Nvidia Teases DGX Cloud AI-As-A-Service As Earnings Wow Wall Street

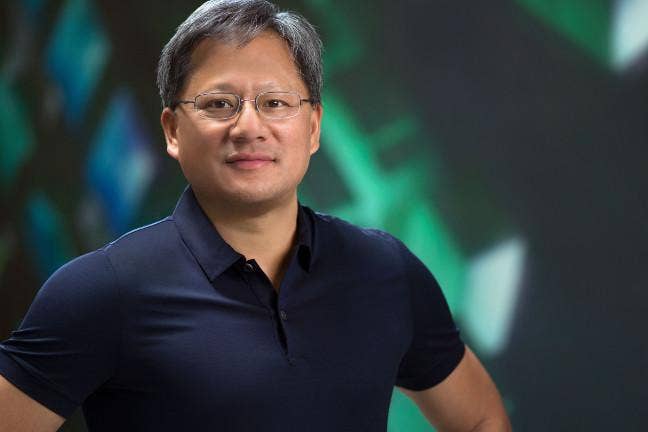

Jensen Huang, Nvidia’s CEO and co-founder, calls DGX Cloud the ‘next level’ of the GPU designer’s business model and says it’s meant to ‘help put AI within reach of every enterprise customer.’ The service is already available on Oracle Cloud, and it’s coming to Microsoft Azure, Google Cloud and other cloud services soon.

Nvidia used its most recent earnings to tease its new Nvidia DGX Cloud AI-as-a-service coming to cloud service providers as Wall Street responded favorably to its fourth-quarter financial results.

Jensen Huang, Nvidia’s CEO and co-founder, called DGX Cloud the “next level” of the GPU designer’s business model and said it’s meant to “help put AI within reach of every enterprise customer.”

[Related: Intel Vows To Restore Staff Salaries In Fall As EMEA Head Resigns]

The service provides browser access to the Nvidia AI Enterprise software suite for training large language models on a DGX Supercomputer, and it’s targeted for businesses who want to build proprietary generative AI models and services, according to Nvidia.

“By putting Nvidia’s DGX supercomputers into the cloud with Nvidia DGX cloud, we’re going to democratize the access of this infrastructure and, with accelerated training capabilities, really make this technology and this capability quite accessible,” Huang said on Nvidia’s fourth-quarter earnings call.

The service is already available on Oracle Cloud Infrastructure, and it’s expected to arrive on Microsoft Azure, Google Cloud and other cloud services soon, the company said. Huang said the service will be sold by Nvidia and its go-to-market partners.

Huang said DGX Cloud will drive demand for cloud service providers because Nvidia has many customers, including AI startups and enterprises, who want to run AI applications in the cloud, in hybrid cloud configurations or in multiple cloud services.

“We’re going to be the best AI salespeople for the world’s clouds,” he said.

Nvidia is expected to share more details about DGX Cloud at its virtual GTC event in March.

Nvidia Stock Jumps After Beating Wall Street’s Expectations

Nvidia’s stock price jumped by more than 8.5 percent in after-hours trading Wednesday after the GPU designer beat Wall Street’s expectations on revenue and earnings for the fourth quarter of the company’s 2023 fiscal year, which ended January 29.

The company’s fourth-quarter revenue was $6 billion, down 21 percent year-over-year but up 2 percent from the previous quarter. The quarterly revenue gain is a sign that Nvidia’s business has started to recover after revenue fell sequentially for the prior two periods.

While Nvidia’s fourth-quarter gross margin of 63.3 percent was down 2.1 points from the same period last year, it grew 9.7 points from the previous period, continuing Nvidia’s gross margin recovery from a low of 43.5 percent in last year’s second quarter. Operating income and net income, while down 58 percent and 53 percent year-over-year, also showed improvements from the previous quarter, growing 109 percent to $1.3 billion and 108 percent to $1.4 billion. These were GAAP-based figures.

Nvidia’s data center business grew 11 percent year-over-year but fell 6 percent sequentially to $3.6 billion in the fourth quarter. This was the resulted of increased sales to hyperscale customers and cloud service providers, the latter of which have signed “multi-year cloud service agreements” for the company’s new DGX Cloud service offerings. The quarterly decline was a reflection of reduced sales in China following last year’s US export ban of the company’s top GPUs to the country.

Gaming revenue, on the other hand, fell 46 percent year-over-year but increased 16 percent sequentially to $1.8 billion in the fourth quarter. The company attributed the yearly decline to decreased demand due to macroeconomic issues and COVID-19-related disruptions in China. However, it said the company’s new Ada Lovelace-powered RTX 40 series GPUs drove quarterly sales growth.

Nvidia’s professional visualization business declined 65 percent year-over-year but increased 13 percent sequentially to $226 million in the fourth quarter. Automotive revenue grew 135 percent year-over-year and 17 percent sequentially to $294 million. The company’s OEM and other revenue segment declined 56 percent year-over-year but grew 15 percent sequentially to $84 million, driven by notebook OEM and Cryptocurrency Mining Processor sales, though Nvidia said revenue for the latter was “nominal” in 2023.

Nvidia’s revenue for its 2023 fiscal year, which ended on January 29, was nearly $27 billion, almost unchanged from the previous year. On a GAAP basis, its gross margin for 2023 was 56.9 percent, down 8 points from the previous year. Operating income was down 58 percent to $4.2 billion while its net income fell 55 percent to $4.3 billion.