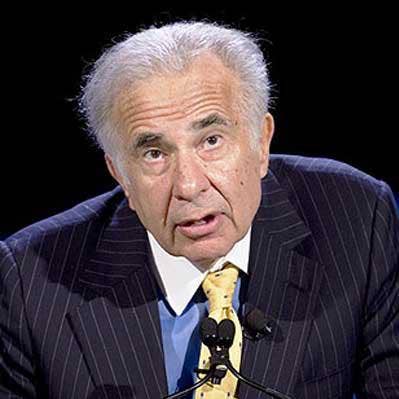

Icahn Takes Bigger Stake In Conduent, Amid Turmoil

“This is basically his company,” Shannon Cross with Cross Research tells CRN about Carl Icahn. “We’ll see who he decides to put in as CEO, but he’s got three of the board seats, and I think he was pretty influential in getting [outgoing CEO] Ashok [Vemuri] there. This is basically the same playbook he ran with Xerox, only with a lot less litigation.”

Carl Icahn has added 9 million shares to his stake in Conduent, just days after the company's CEO announced his resignation and a month after the company accused him of attempting to take over the board of directors.

Icahn had owned about 19 million shares of Conduent prior to the purchases, which were made in the days after the company’s earnings call last week. On the call, Conduent reported lower revenue and lower guidance for the year. Following the call, Conduent share prices fell from $12 a share to below $8. In a Form 4 filed with the Securities and Exchange Commission Monday, Icahn disclosed buying 9.09 million shares for a total stake of 28.9 million shares, or 13.74 percent of the company.

[RELATED: Conduent CEO To Resign Amid Falling Revenue And Battle With Carl Icahn]

He bought 1.7 million of those shares when the stock price fell to $8.37 Friday and then another 2.2 million shares at $8.33 Monday. The rest were purchased for $10 a share, according to the SEC filing.

During last week’s earnings call, an analyst asked if the company was possibly for sale and she was not given an answer, something that is likely to fuel speculation about Conduent's future.

“This is basically his company,” Shannon Cross of Cross Research told CRN. “We’ll see who he decides to put in as CEO, but he’s got three of the board seats, and I think he was pretty influential in getting [outgoing CEO] Ashok [Vemuri] there. This is basically the same playbook he ran with Xerox, only with a lot less litigation. ... Our speculation is he’ll find a way to carve it up and sell it.”

The board of directors has already accused Icahn of staging a board takeover attempt in early April when one of his appointed board members resigned via a four-page letter that outlined ways Conduent's board and management had failed the company.

In a rebuttal to the board member’s letter, Conduent said Icahn offered to keep his board member’s letter private if Conduent’s chairman of the board, William Parrett, stepped down. Michael Nevin, a portfolio manager with Icahn Enterprises, later said Icahn never delivered an ultimatum but rather stated his displeasure with Parrett and the CEO.

Nevin said Icahn holds those two men responsible for the company's 40 percent loss of value at the time of the April 12 letter. The company has shed more value since that letter, after reporting a decrease in revenue last quarter, a 39 percent drop in new business signings, the loss of a $140 million contract with California, and its biggest customer shrinking its buy with Conduent.

All of that saw stock prices drop from about $12 a share prior to its most recent earnings call to $8.52 Monday. Share prices recorded a high of $23.39 late last year.