5 Companies That Came To Win This Week

For the week ending Jan. 7, CRN takes a look at the companies that brought their ‘A’ game to the channel.

The Week Ending Jan. 7

Topping this week’s Came to Win list is Apple, which became the first public company with a market value of $3 trillion.

Also making this week’s list are solution provider ConvergeOne for continuing its aggressive acquisition strategy, power management giant Eaton for its own savvy acquisition in the electrical connectivity space, data analytics software developer Qlik for its IPO plans, and cloud service provider 2nd Watch for a strategic acquisition in data analytics and management services.

Apple’s Market Value Hits Historic $3 Trillion Mark

Apple hit an historic milestone this week when its market value reached $3 trillion – the first public company to do so.

On Monday, the first day of trading in 2022, Apple’s share price climbed to nearly $183. That put the company’s market cap over the $3 trillion threshold for the first time. It came just 17 months after Apple became a $2 trillion company.

Apple’s share price settled back a bit as the week went on. On Thursday, Apple’s share price closed at $172, putting its market value at $2.82 trillion.

Microsoft also has a market cap over $2 trillion ($2.37 trillion at the close of trading Thursday). Google parent Alphabet, whose market cap briefly exceeded $2 trillion in November 2021, is now around $1.83 trillion while Amazon’s market value stands at $1.67 trillion.

ConvergeOne Acquires Integration Partners

Services-led cloud solution provider ConvergeOne this week acquired Integration Partners Corp., a Lexington, Mass.-based IT services engineering firm with a solutions and services portfolio that spans cloud, security, collaboration, digital infrastructure and managed services.

The move is the latest in a string of acquisitions for ConvergeOne, No. 34 on the CRN Solution Provider 500, after ConvergeOne was itself acquired in January 2019 by CVC Fund VII, a private equity and investment consulting firm, for $1.8 billion.

ConvergeOne, based in Bloomington, Minn., made four acquisitions in 2021 including digital transformation solution provider Prime TSR, managed and professional services company WrightCore, Salesforce services provider NuAge Experts, and education-focused solutions provider AAA Network Solutions.

The acquisitions have boosted ConvergeOne’s sales: The company is expected to generate about $1.7 billion in revenue in 2022.

Eaton Buys Power Specialist Royal Power Solutions For $600M

Coming off its blockbuster $1.65 billion acquisition of Tripp Lite in 2021, power management giant Eaton this week acquired electrical connectivity specialist Royal Power Solutions, a manufacturer of power distribution and transmission technologies, for $600 million.

Royal Power Solutions, based in Carol Stream, Ill., manufactures electrical connectivity components used in industrial, mobility, electric vehicle and energy management markets.

Eaton said the acquisition will boost the company’s energy management, industrial and mobility businesses.

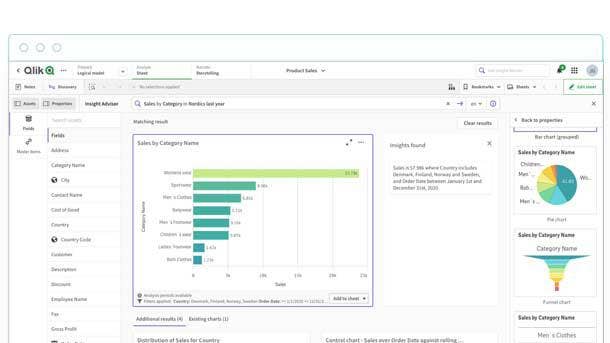

Data Analytics Software Company Qlik Signals Its IPO Plans

Qlik, a privately owned developer of data analysis, data management and data integration software, signaled this week that it is planning an initial public offering that will make it Qlik a publicly traded company once again.

Thursday Philadelphia-based Qlik said it had confidentially submitted a draft registration with the SEC for a proposed IPO of common stock. The company said the number of shares to be offered and the price range for the proposed offering have not been determined.

Qlik was once a public company with its shares traded on the Nasdaq exchange. In August 2016 Qlik was acquired by private equity firm Thoma Bravo for $30.50 per share or about $3 billion in cash.

The IPO would make Qlik the latest big data company to go public, following an IPO from real-time data tech developer Confluent in June 2021 and the blockbuster IPO from data cloud provider Snowflake in September 2020.

2nd Watch Expands Data Analytics Services Portfolio With Aptitive Acquisition

ConvergeOne wasn’t the only solution provider making acquisition news this week. Strategic cloud service provider 2nd Watch acquired data consulting services firm Aptitive in a move to boost its data engineering, data science and data analytics service offerings.

The acquisition also expands 2nd Watch’s presence in the fast-growing Snowflake services universe and in several data-intensive vertical industries including retail and healthcare, 2nd Watch CEO Doug Schneider said in an interview with CRN.

The strategic service provider launched its own data analytics practice in 2020. Schneider said the acquisition of Aptitive, with its data engineering, data science and data analytics expertise and consulting services, will allow 2nd Watch to quickly ramp up that data consulting practice to meet growing demand.