Avaya Bankruptcy Filing: 5 Things To Know

‘The actions we are taking are designed to accelerate our transformation and make Avaya an even stronger partner to our customers and strategic and channel partners,’ Avaya said in a channel and strategic partner FAQ on its bankruptcy filing.

Avaya CEO Alan Masarek

After months of speculation and reports from the unified communications market, Avaya Holdings Corp. officially filed for Chapter 11 bankruptcy protection in Texas federal court Tuesday.

Durham, N.C.-based Avaya has been struggling since May to put its finances back on solid ground, but the bankruptcy declaration comes on the heels of accounting problems related to cloud subscriptions that led to substantial earnings and revenue target misses that the company couldn’t come back from without ultimately undergoing a financial restructuring.

Despite the financial upheaval, the company remains positive—and even bullish—on its future and is going all in on cloud communications in any form, be it private, public or hybrid unified communications offerings. And Avaya President and CEO Alan Masarek, who has been at the helm of the company for six months, is accustomed to navigating companywide transformations.

“The actions we are taking are designed to accelerate our transformation and make Avaya an even stronger partner to our customers and strategic and channel partners—we expect to emerge from this process with one of the strongest balance sheets in our industry, significantly reduced debt and substantial additional liquidity to drive the business forward,” Avaya said in a channel and strategic partner FAQ on the bankruptcy filing that CRN obtained.

Here are the details of Avaya’s bankruptcy filing, the financial background story and what the company’s financial restructuring means for partners.

Jim Chirico

The Background

Avaya’s stretch of financial difficulties began in May when the company reported that it had missed its revenue target and posted a considerable earnings miss with revenue that declined 20 percent during the company’s third-quarter 2022, which ended June 30, 2022. The company then made the move to replace Jim Chirico, the company’s CEO since 2018. Alan Masarek was brought on in August as president and CEO after serving as Vonage’s CEO for six years.

Masarek told CRN when he joined the company that about “two-thirds of the mess” was due to an accounting error in regard to the company’s cloud subscriptions.

“The reasons were tied to contact duration—length of contract and contract size—for purposes of [revenue recognition]. What happens is customers sign a shorter-term contract, or let’s say there’s a cancellation clause in the contract [for] future performance obligation. While the contract value may be, let’s say, $1 million a year for three years but it’s cancellable after one year, you can’t treat it as a $3 million TCV. So, there’s all sorts of nuance from a [revenue recognition] perspective that gets depressed when you have, from a TCV perspective, smaller [contract] size and smaller duration together. The other side is, we had customers who renewed maintenance instead of flipping into a multiyear subscription contract,” Masarek explained.

The CEO added that the company was diagnosing those issues quickly but recognized that it caused concern in the market. In the fall, reports surfaced that Avaya was once again considering filing for bankruptcy for the second time in six years.

Avaya previously filed for bankruptcy in 2017.

The Chapter 11 Filing

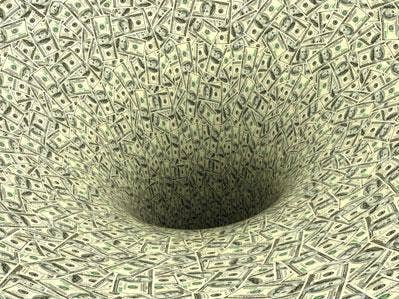

On Feb. 14, Avaya filed for Chapter 11 bankruptcy protection in federal court in Texas. Avaya in its filing listed total assets of between $1 billion and $10 billion and total liabilities of between $1 billion and $10 billion. The company lists its number of creditors as being between 25,001 and 50,000.

Avaya’s “Restructuring Support Agreement,” according to the company, will reduce Avaya’s total debt by more than 75 percent, from approximately $3.4 billion today to approximately $800 million. In addition, Avaya said it has secured committed financing of approximately $780 million. The company said it expects this financial restructuring to be completed within 60 to 90 days. Kirkland & Ellis is serving as legal counsel to Avaya, Evercore Group is serving as financial adviser and AlixPartners is serving as restructuring adviser, Avaya said in a statement issued Tuesday.

The Company’s Creditors

Avaya in the court filing included a consolidated list of creditors with the 30 largest unsecured claims or claims that don’t hold priority on debt collection from the company. Topping the list was software giant Verint Americas in the amount of $22.93 million. Microsoft was the second highest creditor that the company owes, totaling $9.01 million. Electronics manufacturer Wistron Corp. took the third spot and is owed $8.93 million, and solution provider giant SHI International rounded out the top four creditors, standing with $7.71 million in an unsecured claim from Avaya.

Channel Impact

Avaya said in a press release that its filing “will not impact the company’s customers, channel and strategic partners, suppliers, vendors or employees.” Avaya stressed that partner contracts will remain in place and that partners will continue to be paid commissions on time and in full, including those earned prior to the filing date, Avaya said in its channel and strategic partner FAQ published Tuesday.

“We are operating normally. We look forward to emerging from this process as a well-capitalized company with one of the strongest balance sheets in our Industry,” Avaya elaborated in the FAQ.

The company added that its subsidiaries outside of the U.S. are not included in the court-supervised process and are not expected to file their own insolvency proceedings as part of the U.S. proceedings.

Moving Forward

Masarek, who is no stranger to turning companies around and changing culture, remains bullish on the company’s long-range product road maps and investing in innovation to advance its product development, specifically as it relates to Avaya Experience Platform, its cloud-based contact center offering in which the company has been placing its bets.

Avaya referred to its financial restructuring as the culmination of a monthslong engagement with financial stakeholders aimed at strengthening its capital structure, increasing liquidity and acceleratin its investment in cloud products and solutions.

“This a positive step for Avaya, and we look forward to moving ahead as a well-capitalized company with one of the strongest balance sheets in our industry and substantial cash to invest in the business,” the company said in its FAQ to partners.