Apple CEO: ‘Challenging Environment’ Hurt Holiday Device Sales

A boost in services and iPad revenue was not enough to offset Apple’s sales slump for iPhones, Macs and wearables in the first quarter of its 2023 fiscal year, which ended in December. ‘I’m proud of the way we have navigated circumstances, seen and unforeseen, over the past several years, and I remain incredibly confident in our team and our mission and in the work we do every day,’ CEO Tim Cook says.

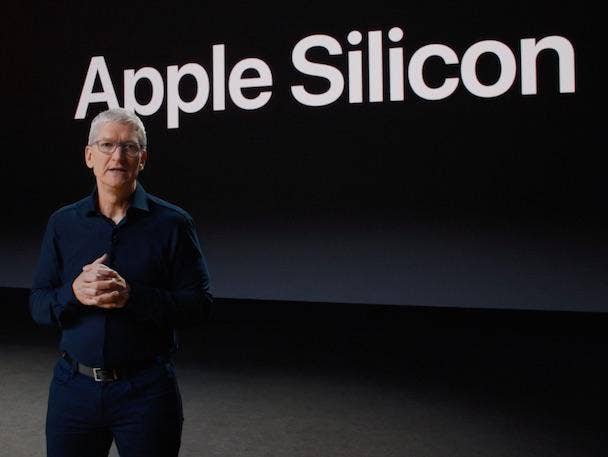

Apple CEO Tim Cook said a “challenging environment” caused the iPhone giant’s device sales to plunge during last year’s holiday season.

The Cupertino, California-based company reported on Thursday that it made $117.2 billion in revenue for the first quarter of its 2023 fiscal year, which ended Dec. 31, 2022. That was a 5 percent decline from the same period a year ago, and it was roughly $4 billion below the average estimate of Wall Street analysts. Apple’s earnings per share was $1.88, also below expectations.

“I’m proud of the way we have navigated circumstances, seen and unforeseen, over the past several years, and I remain incredibly confident in our team and our mission and in the work we do every day,” Cook said during the company’s earnings call.

[Related: Tim Cook: Apple Met 2022 Challenges Head On, With Only iPad Slipping]

Cook cited three factors that contributed to Apple’s holiday sales slump. First, “foreign exchange headwinds” impacted revenue by nearly 800 basis points.

Second, production challenges related to the COVID-19 pandemic in China “significantly impacted” the supply of Apple’s new iPhone 14 Pro and iPhone 14 Pro Max devices. This contributed to Apple’s iPhone revenue declining by 8 percent year-over-year to $65.8 billion in the first quarter.

For the third factor, Cook also cited the “enduring impacts of the pandemic” as well as inflation and Russia’s ongoing invasion of Ukraine among the “unprecedented circumstances” faced by the world.

“And we know that Apple is not immune to it. But whatever conditions we face, our approach is always the same. We are thoughtful and deliberate. We manage for the long term,” he said.

Among the company’s product lines, Macs suffered the largest plummet with a 29 percent decline, resulting in $7.7 billion in revenue for the category.

Cook said the holiday season was a “difficult compare” to the previous one when Apple released the redesigned MacBook Pros with the company’s homegrown Arm-compatible M1 chips. The sales slump was also the result of “challenging macroeconomic environment and foreign exchange headwinds.”

However, Cook said, Apple is bullish on Mac’s future, in part because of the recently announced MacBook Pro notebooks using the company’s new M2 Pro and M2 Max chips.

Besides Mac and iPhone, the other device category that saw a decline in the first quarter was the group containing Apple’s wearables, smart home devices and accessories. The category saw an 8 percent year-over-year decline in revenue, bringing it to $13.5 billion for the period.

“However, our installed base of devices in the category set a new all-time record thanks to the largest number of customers new to a smartwatch that we’ve ever had in a given quarter,” said Luca Maestri, Apple’s CFO, on the earnings call.

The one bright spot in Apple’s hardware portfolio was the iPad. In contrast to the rest of the company’s device segments, iPad revenue grew 30 percent year-over-year to $9.4 billion for the quarter.

Maestri said iPad sales growth was in part the result of the company having “enough supply to meet demand” in contrast to the 2021 holiday season when there were “significant supply constraints.” Sales also received a boost from last fall’s launch of the new M2-powered iPad Pro.

“The iPad installed base reached a new all-time high thanks to incredible customer loyalty and a high number of new customers. In fact, over half of the customers who purchased iPads during the quarter were new to the product,” Maestri said.

These products combined resulted in Apple’s total device revenue declining 8 percent year-over-year in the first quarter to $96.4 billion.

The iPhone maker’s services revenue, on the other hand, increased 6 percent to $20.7 billion in the first quarter compared to the same period a year ago. This was an “all-time revenue record,” according to Cook. Contributing to that was double-digit revenue growth from App Store subscriptions as well as new revenue records for cloud and payment services, among other categories.

While Apple continued its practice of not giving revenue guidance for the next quarter, Maestri said the company expects year-over-year sales in the second quarter to be on par with the first. This is based on Apple’s projections that services revenue will grow, Mac and iPad sales will decline, and iPhone sales will improve during the period, which ends in March.

Apple’s stock price fell by more than 3 percent in after-hours trading to $145.80.