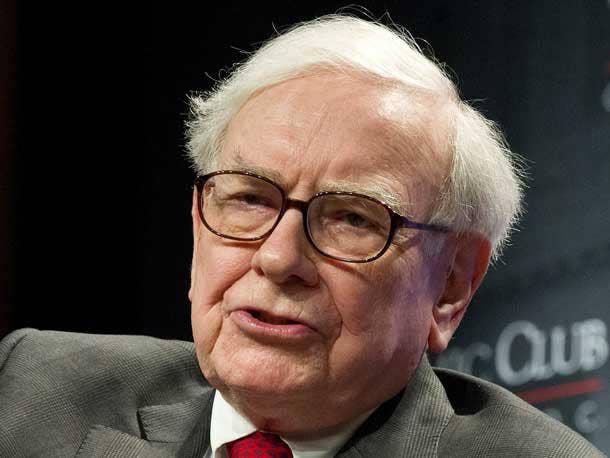

HP Stock Surges As Buffett’s Berkshire Hathaway Takes Stake

The “Oracle of Omaha” purchased nearly 121 million shares of the Palo Alto, Calif.-based IT giant for a $4 billion position, according to SEC filings.

Warren Buffett and his legendary investment fund placed a huge bet on HP Inc. with a massive $4 billion investment that gives Berkshire Hathaway an 11.4 percent stake.

SEC filings show Berkshire Hathaway increased its stake by 11 million shares since April, when a separate filing showed it owned 109.8 million HP shares. Buffett has been on an investment tear in recent weeks, floating another $11.6 billion to buy insurer Alleghany and spending $7.6 billion for a 14.6 percent stake in Occidental Petroleum.

HP stock shot up more than 15 percent to $40.42 as of 1 p.m. ET as news of the disclosure continued to excite investors on Thursday. Shares soared as much as 17 percent earlier in the trading day.

With the purchase, Berkshire Hathaway becomes the largest institutional investor in HP, beating out Vanguard Group’s 9.85 percent stake and Dodge & Cox’ 9.62 percent position.

[Related story: HP’s Poly Buy Gives Solution Providers Reason To Cheer]

CRN reached out to Berkshrie Hathaway for comment. A spokesperson for HP Inc. said in a statement to CRN, “Berkshire Hathaway is one of the world’s most respected investors and we welcome them as an investor in HP Inc.”

Mike Turicchi, vice president of Gainesville, Va.-based NCS Technologies, said HP channel partners have reason to be optimistic with Buffett’s move. “Berkshire Hathaway has a proven track record for making investments in companies they think will perform well,” he said. “The recent investment leads me to believe that HP is positioned well to continue growing existing business and capitalize on new business opportunities.”

The 91-year-old Buffett shows no signs of slowing down with his relatively new interest in tech investments. Berkshire Hathaway also owns 5 percent of Apple Inc. with a stake of $157.5 billion, a $1.8 billion stake in Amazon, and a $1.8 billion position in data warehousing tech company Snowflake. Apple alone makes up almost half of Berkshire Hathaway’s massive portfolio, according to Hedge Follow.

The move shows a vote of continued confidence for the booming PC market. HP posted Q1 2022 revenues of $17 billion, a year-over-year spike of 8.7 percent – mostly from its personal systems side of the ledger. The company continues to make bold moves, announcing last week it would scoop up global video conferencing giant Poly for $3.3 billion (including Poly’s debt) in a bid to boost its hybrid office business.

“We view Berkshire buying HPQ shares as a positive that validates HPQ’s strategy/deep value,” wrote Evercore ISI tech analyst Amit Daryanani in a note to investors.

All of HP’s business moves benefit partners, HP CEO Enrique Lores told CRN during a call announcing its quarterly results. “We are a channel-oriented company,” Lores said. “We do the majority of our business in the channel and this is not going to change.”