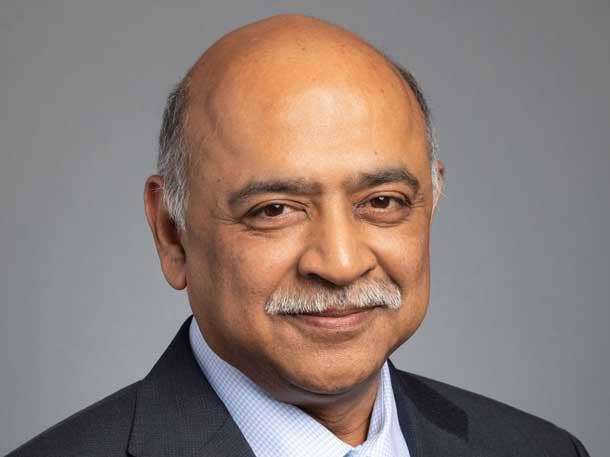

New CEO Arvind Krishna Needs To Revitalize IBM’s Channel Strategy: Partners

IBM Business Partners are looking for Krishna to breathe new life into practice areas that languished as outgoing CEO Virginia “Ginni” Rometty strove to modernize the company during her eight-year tenure.

New CEO Arvind Krishna needs to re-energize IBM’s channel strategy to give partners more midmarket muscle and enterprise sales commitment, solution providers told CRN.

IBM Business Partners are looking for Krishna to breathe new life into practice areas that languished as outgoing CEO Virginia “Ginni” Rometty strove to modernize the company during her 8-year tenure.

Krishna, a highly regarded technologist who’s relatively unknown outside IBM, officially took the reins from Monday, becoming just the 10th chief executive in the enterprise giant’s 108-year-history.

Rometty led IBM through its longest financial downturn, a period in which she drastically transformed Big Blue across the “strategic imperatives” of cloud and cognitive computing, then invigorated the company with the $34 billion acquisition last July of Red Hat.

Partners said that Krishna, who championed the Red Hat acquisition as IBM’s senior vice president for cloud and cognitive software, must now focus on upping IBM’s channel game if the company is going to reverse a trend that has relegated IBM to a smaller share of their cloud services revenue base.

Michael Gray, COO of Champion Solutions Group, has seen his firm’s IBM revenue contracting by about 10 percent for each of the last three years—across storage, Power Systems and software—while other cloud practices have grown.

[Related: Paul Cormier Named New CEO Of Red Hat, Jim Whitehurst To Become IBM President]

“It’s generally a declining business, but just a question of how much,” Gray said. “Not what it was, not what it should be. You almost hope it’s not too late” to turn around the trajectory of several divisions.

But the problem, as Gray sees it, isn’t the products themselves.

“IBM has great technology, great products, still some great people,” Gray said. “But they have no mindshare in the marketplace. They have no real sales or marketing strategy that I can see outside of the Fortune 1000.”

That focus on giant customers isn’t healthy for IBM’s channel—and fawning rhetoric won’t change that reality.

“They can’t just keep telling us how much they need us,” Gray said. “They need to prove that in the offerings they bring out. Are they truly channel friendly, truly designed for mid and upper mid markets?”

IBM otherwise runs the risk of only selling to the largest of enterprises, a market in which the channel often plays second fiddle. And in the meantime, AWS and Microsoft are seizing market share every day across the Fortune 5000.

“You can sit and tell us how important we are, but if we don’t have air cover, backup, marketing, support, it’s very difficult for partners to survive in the market we play in,” Gray said.

Krishna should understand that great technology isn’t in itself a channel enabler. IBM has superior artificial intelligence, Gray said as an example, yet partners never really understood how they were to sell the Watson cognitive platform.

Gray hasn’t yet met Krishna, but he understands the new CEO- who holds a doctorate in computer engineering- to be a talented technical leader.

“Hopefully he brings more than just technical skills,” Gray said, and “has good business acumen. Which I’m sure he does.”

That will mean installing the right channel leadership structure under him, he added.

IBM’s channel leadership team has gone through a number of recent transitions.

IBM has had three different global channel chiefs over the last three years. Marc Dupaquier left in June 2017 after four years in the position and was replaced by John Teltsch, who held the post until July 2019 before being succeeded by current channel chief David La Rose. IBM also swapped out its North America channel sales leader in April 2019 when Carola Cazeneve replaced Dorothy Copeland, who has since left IBM.

Darrin Nelson, vice president of software sales at Sirius Computer Solutions, one of IBM’s largest channel partners, said IBM needs a leader “who can get them out of chasing the tail.”

The landmark deal for Red Hat was a great start, Nelson said, but “besides stroking a $34 billion check,” IBM hasn’t done anything particularly bold of late to bolster its portfolio and leapfrog competitors.

“I love that they took that kind of risk, but now we need to execute on it,” Nelson said of the Red Hat deal. “They can’t stop there. They got to build around this.”

The former IBM engineer who helped build two channel powerhouses on the IBM software stack said those businesses thrived during “an awesome run for a decade plus for us.” In that period, Nelson worked closely with esteemed software division leaders Steve Mills and Robert LeBlanc, and “Arvind was the tech guy” in that mix.

But at a crucial juncture, public cloud, hybrid cloud, and the app-modernization journey “just wasn’t being considered,” Nelson said, as IBM leaned on the “cash cow” of its legacy software stack.

Sirius’ IBM revenue became inconsistent and didn’t keep pace with other key vendors because IBM chose not to invest in the cloud space for too long, he said.

“That portion of the market quickly passed them by,” Nelson said. The acquisition of SoftLayer in 2013 was too late in the game to significantly change the dynamic of Amazon Web Services and Microsoft Azure dominating public cloud, and IBM’s initial hesitance encouraged Sirius to diversify its business by partnering with those leading hyper-scalers.

But Red Hat has “tremendous merit,” Nelson said.

Sirius has already seen the synergistic benefit to both its IBM and Red Hat practices. IBM has boosted the credibility of Red Hat open source in the enterprise market while empowering the company with its sales apparatus; and Red Hat has given IBM a powerful app modernization story that finally puts IBM squarely in hybrid and public cloud conversations, Nelson said.

And in another important regard, IBM can take a lesson from Red Hat, which said around the time of its acquisition in 2018 that its channel accounted for more than 70 percent of its $2.92 billion in annual sales.

IBM doesn’t report its ratio of partner-led business, but at a PartnerWorld Leadership Conference in 2015, Rometty told partners they provided 20 percent of what at the time was more than $80 billion in revenue.

“They still remain very reticent to have the channel participate and provide lift in enterprise-caliber accounts. They want to push us downstream,” Nelson said. And that’s a mistake, as partners like Sirius often have strong relationships with potential enterprise clients.

“They’ve completely alienated the ecosystem in the enterprise accounts,” he said.

Rich Michos, IBM’s global CMO for the communications sector, told CRN that Krishna is the perfect leader to succeed Rometty “because the technology at this particular junction matters. Differentiating is hard unless you have really different things.”

Krishna will advance Rometty’s strategy of emphasizing IBM Cloud and the cognitive enterprise, with analytics, security and connectivity baked in.

Then you bring in James Whitehurst, the former CEO of Red Hat who was recently elevated to IBM’s president and took a seat on the board, and “it’s the best of both worlds,” Michos said.

Krishna, a long-time IBM exec, understands the depths of the company’s differentiation, while Whitehurst brings a different perspective shaped by the open source community around cutting-edge digital transformation technologies like Kubernetes.

With those two leading the way, “we’re in good shape,” he told CRN.

Nelson, of Sirius, said he expects Whitehurst, who many IBM-watchers had expected to get the top job, will take charge of the day-to-day and cultural aspects of the business, while Krishna focuses more on the overall direction of IBM’s technology.

The elevation of Krishna is reminiscent of what Microsoft did six years ago, he said, when it surprised many by promoting Satya Nadella, who had also been a relatively unknown executive leading a cloud division that in the following years would become Microsoft’s game-changing growth engine.

That hire was “nothing short of extraordinary,” Nelson said.

After long neglecting a Microsoft partnership, the Sirius team running a small Microsoft Office 365 practice convinced Nelson three years ago to attend Microsoft’s Ignite event. Hearing Nadella and his leadership team speak of their vision and strategy was enough for Nelson to entirely reverse his thinking and launch a hypergrowth plan for its Microsoft practice.

“Satya made Microsoft not just relevant, but a fierce competitor,” Nelson said. “We need Arvind to be transformational in that kind of way.”

And for IBM, that means breaking away from selling traditional enterprise ELAs and relying on incremental technological improvements to maintain competitiveness in the rapidly evolving cloud market, Nelson said.

Before Red Hat, the last thing IBM did that was “really, really interesting” was the acquisition of Q1 Labs, which launched a formidable security business in 2011, Nelson said. But an admirable effort to build out a security portfolio around QRadar was “completely diluted of its viability and meaningfulness” when those products were folded into other IBM brands.

IBM was once winning the identity and access management space, and then it lost it. Now it will have to make more acquisitions or fund true organic innovation to recover that market standing, Nelson said.

Rometty deserves credit, however, for changing course after becoming CEO in 2012—assuming the mantle of leadership during a phase of tremendous market disruption driven by new players like AWS, who radically changed the model for enterprise IT, Nelson said.

She presided over 65 acquisitions, including Red Hat, while also divesting from various hardware, software and services businesses that generated a good share of revenue but weren’t core to IBM’s transformation strategy.

Krishna now has an opportunity to apply his unique talents and experience to advancing Rometty’s vision along the “strategic imperatives” his teams previously developed while learning from the missteps of recent years.

They have “two very different personalities, different perspectives, different lenses,” Nelson said. “I’m optimistic that there will be change, and I’m hopeful that it’s the right change.”

But Krishna’s path to get off-and-running in ingratiating himself to the larger ecosystem might face a hurdle that no one had initially expected.

Because of the coronavirus pandemic, IBM was forced to cancel its upcoming Think conference, at least as a live event, which would have been a sort of coming-out party for the new CEO—his first introduction to some of the players in the ecosystem looking for him to renew their confidence in the alliance.

“Now he’ll have to do that virtually,” Gray, of Champion Solutions, said. “That will be a very important meeting.”