Linksys Cloud Manager Aims To Disrupt MSP Networking Market

Linksys Wednesday kicked off a bold bid to unleash a new era of networking-as-a-service offerings for MSPs with the release of Linksys Cloud Manager—a cloud-hosted Wi-Fi management platform built from the ground up for MSPs targeting small- and midsize-business customers.

The new offering—the culmination of a two-year, multimillion-dollar global development effort—provides a robust multisite cloud management Wi-Fi system for MSPs with enterprise- grade capabilities at a breakthrough new price performance point for SMB customers.

The Cloud Manager software, partners said, may well be the first cloud management platform of its kind that includes no annual subscription for five years for the cloud licenses for each access point.

That's a huge cost savings for partners and SMB customers, given that enterprise-grade competitors charge annual subscriptions per access point of anywhere from $100 to $175 per year. Those licensing charges amount to 10 times the cost of access points over a five-year period, according to Irvine, Calif.-based Linksys.

"This is a disruptive product," said Wayne Newton, channel chief and director of commercial business at Linksys, in an interview with CRN. "We are lowering the acquisition cost of SMB networking by an order of magnitude by eliminating the subscription cost of cloud networking to the reseller. We believe we are unlocking a lot of value for resellers and MSPs by providing affordable cloud-based networking for SMBs."

Newton said the product opens the floodgates for MSPs to enter the networking-as-a-service market by eliminating cost-prohibitive subscription fees. "Cloud Manager enables MSPs to start selling more services because they now have an affordable networking solution they can use," he said. "And we believe business owners will jump on this because it is affordable, and they get peace of mind with a budgetable service that they can plan their business around. It is a win-win."

Linksys Cloud Manager—which is targeted at SMBs with 100 seats and below per site—packs a lot of the features that have made enterprise-grade products big sellers in the channel into a simple user interface.

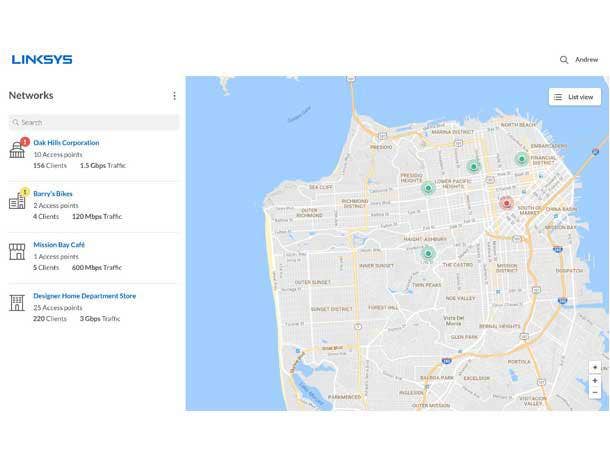

Cloud Manager provides a global map view that allows MSPs to remotely monitor, manage and troubleshoot all their Wi-Fi networks, sites and devices from either a laptop, tablet or mobile phone.

The Cloud Manager also platform provides MSPs with network alerts and real-time statistics on clients and devices including signal strength and connection duration, along with a wide range of troubleshooting tools such as ping test, radio frequency (RF) environment scan and rogue access point detection.

Cloud Manager is being pre-installed on select Linksys access points including the LAPAC1200C with data rates up to 1,200 Mbps at $199; the LAPAC1750C with data rates up to 1,750 Mbps at $329.99; and the Mu-MIMO LAPAC2600C with data rates up to 2.53 Gbps, priced at $499.99.

Looking beyond the five-year no licensing fee model for Cloud Manager, Linksys said it is currently evaluating pricing options to extend that licensing beyond five years.

Partners said the Cloud Manager software platform represents a breakthrough for SMB-focused MSPs.

"Not charging a licensing software fee for each access point gives us the ability to offer Wi-Fi as a service," said Michael Goldstein, CEO of LAN Infotech, a Fort Lauderdale, Fla., solution provider, who was briefed on the Cloud Manager launch at CRN parent The Channel Company's XChange 2018 conference. "With Cloud Manager, Linksys is giving us the chance to establish networking as a service without a big up-front investment. They are stepping up and helping the MSP community. This could be a new economic model for SMB VARs."

Goldstein said he was "surprised" by the breadth and depth of Linksys Cloud Manager. "You have to give it up for Linksys," he said. "They have been around for a long time and are well known for their SMB products, but with Cloud Manager they are reinventing themselves as an MSP staple. We are definitely going to look at adding networking as a service with Linksys Cloud Manager. It's a great brand with a long-standing relationship with the channel."

Linksys has already received great scores from a beta test with 50 MSPs that were managing multiple businesses with a competitive cloud offering. Overall, those beta testers on a scale of 1 to 10—with 1 being much better than what they were using and 10 being much worse—gave Cloud Manager a 1.4 score, according to Linksys. "That was shocking to us," said Anthony Pham, senior product manager for Linksys. "That showed we were right on the track."

Shawn Reed, a onetime owner of a small-business solution provider and a 15-year IT veteran who has beta tested the Cloud Manager offering for the past two months, told CRN he gives the device an A+.

Reed said he was most impressed with ease of setup and cloud management and visibility into the Wi-Fi network along with the robust toolset provided by Linksys.

"It's a set-it-and-forget-it kind of product for that small business 25- to 50-seat customer that doesn't have the budget for an enterprise product," he said. "What impressed me the most was the ease of setup and manageability. It really is simple to access, have visibility into your network and make changes to your network. It's a single-pane-of-glass visibility with all your access points so you can see any anomalies on your network."

Ease of setup and management was, in fact, was the No. 1 request from MSPs interviewed as part of the research done by the Cloud Manager team.

Cloud Manager setup is five minutes compared with several hours for an enterprise-grade product, said Reed. "Setup and configuration was a breeze," he said.

Even with the ease of setup, the product has robust features including over-the-air firmware updates, which is critical for securing SMB customer networks, said Reed. "Having your access point always up to date with firmware releases is key," he said. "It's comforting to know the Linksys team is behind you keeping track of things like zero-day exploits and security vulnerabilities, pushing out firmware fixes and making sure customers are safe."

Reed commended Linksys for bringing an impressive first offering to the table for MSPs. "Since this was their first MSP cloud managed offering, I didn't know what to expect," he said. "I feel really good about the product. Performance- and stability-wise I couldn't give you a reason I would look at different access point other than Linksys."

Douglas Grosfield, founder and CEO of Five Nines IT Solutions, a Kitchener, Ontario-based strategic service provider, said he is definitely going to consider using Linksys Cloud Manager as the basis for a networking-as-a-service offering.

"Linksys is filling a gap that no one is filling right now by bringing an affordable SMB platform to market with manageability from a single pane of glass, network analytics, intelligence and even ease of billing," said Grosfield. "A lot of vendors have paid lip service to the MSP model, but they have not put enough skin in the game to make this happen. It's a great time for Linksys to get into this market. They have a massive installed base and a huge footprint in distribution."

Grosfield said it appears that Linksys has come up with a channel-friendly model that could leave competitors stunned by just how much progress the company will make in the channel. "The question is how fast can Linksys move before other vendors realize Linksys is eating their lunch," he said.

The key for MSPs is to bring a new era of high-value data to help drive sales growth for their SMB customers with business intelligence and artificial intelligence capabilities. "If you can bring that BI and AI to the networking SMB space, that is going to be a magic bullet for MSPs," he said. "Linksys is redefining the cloud management MSP market. This is a great opportunity for a smaller municipal or regional MSP to go after the SMB market and have a conversation with customers they could not have had before."

Dawn Sizer, CEO of 3rd Element Consulting, a Mechanicsburg, Pa., solution provider also briefed at XChange on the new MSP offering, said she expects the new MSP cloud management platform coming in at a "lower price point" in the bread-and-butter SMB market to be a "winner" for Linksys.

Sizer said the product gives smaller MSPs more flexibility to provide networking services to SMB customers that cannot afford enterprise offerings. "This is a great way for MSPs in the SMB market to make margin," she said. "Linksys took their time, listened and fixed what the other guys were not doing so well. They are doing it their way. This gives smaller MSPs more flexibility."

Linksys’ Newton said Cloud Manager represents a major "pivot point" for the company into the booming MSP market. In fact, he said, Linksys expects the MSP offensive to flip the total percentage of revenue in the commercial market from 35 percent of total sales to 70 percent of total sales over the next three years.

"This is almost an all-new market for us," said Newton of the MSP sales offensive. "Most of our business is transactional and most of it is still consumer networking."

Newton sees Cloud Manager as the foundation for the launch of a wave of new products and services for MSPs from Linksys, which has long been a dominant player in the consumer and SOHO (small-office/home-office) markets.

"What we are most excited about is that with a product platform like this there is a lot of future development we can do to drive into the MSP market with more products and services on top of it," he said. "It is a product and solution for the future."

CRN has learned that Linksys is already looking at integrating Cloud Manager with leading MSP platform providers such as ConnectWise. "Those platforms aren’t being used for networking today," said Newton. "We think it is a necessary integration to make sure that MSPs are monetizing networking managed services."

No matter how big a move into the multibillion-dollar networking market is for Linksys, Newton said it is even bigger for MSPs. "I think partners have a bigger opportunity to grow their business and grow their profits than we do," he said. "More of the money is in the channel for the reseller than there is for us."

The Linksys MSP technology and sales offensive is sure to receive a boost from the proposed acquisition of Linksys, which is part of Belkin International, by Foxconn Technology Group, the world's largest contract manufacturer with $158 billion in annual sales.

Partners expect the acquisition, which still must pass U.S. regulatory approvals, to translate into significant product innovation and manufacturing advantages for Belkin and Linksys.

Linksys is now hammering out a strategic three- to five-year plan for the commercial MSP business, said Newton. "We are planning to scale," he said. "We will make investments in more sales resources in the field; more inside sales people; more sales engineering people; more channel managers; marketing and continued product development. This is just the start. We have got a road map of products and services we can develop off of this."

Rick Khan, CEO of Micro Trends,a 35-year-old Pasadena, Calif., MSP telecom services provider, said he sees Linksys Cloud Manager as a channel game-changer.

"The Linksys presentation on Cloud Manager blew me away," said Khan. "There is a huge gap in the market for a product like this. I think they are going to make a big dent in the MSP market."

Khan himself said he expects to switch $50,000 a year in networking router and switching purchases to Linksys as part of a plan to build a bigger business around Cloud Manager.

"We are ready to implement this as a network service," he said. "You can't beat the price of this as a cloud-based service for our SMB customers."

Khan said he sees the Foxconn-Linksys combination driving a new era of SMB services around security, artificial intelligence and IT automation. "This is a huge opportunity for us," he said. "I am going to build this into my MSP recurring revenue model to access and manage SMB customer networks."