Palo Alto Networks CEO Arora: Large Companies Are Built By Successful M&A

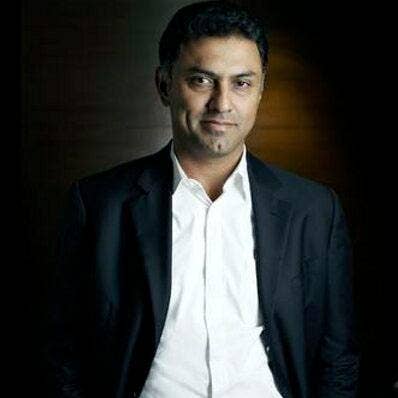

‘We believe that our ability to acquire, integrate and leverage our go-to-market for acquisitions is a strategic competitive advantage,’ says Palo Alto Networks CEO Nikesh Arora.

Palo Alto Networks CEO Nikesh Arora dismissed concerns raised by investors around the company’s aggressive acquisition strategy and argued these mega-deals are key to long-term growth.

“Very large enterprise companies have been built by successful M&A strategy,” Arora told investors Monday during the company’s earnings call. “We believe that our ability to acquire, integrate and leverage our go-to-market for acquisitions is a strategic competitive advantage.”

The Santa Clara, Calif.-based platform security vendor has spent $2.7 billion to acquire eight up-and-coming cybersecurity companies since the start of 2019, most recently scooping up attack surface management vendor Expanse for $800 million just last week. Arora said these deals are predicted to account for roughly 15 percent of Palo Alto Networks’ billings in the fiscal year ending July 31, 2021.

[Related: Attack Surface Lockdown: Palo Alto Networks To Buy Expanse For $800M]

Palo Alto Networks looks for early-stage companies with products that are easy to integrate, address areas of high customer demand, and where the vendor believes it can significantly change the trajectory of the acquired asset, Arora said. The company will continue to be opportunistic in pursuing acquisitions going forward to maximize its long-term growth prospects, according to Arora.

Expanse on a standalone basis would have generated $67 million of annual recurring revenue in the current fiscal year, Arora said, but as part of Palo Alto Networks is projected to generate $73 million of annual recurring revenue in the current fiscal year. Expanse’s transaction multiples are very favorable compared to other companies, especially given that the company is growing by 100 percent annually.

Palo Alto Networks plans to offer all CIOs and CISOs attending the company’s Ignite user conference this week an Expanse exec report, which Arora said provides a vulnerability map and insights into the client’s complete attack surface, risks and suspicious activity. The initiative should be a great lead generation tool, allowing the Palo Alto Networks sales team to hit the ground running once the Expanse deal closes.

“It’s because of Expanse’s insight that their technology is trusted by some of the world’s largest and most complex organizations, from members of the Fortune 500 to the U.S. military,” Arora said.

Palo Alto Networks sales for the quarter ended Oct. 31 jumped to $946 million, up 22.6 percent from $771.9 million a year ago. That crushed Seeking Alpha’s estimate of $921.4 million.

The company recorded a net loss of $92.2 million, or $0.97 per diluted share, 54.7 percent worse than a net loss of $59.6 million, or $0.62 per diluted share, the year before. On a non-GAAP basis, net income soared to $158.1 million, or $1.62 per diluted share, up 50.9 percent from $104.8 million, or $1.05 per diluted share, last year. That beat Seeking Alpha’s net income projection of $1.33 per diluted share.

Palo Alto Networks’ stock climbed $13.89 (5.37 percent) to $272.59 per share in morning trading. Earnings were announced before the market opened Monday.

Subscription and support revenue for the quarter leapfrogged to $708.7 million, up 31.1 percent from $540.7 million last year. Product revenue for the quarter inched ahead to $237.3 million, up 2.6 percent from $231.2 million the year prior.

For the coming quarter, Palo Alto Networks expects diluted non-GAAP net income of $1.42 to $1.44 per share on total sales of $975 million to $990 million. Analysts had been expecting non-GAAP earnings of $1.35 per share on total revenue of $971.2 million, according to Seeking Alpha.