The Best (And Worst) States To Start A Solution Provider Company In 2018

Having finally shaken off the last vestiges of the Great Recession, the U.S. economy is performing better than it has in more than a decade, maybe even since the end of the dot-com boom in 2000. The most recent estimate is that U.S. real gross domestic product (GDP) growth accelerated to an annualized 4.2 percent in the second quarter.

If there was ever a time to start a solution provider business, this might be it.

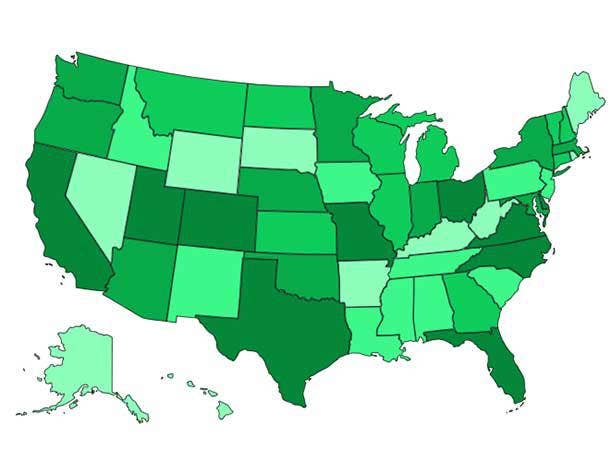

For the sixth year, CRN researchers and editors have undertaken a detailed analysis of the business climate in all 50 states to offer entrepreneurs and solution providers guidance about which states offer more business opportunities, more potential for innovation and growth, better pools of talented workers, lower costs, and less burdensome taxes and regulations.

Here we provide the results of our 2018 research, including a slide show with a state-by-state analysis ranked from the least favorable state to the state that has the most to offer a startup solution provider.

The criteria include state-by-state data that's important for entrepreneurs starting a solution provider business, everything from the education and experience levels of a state's workforce, to corporate income and sales tax rates, to state GDP growth and economic climates. (A more detailed description of the Best States methodology and data sources is provided in a separate story.)

This year we are putting particular emphasis in Best States on the issue of hiring tech talent. The research includes updated information in state-by-state education rankings, new data such as state tech employment job gains, and information from new sources such as WalletHub's Most Educated States in America. And in evaluating the data, we've more heavily weighted employment criteria such as states' job growth, unemployment rates and education attainment levels of the available labor force.

So which states are the best for starting a solution provider business?

For the third year in a row Florida achieved the No. 1 ranking in our Best States analysis.

The Sunshine State, as it has the previous two years, was ranked No. 1 in taxes and regulations. The state's corporate income tax is a moderate 5.5 percent, its sales tax is 6.0 percent, unemployment insurance taxes are low and there is no individual income tax. For its overall low tax burden Florida is No. 4 on the Tax Foundation's 2018 State Business Tax Climate Index.

Florida also boasts a strong business climate/competitive environment where it ranked No. 4 (down two spots from No. 2 in 2017): It had the fourth largest state GDP in 2017—$984.1 billion. It's No. 2 in both the number of private sector firms and in the number of small and midsize companies that provide solution providers with potential customers. The state is home to 31,835 tech business establishments (No. 3) and the state's tech employment ranks grew by 12,022 last year.

North Carolina, which was ranked No. 2 in 2017, held onto that position this year. Rounding out the top five were Missouri, Utah and Texas.

At the other end of the 2018 Best States rankings was West Virginia, which was No. 50 for the fourth year in a row with its No. 50 ranking for entrepreneurship and innovation, No. 48 position in workforce education and experience, high labor and operating costs, and relatively small tech sector (just 4 percent of total gross state product in 2017).

One bright spot: West Virginia's GDP grew 2.6 percent in 2017, faster than the 2.3 percent national GDP growth rate.

Joining West Virginia at the bottom of the rankings were Nevada, Kentucky, Arkansas and Hawaii.

Interviews with people in the channel community highlight the fact that with the economy doing so well, finding and hiring the employees needed to sustain and grow a business has become the No. 1 challenge for solution providers.

"It's incredibly difficult to find the people we need," said Steve Freidkin, CEO of Ntiva, a fast-growing IT consulting, cloud and managed services company in McLean, Va.—one of the country's technology hubs.

Ntiva has to compete with the many IT companies, solution providers, government contractors and even government agencies for tech talent. And that competition pushes up salaries and other hiring costs: The average tech industry wage in Virginia is $114,774 (No. 6 of all states) and $109,964 in Maryland (No. 9), according to the CompTIA Cyberstates 2018 report.

The Washington, D.C., region is a great place for a solution provider to do business: The Best States analysis ranked Virginia No. 10 and Maryland No. 15. "There's a tremendous amount of competition, but there's also a tremendous amount of opportunity," Freidkin said. He noted that the D.C. region has the added benefit of being less subject to economic downturns given the prevalence of government IT customers.

One would think finding and hiring needed workers would be easier in Massachusetts, ranked No. 1 in the Best States analysis for workforce education and experience—including being tops in the share of the labor force with a four-year college degree (49.0 percent) and percent of people 25 or older with an advanced degree (18.4 percent).

But Scott Winslow, president of Winslow Technology Group, a Waltham, Mass.-based solution provider, will tell you that hiring in his state can still be tough.

"It's about hiring the right people, training them and keeping them motivated," Winslow said of the challenge. "The workforce is incredible," he said, noting the Boston area's diverse economy with IT, health-care, biotechnology and financial services companies that attract top-level employees, and the number of colleges and universities that produce educated, more entry-level workers.

Winslow Technology, which has most of its employees in Massachusetts, has taken advantage of the region's educational institutions by working with several area schools, including Northeastern University and Holy Cross, to offer internships for students. Those interns often end up working at the solution provider, mostly on the sales side, upon graduation. (Winslow is starting an internship program with the Wentworth Institute of Technology to develop engineering talent.)

New Hampshire touts itself as a business-friendly state for its low labor costs and lack of sales and personal income taxes (it's ranked No. 6 on the Tax Foundation's 2018 State Business Tax Climate Index).

But Timothy Howard, president and CEO of RMON Networks, a Plaistow, N.H.-based supplier of IT consulting, managed and cloud services, downplays taxes as a factor in a solution provider's success or failure. "It's not that big of an economic advantage anymore," he said.

As with other solution providers, Howard said finding tech employees to maintain his company's rapid growth is among his top challenges. (New Hampshire was No. 6 in Best States for its educated and experienced workforce.) He said one problem is convincing younger workers to stay in New Hampshire rather than moving to Boston or other metropolitan areas.

"We're constantly hiring folks because we're growing," Howard said. "We're constantly adding services and moving into new technology areas that we want to be a leader in. Inevitably, it's the people that we need to have on the team that will allow us to grow into new areas."

Many of the states ranked among the top dozen in this year's CRN Best States list have consistently been there since the first list in 2013, including Utah, Texas, Virginia and Washington. Likewise, many near the bottom of this year's rankings, including West Virginia, Hawaii, Arkansas and Mississippi, have been there in previous Best States analyses.

States, nevertheless, can quickly rise and fall in the rankings. North Dakota, which once enjoyed an exploding economy because of the oil boom, ranked as high as No. 11 in the 2014 Best States analysis. With stagnant oil prices in recent years, North Dakota's economy has returned to earth and the state was ranked No. 23 this year.

A state's rise or fall in the Best State's rankings may be due to actual changes in a state's situation (a significant tax rate hike or cut, for example, or hiring growth in a state's tech sector). State rankings can also change with the inclusion of new data in the analysis, with changes in the analytical weighting of the data, or any combination of those.

This year, for example, Missouri moved up to No. 3 in the Best States rankings from No. 13 last year. New and updated data resulted in the Show Me State improving its standing in the personal cost of living/quality of life, entrepreneurship and innovation, and business climate/competitive environment rankings.