Dell Fires Back At Icahn: VMware Stock Swap 'In The Best Interests' Of Shareholders

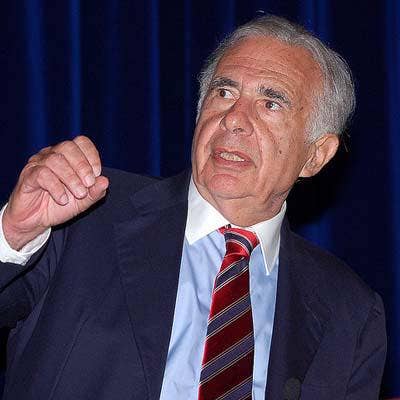

One day after activist investor Carl Icahn sent a fierce letter to DVMT shareholders slamming Dell Technologies' proposed stock swap with VMware to become a public company, the infrastructure giant has responded by saying the move is in the best interests of shareholders. Additionally, Dell told CRN that it plans to soon set a date for the highly anticipated shareholder vote.

"Dell Technologies continues to believe that the proposed offer for DVMT shares, which represents a 29 percent premium to the DVMT share price immediately prior to the announcement of the transaction, is fair and in the best interests of DVMT shareholders," said the company in a statement to CRN. "The transaction offers DVMT shareholders an opportunity to hold a direct economic interest in Dell Technologies. … The transaction also offers DVMT shareholders seeking liquidity $9 billion in aggregate cash consideration."

Dell's statement was in response to Icahn's scathing letter on Monday urging shareholders to vote against Dell’s plan to become public through a $21.7 billion share swap with its DVMT VMware software business tracking stock. To become public again, DVMT shareholders— other than those held by affiliates of Dell Technologies such as Michael Dell— must approve the agreement.

[Related: 5 Things We Learned About VMware CEO Pat Gelsinger]

Icahn, who revealed he owns an 8.3 percent stake in DVMT tracking stock, accused Dell CEO Michael Dell and private equity firm Silver Lake of creating a "fear campaign" to force shareholder to approve the VMware stock swap agreement as well as alleging that Dell has long planned to repurchase the tracker stock at "bargain basement prices."

"I firmly believe Dell and Silver Lake are trying to capture $11 billion of value that rightly belongs to us, the DVMT stockholders. As such, I intend to do everything in my power to stop this proposed DVMT merger," said Icahn in his letter to shareholders. "It is better to have peace than war, but be assured, I still enjoy a good fight for the right reasons, and in the current situation, I do not see peace arriving quickly!"

In a statement to CRN, Dell said it's been very transparent throughout the process and created an independent Special Committee representing DVMT shareholders who determined that the transaction was the best available option for shareholders.

Dell said it expects to file definitive proxy materials in the coming weeks and set a date for the shareholder vote in the fourth quarter of calendar year 2018.

Channel partners say Dell going public through a VMware stock swap would benefit solution providers because it would create an even tighter collaboration partnership between the two vendors.

Dan McCormick, executive vice president of Davenport Group, a St. Paul, Minn.-based Dell EMC partner and 2018 CRN Triple Crown winner, said the VMware tracking stock buyout could "accelerate the integration and alignment work" already underway between the two organizations.

"Dell Technologies, Dell EMC and VMware in particular, has demonstrated a commitment to align products, solutions, services and programs across brands, and I expect to see increasing collaboration going forward irrespective of which path Dell Technologies may take to re-emerge as a public company," said McCormick.

He said Davenport customers are already "greatly benefiting" from tighter collaboration while the partnership is also increasing the role for channel partners in deals. "The channel's value often hinges on our ability to understand, navigate and successfully implement and support technologies from multiple partners. The more closely Dell EMC and VMware align internally, the more value we can help create for our mutual customers," he said.

Under the terms of the proposed buyout, shareholders of the DVMT tracking stock would exchange each share of DVMT tracking stock for 1.3665 shares of Dell Technologies Class C common stock, or $109 per share with the aggregate, not exceeding $9 billion.

If the shareholder vote fails, Dell has confirmed it has been meeting with investment banks to explore the option of a traditional IPO.