AWS, Google, Microsoft Dominate Data Center Spending

One in every three dollars spent on data center hardware and software is now coming from hyperscale operators including Apple, AWS, Facebook, Google and Microsoft.

Hyperscale operators led by public cloud titans Amazon Web Services, Google and Microsoft are rapidly taking over the spending share in the data center, with one in every three dollars spent on data center hardware and software now coming from hyperscaler operators.

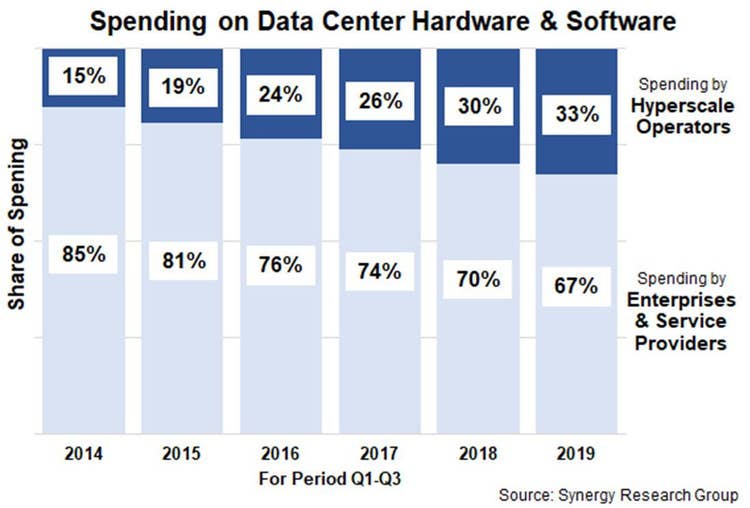

As enterprises pull back from data center spending and hyperscale operators become the ones driving growth, the dynamics of the data center market are changing. Hyperscale operators accounted for 33 percent of all spending on data center hardware and software in the first three quarters of 2019, according to Synergy Research Group, up from 30 percent in the the first three quarters of 2018, 26 percent in the first three quarters of 2017 and 15 percent in the first three quarters of 2014.

Over the past five years, hyperscale operator spending in data centers has increased threefold while enterprise spend has increased just 6 percent. As the demand for public cloud services spikes tied to strong growth from social networking, the hyperscalers leading this spending charge are Apple, AWS, Facebook, Google and Microsoft, followed by Alibaba, Baidu, IBM, NTT, Oracle and Tencent.

“We are seeing very different scenarios play out in terms of data center spending by hyperscale operators and enterprises,” said John Dinsdale, a chief analyst at Synergy Research Group. “On the one hand, revenues at the hyperscale operators continue to grow strongly, driving increased demand for data centers and data center hardware. There is an ever-increasing number of hyperscale data centers, many of which continue to be expanded. Those huge data centers are crammed full of servers and other hardware which are on a frequent refresh cycle.”

[Related: The 10 Hottest Hyperconverged Systems Of 2019]

On the other hand, Dinsdale said there is a continued decline in the volume of servers being bought by enterprises. “The impact of those declines is balanced by steady increases in server average selling prices, as IT operations demand ever-more-sophisticated server configurations, but overall spending by enterprises remains almost flat,” he said. “These trends will continue into the future.”

While a traditional data center typically supports hundreds of physical servers and other IT hardware along with thousands of virtual machines, these massive hyperscale data centers house tens of thousands of servers and hardware alongside millions of virtual machines.

Total data center infrastructure equipment revenue, including both cloud and non-cloud, hit $38 billion in the third quarter of 2019.

Servers, operating systems, storage, networking and virtualization software combined accounted for 96 percent of the $38 billion, with Dell EMC leading both server and storage revenue while Cisco Systems dominated the networking segment. Microsoft and VMware are heavily used in data centers due to their leadership in server OS and virtualization applications, according to Synergy Research.

Hyperscaler data center Capex spending in the third quarter of 2019 reached $31 billion, up 8 percent year over year, making it the second-highest spending quarter in history in terms of the amount hyperscale operators are spending on building, expanding and equipping data centers.

The number of these massive data centers has tripled since 2013. At the end of the third quarter of 2019, a total of 504 hyperscale data centers were being operated by hyperscale providers with more than 150 new facilities on the way.

The largest colocation providers in the world are shifting to meet the demand for how the majority of new data centers are now being built. For example, Equinix this year unveiled a $1 billion venture to specifically build hyperscale data centers throughout Europe.