‘Smart Move:’ IBM Splits In Two With Blockbuster Managed Infrastructure Services Unit Spin-Off

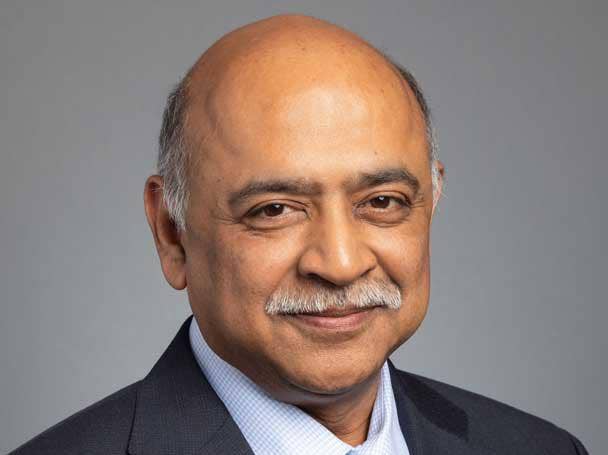

‘Now is the right time to create two market-leading companies focused on what they do best,’ says IBM CEO Arvind Krishna. ‘IBM will focus on its open hybrid cloud platform and AI capabilities. NewCo will have greater ability to design, run and modernize the infrastructure of the world’s most important organizations. Both companies will be on an improved growth trajectory with greater ability to partner and capture new opportunities—creating value for clients and shareholders.’

IBM Thursday said it plans to split in two by creating a publicly held spin-off of its behemoth Global Technology Services’ (GTS) managed infrastructure services unit.

The 109-year-old company expects the spin-off of the GTS managed infrastructure services unit—which it is referring to as “NewCo” for now until it adopts a formal name—will be completed as a “tax-free” deal by the end of 2021.

The spin-off news sent IBM shares up more than 6 percent in midday trading to $131.20.

IBM is touting NewCo—which has a $60 billion services backlog—as the “world’s leading managed infrastructure services company.” The services spin-off will have revenue of $19 billion with more than 4,600 clients in 115 countries including more than 75 percent of the Fortune 100.

IBM will retain $8 billion from the GTS cloud services consulting business and its $16.63 billion Global Business Services unit with business, strategy and technology consultants that are chartered with helping customers modernize existing applications.

Once the spin-off is completed, IBM will move from a No. 1 ranking on the 2020 CRN Solution Provider 500 list of North America’s largest solution providers to No. 2 behind Accenture. The NewCo spin-off will enter the CRN SP500 list at No. 5 behind Accenture, IBM, Tata and DXC Technology.

“This is the smartest move IBM has made in 20 years,” said Martin Wolf, president of martinwolf M&A Advisors of Walnut Creek, Calif., one of the top channel investment advisory deal-makers. “They had an unwinning hand. The problem with IBM’s business model for the last 20 years is they have competed against best-of-breed product and services and they weren’t best of breed. The weakest component of the business was subsidized by the strongest. They should have been broken up 20 years ago.”

The NewCo spin-off leaves IBM with Red Hat as its crown jewel, “laser-focused” on the $1 trillion hybrid cloud opportunity, IBM CEO Arvind Krishna said in a press release.

“Now is the right time to create two market-leading companies focused on what they do best,” he said. “IBM will focus on its open hybrid cloud platform and AI capabilities. NewCo will have greater ability to design, run and modernize the infrastructure of the world’s most important organizations. Both companies will be on an improved growth trajectory with greater ability to partner and capture new opportunities—creating value for clients and shareholders.”

IBM said the spin-off transforms it from a $71 billion company with more than half of its revenue in services to one with a “majority in high-value cloud software and solutions” and more than 50 percent of its portfolio as “recurring revenues.”

Besides the Red Hat portfolio and Global Business Services, IBM will retain its systems business, software portfolio focused on big data, AI and security, and mission-critical public cloud service.

Wolf said he believes if shareholders were the “paramount concern” IBM would have focused purely on Red Hat after the $34 billion acquisition of the open-source market leader in 2019. “IBM should have gotten rid of everything else, making it a pure play,” he said. “This is the smartest move they have made in 20 years including the Red Hat acquisition, which was brilliant. IBM should have gotten rid of all the old IBM legacy units when it bought Red Hat.”

IBM has a storied history of selling off businesses that have created significant shareholder value, including the sale of its PC business to Lenovo in 2014 for $2.3 billion and the sale of its customer care outsourcing business to distributor Synnex for $505 million in 2013, said Wolf. “Those spin-offs created billions of dollars in value,” he said.

As for the impact on the channel, Wolf said it is not material. “I don’t think IBM really matters to the channel anymore,” he said. “They are not significant. You never hear partners talk about IBM. I hear them talk about ServiceNow, Salesforce but not IBM.”

Bob Venero, CEO of Holbrook, N.Y.-based solution provider Future Tech Enterprise, No. 101 on the CRN Solution Provider 500, said he also sees the IBM spin-off as a “smart” play that lets the managed services infrastructure business stand on its own without having to be dragged down by the systems, software and product business. “That product business is a lot more volatile and transactional than the service business,” he said. “This is a more focused approach to the business, which is a smart long-term play.”

Venero said doubling down on the Red Hat hybrid cloud business could spark a more aggressive channel focus. “Hopefully this gets IBM to focus more on the channel,” he said. “This should give them the ability to double down on the channel with increased margin and potentially better programs and support of those Red Hat offerings. It could be a good thing for the channel. It’s definitely a smart play for IBM and its shareholders.”

As for the NewCo managed services infrastructure spin-off, it will remain a business that sometimes partners with and sometimes competes against partners, said Venero. “This takes the handcuffs off that services business and lets them focus unshackled on the managed infrastructure rather than being tied to assets like Red Hat and the systems and software business,” he said.

The spin-off is subject to closing conditions, including a registration of securities with the U.S. Securities and Exchange Commission, a tax opinion from its counsel and final approval by IBM‘s board. After separating, the companies expect to pay a combined quarterly dividend no less than IBM’s pre-spin dividend per share.

As part of the reorganization, IBM said it would “simplify and optimize its operating model for speed and growth” by streamlining its geographic model and overhauling its go-to-market structure, while continuing to consolidate its shared services. It was not immediately clear if that would include layoffs.

As to whether IBM ultimately moves to more aggressively embrace partners, Venero said it will depend on whether IBM hits its sales targets. “If they are not hitting the sales numbers they need, they will have to rely more heavily on partners,” he said.