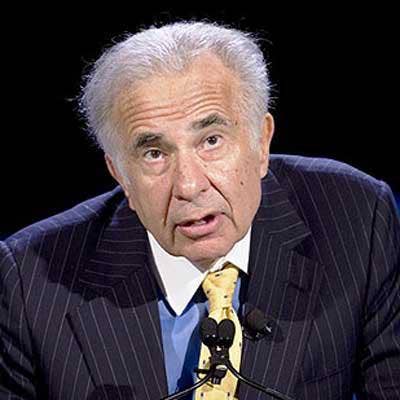

Carl Icahn Drops 'Unwinnable' Case Against Dell's VMware Stock Swap Deal

Activist investor Carl Icahn is throwing in the towel in his lawsuit against Dell Technologies, saying the litigation is "unwinnable" following a new VMware stock swap deal Dell unveiled Thursday which sweetened the offer for shareholders.

"In connection with the revised deal, it appears that stockholders representing 17 percent of the stock have decided to switch over and support Dell. As a result of this, as well as the support Dell already had, we have determined that a proxy fight would be unwinnable and have decided to withdraw our Delaware litigation and terminate our proxy contest," said Icahn in a statement Thursday.

Dell said an "overwhelming number" of shareholders support the company's new offer of $120 per share in cash and stock of up to $14 billion in its bid to become a public company. Icahn was Dell's most vocal opponent against the original deal. He not only sued the infrastructure giant, but labeled the deal as "the Michael Dell/Silver Lake buyout scheme."

[Related: 4 IT Companies Where Investor Carl Icahn Is Stirring The Pot]

"I firmly believe Dell and Silver Lake are trying to capture $11 billion of value that rightly belongs to us, the DVMT stockholders. As such, I intend to do everything in my power to stop this proposed DVMT merger," said Icahn in a letter to shareholders last month. Icahn owns a 9.3 percent stake in DVMT tracking stock and 2.27 million shares of VMware.

Under Dell's original terms, shareholders of the DVMT tracking stock would exchange each share of DVMT VMware tracking stock for 1.3665 shares of Dell Technologies Class C common stock, or $109 per share, not exceeding $9 billion. After weeks of negotiations with shareholders, the new terms are that DVMT shareholders would exchange each share for between 1.5043 to 1.8130 of Class C shares, or $120 per share, not exceeding $14 billion – a $5 billion increase to the original deal.

Dell said it has gained binding agreements to vote in favor of the new offer from investors Elliott Management, Dodge & Cox, Canyon Partners and Mason Capital Management, who collectively owned approximately 17 percent of the total outstanding Class V common stock.

Icahn on Thursday took credit for Dell's new deal. "Largely due to our opposition, today Dell enhanced the deal by reducing the value being diverted from DVMT stockholders from over $11 billion to $8 billion," he said in a statement on Thursday. "Although we believe a far better deal could have been obtained, unfortunately, and as you might imagine, we were not invited to the negotiations by either Dell or Goldman."

A top executive from a solution provider who partners with Dell Technologies said Icahn's exit is good news for the channel.

"Icahn's a big investor in Dell who doesn't like how the company is run or Michael Dell," said the executive who declined to be identified. "With him stepping aside after kicking and screaming for months, it means that Dell can now go forward and become public again through VMware. … I'm excited to see what a public Dell looks like in 2019 with major investment backing that should help R&D, maybe even some M&A – all good news for partners."

In order for Dell to become a public company again, DVMT shareholders -- other than those shares held by affiliates of Dell Technologies such as Michael Dell and private equity firm Silver Lake -- must approve the agreement. The critical shareholder vote will take place at 8 a.m. central time on Dec. 11 during a special meeting of stockholders at Dell's headquarters in Round Rock, Texas.