business or organization, but they have struggled to put in place the necessary infrastructure to do so broadly across their departments and teams. We look forward to collaborating with our partners, including Goldman Sachs, to dramatically expand our product offerings, open new markets, and provide companies with solutions that drive data literacy, access and usability, all powered by our knowledge graph.”

Demostack

Headquarters: San Francisco and Tel Aviv, Israel

CEO: Jonathan Friedman

Funding: A $34 million Series B financing round.

Investors: The round was led by Tiger Global Management with participation from Bessemer Venture Partners, Amiti Ventures, GTMFund, Operator Collective and StepStone.

What company does: Demostack develops a demonstration experience platform for creating tailored software product demos for online sales pitches.

CEO Quote: “The recent investment further positions us to become the market leader of demo experience solutions for the industry and allows us to continue to invest in R&D, innovation, and global growth. It is now more important than ever before to deliver a great product demo, and the reason is two-fold: Remote selling is here to stay, and buyers expect a seamless, personalized buying experience. We built Demostack to help sellers adapt to this market shift.”

Twingate

Headquarters: Redwood City, Calif.

CEO: Tony Huie

Funding: The $42 million Series B funding round brought the company’s total funding to $67 million and raised its valuation to $400 million.

Investors: The round was led by BOND with participation from existing investors WndrCo, 8VC and SignalFire.

What company does: Twingate develops cybersecurity technology that allows organizations to quickly implement Zero Trust security by bringing together identity, device and contextual information.

CEO Quote: “We’re going to make a big investment to really build out our capabilities on the channel side. We think there’s a huge opportunity to work with channel members to help them solve the security problems of their clients. We think the channel is a fantastic community of players to work with.”

dotData

Headquarters: San Mateo, Calif.

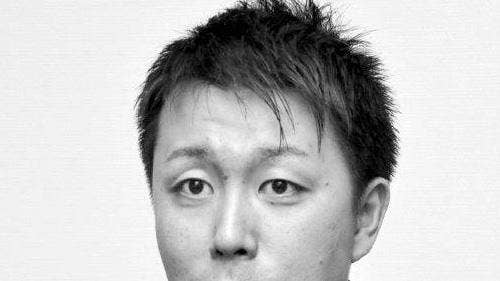

CEO: Ryohei Fujimaki

Funding: The $31.6 million Series B funding round brought the company’s total financing to $74.6 million.

Investors: The round was led by Otsuka Corp., Sumitomo Mitsui Banking Corp. and Sumitomo Mitsui Trust Bank Ltd.

What company does: The dotData Enterprise data science automation platform allows enterprises to automate data science workflows and build and deploy AI and machine learning models in days instead of months. The system handles data ingestion and wrangling, automated feature engineering, AutoML and model operationalization tasks – all with zero coding.

CEO Quote: “The latest round of funding will enable dotData to accelerate product development and innovation to better meet customers’ demands and continue supporting customers’ business transformation through AI.”

Ascend.io

Headquarters: Menlo Park, Calif.

CEO: Sean Knapp

Funding: A $31 million Series B round of funding.

Investors: The round was led by Tiger Global with participation from Shasta Ventures and existing investor Accel.

What company does: The Ascend Data Automation Cloud combines the core capabilities of data engineering including data ingestion, transformation, delivery, orchestration and observability into a single platform.

CEO Quote: “At Ascend.io, our focus on data engineering productivity has truly resonated with customers, and we’re seeing faster growth across our user base than ever before. This latest round of funding enables us to help even more data teams around the globe take advantage of this new wave of automation, ensuring they have a leg up as they drive innovation in their respective industries.”