Nvidia Sees Explosive Growth In Data Center, Professional Visualization

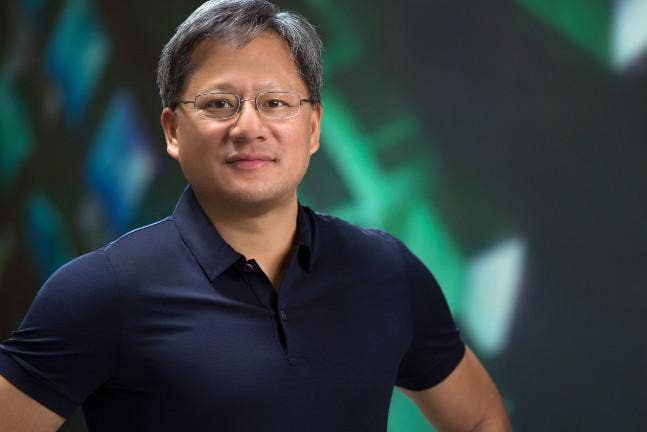

Nvidia CEO Jensen Huang reports 83 percent year-over-year growth in data center technology revenue, making it the big driver for Nvidia’s first fiscal quarter 2023 and helping give the high-performance GPU, DPU and CPU maker a strong start to its new fiscal year.

Nvidia, a leading manufacturer of GPU, CPU and other electronic components, software and systems, is seeing strong momentum in the data center and professional visualization sectors following what is arguably the company’s most significant product launch.

Nvidia’s data center, professional visualization and gaming businesses all showed double-digit sales growth during its first fiscal quarter 2023, which ended May 1.

The company’s growth comes as it remains focused on four major initiatives, said Jensen Huang, founder and CEO of Santa Clara, Calif.-based Nvidia, in his prepared remarks during the company’s financial analyst conference call Wednesday.

[Related: Nvidia CEO Jensen Huang: 10 Bold Statements From GTC 2022]

The first, Huang said, is ramping Nvidia’s next-generation of AI infrastructure chips and platforms, including its new Hopper GPUs, Bluefield DPUs (data processing units), NVLink scalable GPU-to-GPU interconnects, Quantum InfiniBand and Spectrum Ethernet networking.

“All this [is] to help customers build their AI factories and take advantage of new AI breakthroughs like transformers,” he said.

The second is to ramp Nvidia’s system and software industry partners to launch Grace, the company’s first CPU and one that integrates technology from processor developer ARM, Huang said.

The third is to ORIN, Nvidia’s new robotics processor, which Huang said is already in use in nearly 40 customers building cars, robo taxis, trucks, delivery robots, logistics robots, farming robots and medical instruments.

The fourth is Nvidia’s software platforms that add new value to the company’s ecosystem with Nvidia AI and Nvidia Omniverse and expanding into new markets with new CUDA acceleration libraries, Huang said.

“These initiatives will greatly advance AI while continuing to extend this most impactful technology of our times to scientists in every field and companies in every industry,” he said.

Nvidia’s NVLink, for instance, is key to building better data centers and expanding Nvidia’s data center business, Huang said in response to a financial analyst’s question.

“[We have the] ability to support every single workload because we have a universal accelerator running every single workload from data processing to data analytics to high-performance computing to training [AI] inference that we can support ARM and x86, and we support PCI Express to multi-system NVLink and multi-chip NVLink and multi-die NVLink,” he said. “That capability makes it possible for us to really be able to serve all these different segments.“

There are a lot of different system configurations Nvidia will make, Huang said.

“If you take a step back and look at the type of systems that are necessary for data processing, scientific computing, machine learning and training, inference, done in the cloud for hyperscale nature, done on-prem for enterprise computing, done at the edge, each one of the workloads and deployment locations, the way that you manage [all this] would dictate a different system architecture,” he said. “So there isn‘t a one size fits all.”

For its first fiscal quarter 2023, which ended May 1, Nvidia reported total revenue of $8.3 billion, up 46 percent compared with the $5.7 billion the company reported for its first fiscal quarter 2022. That beat analysts’ expectations by $190 million, according to Seeking Alpha.

That included revenue from data center technology of $3.8 billion, up 83 percent; professional visualization technology revenue of $622 million, up 67 percent; gaming technology revenue of $3.6 billion, up 31 percent; automotive technology revenue of $138 million, down 10 percent, and OEM and other revenue of $158 million, down 52 percent.

Nvidia reported GAAP net income of $1.6 billion, or 64 cents per share, down from last year’s $1.9 billion, or 76 cents per share. Net income on a non-GAAP basis was $3.4 billion, or $1.36 per share, up significantly from last year’s $2.3 billion, or 91 cents per share. Analysts had been expecting non-GAAP earnings of $1.29 per share, according to Seeking Alpha.

Nvidia share prices rose 5.1 percent to $169.75 per share at the close of the market but fell nearly 7 percent during the first few hours of post-market trading.