Public Cloud Sales Hit $544 Billion Despite Economic Woes

There is no stopping public cloud sales momentum in 2023 and beyond, with Synergy Research Group predicting the market to exceed $1 trillion in a few years. Read where the biggest cloud revenue growth is coming from.

Worldwide public cloud revenues soared 21 percent annually in 2022 to a record $544 billion, according to new data from Synergy Research Group, which expects public cloud sales to double in size by 2027.

“Revenues from cloud services are now more than three times those of cloud infrastructure hardware and software revenues, and service growth continues to outpace the infrastructure market,” said John Dinsdale, chief analyst at Synergy Research, in an email to CRN.

Despite economic headwinds, such as inflation and many IT companies conducting layoffs in 2022, public cloud sales continued to increase with no signs of slowing down in 2023 and beyond.

[Related: 40,000 Tech Layoffs: Amazon Vs. Google Vs. Microsoft]

“Synergy forecasts that public cloud ecosystem revenues will double in size in the next four years,” Dinsdale.

The cloud companies that featured the most prominently among 2022 market segment leaders were Amazon, Microsoft, Google and Salesforce.

Cloud Market Breakdown Of Leaders And Sales

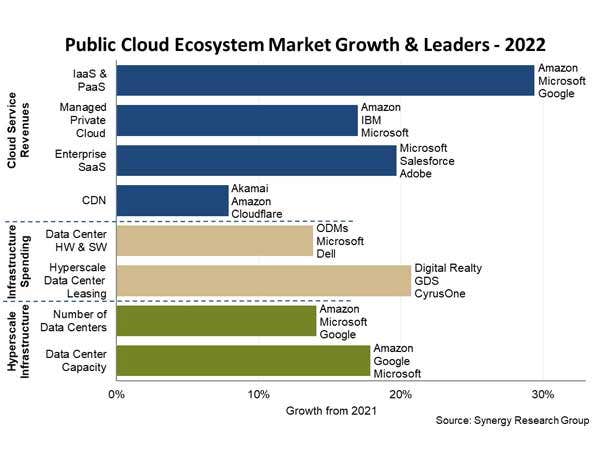

The cloud market segment which witnessed the biggest growth in 2022 was Infrastructure as-a-Service (IaaS) and Platform as-a-Service (PaaS).

Annual revenues from IaaS and PaaS services grew 29 percent annual in 2022 to over $195 billion, led by Amazon, Microsoft and Google.

In the other main cloud service segments: managed private cloud services, enterprise Software as-a-Service (SaaS) and content delivery network (CDN), added another $229 billion in service revenues, up 19 percent compared to 2021.

Market leaders in enterprise SaaS revenue in 2022 were Microsoft, Salesforce and Adobe.

Amazon, IBM and Microsoft were the market leaders last year in managed private cloud, while Akamai, Amazon and Cloudflare lead the CDN market.

Cloud Providers Spent $120 Billion On Data Center Infrastructure

Public cloud leaders like Amazon via Amazon Web Services, Google’s cloud business Google Cloud, and Microsoft spend billions each year building and equipping data centers to power their cloud infrastructure and cloud services.

For example, just this week Amazon announced it will invest a whopping $35 billion in building new AWS data centers across the state of Virginia over the next 17 years.

Public cloud providers spent a whopping $120 billion in 2022 on building, leasing and equipping their data center infrastructure, representing an increase of 13 percent compared to 2021, according to new data from Synergy.

Over the next four years, major cloud providers like AWS, Microsoft and Google Cloud are expected to increase the number of operational hyperscale data centers by 50 percent and expand the capacity of data center networks by over 65 percent, Synergy said.

Layoffs At Amazon, Google, Microsoft

Synergy’s new public cloud data comes the same month as the leading public cloud market share leaders—Amazon, Microsoft and Google—announced massive layoffs.

In January, Amazon announced 18,000 employees layoffs, Microsoft unveiled 10,000 employees will be terminated, and Google said it will cut 12,000 employees.

However, it appears most of these layoffs won’t significantly impact employees working at AWS, Google Cloud or Microsoft’s cloud organizations.

Synergy said the total addressable market forecast data shows that the public cloud ecosystem revenues will likely double in size in just four years, meaning the market will exceed $1 trillion by 2027.

U.S. Remains ‘Center Of Gravity’

While cloud markets are growing strongly in all regions across the globe, the United States remains a “center of gravity,” Dinsdale said.

In 2022, the U.S. accounted for approximately 45 percent of all cloud service revenues and 53 percent of hyperscale data center capacity.

Across all service and infrastructure markets, the vast majority of leading players are U.S.-based companies, followed by Chinese companies that account for 8 percent of all 2022 cloud service revenues and 16 percent of hyperscale data center capacity, according to Synergy.