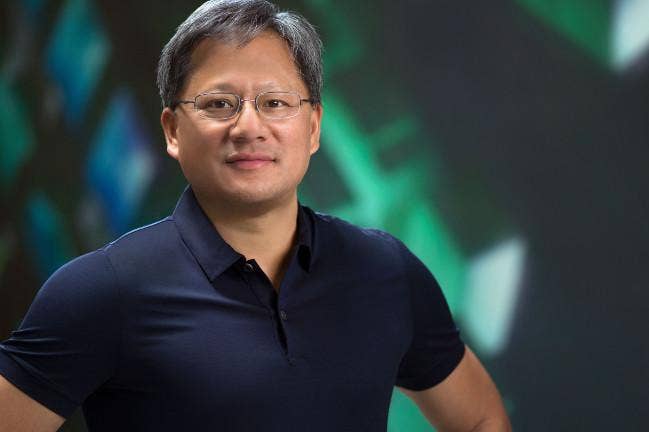

Nvidia CEO: Industrial Data Center Sales Grew Faster Than Hyperscalers

Jensen Huang says AI is having its ‘smartphone moment’ for every industry. ‘All of these industries, whether you’re in medical imaging or in lawn mowers, you’re going to have data centers that are hosting your products, just like the [cloud service providers],’ he says of Nvidia’s new milestone in the company’s latest earnings.

Nvidia’s data center GPU sales through OEMs to vertical industries grew faster than revenue from hyperscalers for the first time in the company’s history, according to Nvidia CEO Jensen Huang.

The Santa Clara, Calif.-based company achieved the milestone in the fourth quarter of its 2021 fiscal year, where the company reported record revenues for the quarter and the year, though overall data center sales were flat from the previous quarter as a result of declining Mellanox networking revenue. The shift in sales means that organizations in verticals ranging from financial services and higher education had higher compute needs than some of the world’s largest consumers of data center infrastructure, which include tech giants like Facebook, Microsoft, Amazon and Google, at least for Nvidia’s latest quarter.

[Related: Gigabyte Axes GeForce RTX 3090 TURBO, Disrupting Partner Server Plans]

Colette Kress, Nvidia’s CFO, said vertical industries drove more growth for data center compute revenue, which includes company’s latest A100 GPU, than hyperscale customers, according to Kress, as OEMs ramped up their A100-based systems and Nvidia’s DGX systems continued to sell well. The strongest performing verticals were supercomputing, financial services, higher education and consumer internet, and they contributed more than half of overall data center revenue.

Data center compute sales grew 45 percent year-over-year in the fourth quarter and more than offset a continued decline in Mellanox sales, resulting in $1.9 billion for total data center revenue that quarter, according to Kress. That marked a 97 percent increase from the same period last year, but it was comparable to the previous quarter, when a decline in the business caused by lower Mellanox networking sales broke a six-quarter sequential growth spurt.

On Nvidia’s earnings call, Huang said the “industrialization of AI” represents the next wave of AI adoption and called it the industry’s “smartphone moment.” He said this means a proliferation of devices that have intelligence baked in.

“All of these industries, whether you’re in medical imaging or in lawn mowers, you’re going to have data centers that are hosting your products, just like the [cloud service providers], and so that’s a brand-new industry,” Huang said, adding that Nvidia’s EGX platform will facilitate such transformations.

Huang acknowledged that Nvidia continued to be “supply constrained” at the company level, with gaming GPUs continuing to see the most impact, but he said he doesn’t believe shortages are impacting the data center side as much.

“For data center so long as the customers work closely with us and we do a good job planning between our companies, there shouldn’t be a supply issue,” he said.

While the decline in Mellanox sales was the result of a large, non-recurring sale to a Chinese OEM in the third quarter, Kress said, Nvidia expects Mellanox sales to return to sequential growth in the first quarter of its 2022 fiscal year.

“We expect to return to sequential growth in Q1, driven by strong demand for our high-speed networking products, including the ramp of ConnectX adapters with [cloud service providers] and all major server OEMs in their upcoming refresh. We also see strong momentum in high-performance computing with HDR InfiniBand products,” she said.

Tim Brooks, managing director at St. Louis, Mo.-based World Wide Technology, a top Nvidia partner and No. 9 on CRN’s 2020 Solution Provider 500 list, recently told CRN that his company’s Nvidia business grew 400 percent over the past three years and is now in the nine digits.

“It’s significant enough where we’ve invested hundreds of people within World Wide — engineers, architects, data scientists and AI solution developers that are all now working for us,” he said. “Whereas in 2016, when we started, there was basically two of us carrying most of the water.”

What drives a lot of WWT’s customers to adopt Nvidia-based GPU servers is a desire for them to transform their business and put data at the forefront of everything they do, according to Brooks.

“That defines strategy that we then get to go execute on, and AI and machine learning are part of that,” he said. “And if you’re going to have AI and machine learning, you’re going to consume GPUs.”

The company reported $5 billion in record revenue for the fourth quarter of its 2021 fiscal year, a 61 percent increase from the same period last year, a 6 percent increase from the previous quarter and $180 million higher than Wall Street’s expectations. Net earnings were $3.10 per share, 29 cents higher than the analyst consensus.

Nvidia finished its 2021 fiscal year with $16.7 billion, a new record and 53 percent increase from the previous year. The company expects revenue for the first quarter of its 2022 fiscal year to reach around $5.30 billion, which would mark a 72 percent year-over-year increase.

The company’s fourth-quarter gaming revenue was $2.5 billion, up 67 percent from the same period last year and up 10 percent from the previous quarter. Professional visualization revenue was $307 million, down 7 percent year-over-year and up 30 percent from the previous quarter. Automotive was $145 million, down 11 percent year-over-year and up 16 percent from the previous quarter. OEM and other revenue was $153 million, up 1 percent year-over-year and down 6 percent sequentially.

Nvidia’s stock price was down around 1.7 percent in after-hours trading Wednesday.