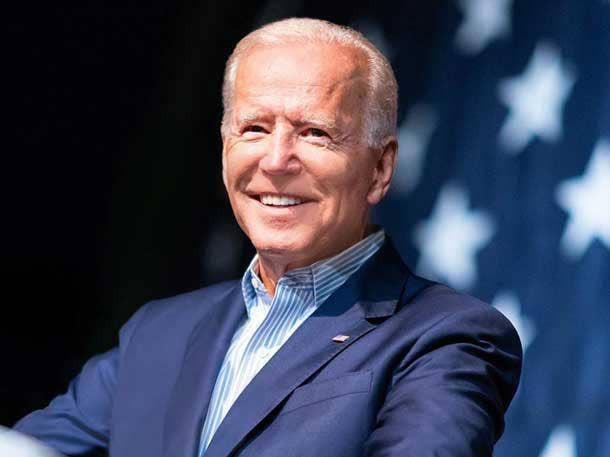

Intel, AMD CEOs Urge Biden To Boost U.S. Chip Manufacturing

Top semiconductor executives are calling for President Joe Biden to rekindle domestic chip manufacturing with ‘substantial funding’ so that the U.S. can become more competitive with other countries that have poured significant investments into chip foundries like TSMC. ‘The costs of inaction are high,’ they say in a letter.

Intel CEO Bob Swan, AMD CEO Lisa Su and several other top semiconductor executives urged President Joe Biden Thursday to rekindle domestic chip manufacturing with “substantial funding” as part of the White House’s economic recovery and infrastructure plan.

The letter to Biden was sent by the Semiconductor Industry Association, which represents 98 percent of U.S. semiconductor industry by revenue, and included signatures by Swan and Su as well as CEOs and top executives at Nvidia, Broadcom, Western Digital, IBM, Qualcomm and several other companies.

[Related: Lisa Su: Shortages Constrained AMD’s Record 2020 And Will Continue]

Semiconductor executives sent the letter on the same day that the Biden administration pledged to assist with a global semiconductor shortage that has impacted the IT and automotive industries, among others. Bloomberg reported that Biden plans to sign an executive order that will direct the government to conduct a supply chain review for critical semiconductor components.

The executives, represented by the Semiconductor Industry Association’s board of directors, said Biden should work with Congress to fund incentives and investments in U.S. semiconductor manufacturing and research that were authorized in the CHIPS for America Act as part of the 2021 defense bill, which passed in January.

“We therefore urge you to include in your recovery and infrastructure plan substantial funding for incentives for semiconductor manufacturing, in the form of grants and/or tax credits, and for basic and applied semiconductor research,” the letter said. “We believe bold action is needed to address the challenges we face. The costs of inaction are high.”

The executives said, “semiconductors are critical to the U.S. economy” and enable technologies needed to realize Biden’s economic recovery and infrastructure goals.

The challenge, according to them, is that the U.S. share of global semiconductor manufacturing has fallen to 12 percent from 37 percent in 1990 due to domestic investments largely being flat while foreign governments have provided significant funding and incentives to chip manufacturers like TSMC overseas.

“As a result, the U.S. is uncompetitive in attracting investments in new fab construction and our technology leadership is at risk in the race for preeminence in the technologies of the future, including artificial intelligence, 5G/6G, and quantum computing,” the letter said.

By increasing U.S. semiconductor output, the government would fuel economic growth, jobs and infrastructure, the executives said. They added that such investments would also enhance “national security and supply chain resilience to meet future challenges.”

Dominic Daninger, vice president of engineering at Nor-Tech, a Burnsville, Minn.-based high-performance computing system integrator, said the issue is pressing as Intel weighs outsourcing more chip manufacturing in the future. Incoming Intel CEO Pat Gelsinger recently said Intel will likely manufacture most of its 2023 products internally while also expanding its use of external foundries overseas for certain technologies and products.

“It’s got to be concerning,” Daninger said.

Increasing investments in domestic chip manufacturing could help improve CPU supply, which can have a substantial financial impact on companies and other organizations, according to Daninger.

For instance, he said, one customer has been using Microsoft Azure cloud instances for HPC purposes, and the customer figured out that it could save significant money by moving all its applications to on-premise servers. However, if component shortages delay server shipments by multiple months, the customer will have to continue incurring large cloud costs.

“He’s spending so much money on Azure cloud costs for HPC purposes now that what he spends in one month would buy him a new [on-premise] cluster,” Daninger said. “But if we can’t get the hardware in a timely fashion, it gets really expensive for them.”