Alteryx President Hansen: Customers’ Need For Data Analytics Outweighs Economic Uncertainties

CRN speaks with Paula Hansen, president and chief revenue officer at analytics automation technology developer Alteryx, about the company’s recent financial performance, its efforts to expand channel sales, and the economic outlook. Here’s what she had to say.

Analytical Insights

Data analytics technology developer Alteryx has had an eventful 2022 including a number of significant changes in its executive ranks, a key product release, a strategic acquisition and a major revamp of its channel partner program.

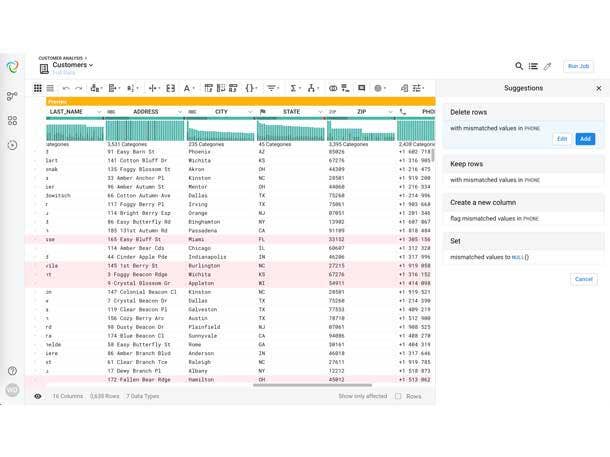

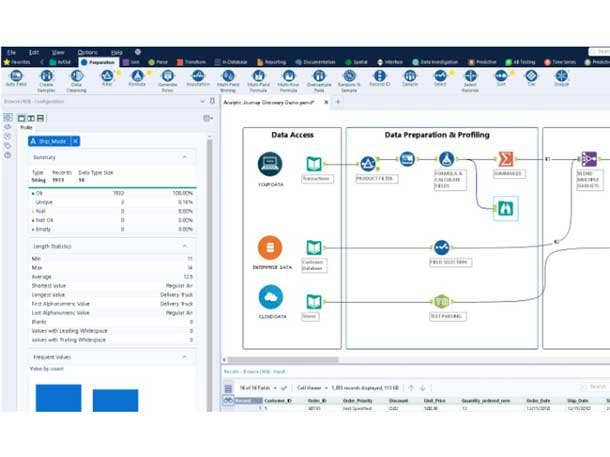

Alteryx refers to itself as “the analytics automation company,” providing a unified platform that incorporates analytics, data science and business process automation into a single system.

In February, chief revenue officer Paula Hansen was promoted to president and CRO. She joined the Irvine, Calif.-based company as chief revenue officer in May 2021. Prior to that she served as CRO at software giant SAP for more than two years and before that worked at Cisco Systems for nearly 19 years in various sales and sales management positions.

Hansen reports to CEO Mark Anderson, who took over that post in October 2020 from company co-founder and long-time CEO Dean Stoecker. This year the company has also named a new chief people officer and a new chief marketing officer, among other new executives, while Chief Operating Officer Scott Davidson stepped down from that job effective March 16.

In January, Alteryx announced a deal to acquire Trifacta, a developer of data “wrangling” tools used for data exploration, transformation and preparation for business analytics tasks. (The acquisition closed Feb. 7.)

In March the company launched the Alteryx Analytics Cloud, a major step by the company to move its products, customers and channel partners into the cloud. The move is important given that market researcher Gartner predicts that by next year organizations will shift two-thirds of analytics workloads to the cloud.

Equally important for partners, Alteryx in March unveiled an updated, expanded partner program, which the company described as “powering its partner-centric growth strategy” and “a key driver towards Alteryx’s mission to democratize analytics across organizations. The revamped program, developed under the direction of Barb Huelskamp, senior vice president, global partners and alliances, included unique benefits for various types of partners, including solution providers and VARs, and provided incentives for joint customer success, technical expertise and new customer acquisition.

Earlier this month, Alteryx released the financial results of its 2022 second quarter (ended June 30), which included a 50 percent increase in revenue to $180.6 million, a doubling of subscription-based license revenue to $80.7 million and a 33 percent increase in annual recurring revenue to $726.8 million.

Hansen recently spoke with CRN to discuss Alteryx’s core strategies, the company’s channel plans and the expanded partner program, the Q2 results, the impact of the Trifacta acquisition, and the company’s outlook given the uncertain economy.

The following interview has been edited and condensed for clarity and space reasons.

What were the highlights and the key takeaways of the second quarter?

By all accounts, it was a fantastic quarter for us at Alteryx. We exceeded expectations across the board. We landed at $727 million of ARR [annual recurring revenue], which was up 33 percent year on year. And then we grew revenues 50 percent year on year and then also overachieved on the bottom line as well.

Across the board [it was a] really, really strong performance for Alteryx and we‘re feeling as though these results are a validation of both the market opportunity for the democratization of data and analytics and the role that plays in customers’ investment agenda.

And then we think it also validates our go-to-market strategy, which I‘ve personally been really focused on this last year-and-a-half, and extra quarter if you will, since I joined the company. We’re thrilled with the results and look forward to the second half.

What were the drivers behind the 50 percent year-over-year revenue increase?

There‘s a couple of things in there. We had strength in contract term for our customers. When we have contract term strength, it contributes to the ARR because we take a portion upfront.

When we do contracts with our customers, they‘re of varying term lengths, one year [and] three years are the most common terms of the contract. Right now, we see contract terms right around one and a half years across the customer base. And because our subscription business today is largely on premise – the vast majority of our software is on premise – we recognize it from a revenue perspective as we take roughly 50 percent of that contract revenue upfront and then [pro-rate] the rest of it over the remainder of the term of the contract. So if a contract term is longer than we expected or guided into, then that 50 percent upfront recognition of revenue [is] higher as well.

What impact did the Trifacta acquisition have on the quarter?

Trifacta we talked about in Q1 as representing roughly $20 million of ARR. So in terms of its impact to the company more broadly against our $700 million-plus of ARR, it actually isn‘t that significant. It hasn’t been material to the performance of the company to this point.

I did understand it was more of a technology acquisition…

Yes, you’re spot on. The reasons that we bought Trifacta … was a technology acquisition. In particular around their SaaS [Software-as-a-Service] platform and the backend, multi-tenant SaaS capability that their business runs on.

And so, as our cloud portfolio continues to expand, we thought that there was a great opportunity with Trifacta to serve as our cloud platform. And now here we are, almost six months down the road past the acquisition that closed in February, and Suresh Vittal, who‘s our chief product officer has spent extensive time with the product teams from Trifacta and from Alteryx, identifying where the architectural benefits are and where the coming together of these two pieces really benefit our customers.

We’ve accelerated that integration with our Alteryx Designer cloud [Alteryx’s data preparation and blending software], powered by the Trifacta solution set. And in that product, what customers will experience is the integration of the user interface that customers have come to love from Alteryx with the cloud platform benefits that Trifacta brings to bear with multi-tenant SaaS and all of the services that customers like from a cloud platform.

So we’re really excited about what that means and then we’re extending that over the next several quarters with our other cloud products such as Alteryx Machine Learning, and Alteryx Auto Insights, which today are cloud products that we are also going to port to the Trifacta cloud platform. So you can see that over time, as we get into 2023, customers will be able to enjoy a full end-to-end analytic cloud platform from Alteryx with all of those components on a single cloud platform.

What were the drivers behind the doubling of the subscription license revenue?

Fortunately, we’ve always been a subscription-based software business model. We do not have perpetual licenses and haven’t had to go through that migration. Subscription software has been our business model since the beginning, 25 years ago.

The growth this quarter was really significant for us. And it really comes down to the execution of our enterprise strategy and meeting our customers where they are. I spend a lot of time traveling globally, meeting with customers, and it‘s become super-apparent to executive teams that to be able to execute on their transformation initiatives they have to unlock their data and drive better business decisions in a more agile way.

And that is where analytics plays a significant role. They can’t address that need by hiring data scientists because there aren’t enough data scientists in the world to solve this. And even the few that there are, they want to be working on the most complex of problems, not the daily business problems.

So when we talk to customers about the democratization of analytics, what we mean by that is, empowering the knowledge workers, empowering the analysts, empowering the users across all lines of business, to be able to participate in the analytics opportunity, answering the questions that they have of their business and solving for the next problem that they’re addressing.

And that‘s where Alteryx has always done very well. Now that feels to me like it’s at a tipping point in the industry. And then you combine that with the macroeconomic situation and inflation and everyone wants to really think about how they drive worker productivity and business efficiencies – analytics tops the list of investments here as we go forward. Some other nice-to-have technologies may get put on hold or delayed, but we‘re hearing from our customers that data analytics will continue to be an investment area for them now and in the future.

Talk about Alteryx’s three-pronged strategy of enterprise customers, partners and customer success.

With the enterprise focus, we’re now seeing an expansion of our customer base in the global 2000. We moved [up] seven points there, we now have 46 percent of the global 2000 We secured two of our largest deals ever in the history of the company in Q2. We had more million-dollar ACV [average contract value] wins than we’ve had in the past, and our customer base in that $1 million ARR and above is growing faster than the rest of the customer base. But so is our 100k ARR and above [customers], which are the next million-dollar customers.

Partners, the second pillar of the strategy, [play] a big hand because they expand your reach, they help you get to new customers, they help you get to new buying centers, they help build relevance to the architectural landscape.

We redesigned our [partner] program as we came into 2022 because we wanted to add more fuel to the fire with our partners and that also showed up in our Q2 results. Our partner-influenced business was roughly 50 percent of our ACV [Annual Contract Value] in Q2, which is a material uptick from what it‘s historically been. And we’re only getting started here. I‘m super bullish on the role that partners will play in the success of the company.

And then the third component is customer success, which partners also play a big role in. Customer success means, what happens after the sale? How do customers onboard users, drive adoption, mature the analytic capability of their organization? [And how do they] embrace all these new products that we‘re releasing into the market when you talk about cloud?

There [are] three brand-new capabilities that we‘ve introduced into the market in the span of six months and customers want to know, ‘How do I use machine learning? How do I deploy auto insights?’ And so our focus on customer success is about human capital, high-touch relationships, [and] also digital platforms and our partner ecosystem. That is where the rubber meets the road in terms of continuing to help our customers really derive value from the investments they make in Alteryx.

Talk about the types of channel partners Alteryx works with and the types of services they offer.

It’s part of what informed the way we redesigned the partner program [in early 2022], because we have four different categories of partners. And the way that you build a program has to resonate uniquely with the different categories. The four [partner] categories we have are our global system integrators, solution providers, ISVs and OEMs.

Global system integrators are the folks that you would think of: PwC , KPMG, Ernst and Young, and the list goes on. And these are some of our largest customers. They use our software today in all of their client engagements. When they are, for example, working with a chief financial officer on automating tax programs or driving better efficiencies in closing their books on a quarterly basis, the GSIs often use Alteryx software because there‘s vast amounts of data and vast amounts of analysis that need to be done in those processes. So there’s lots of high-value, strategic service opportunities for our GSI partners.

Solution providers are often very specialized in the data and analytics space. They‘re companies like Data Meaning, Capitalize Consulting, The Information Lab. These are companies that really understand the people side – they understand the technology side very well, but they also understand the people side in terms of driving enablement.

Solution providers have historically been more on the collaboration fee side of the business model. But we have really leaned in and asked them to consider the resale opportunity as well. And we designed the [partner] program to make that interesting for them. And then we redesigned our internal compensation structure as well for our field [sales] to make it neutral for them for [partner] resale opportunities, which is really important and wasn‘t in place before I got here.

The third category are ISVs. These are technology relationships like Snowflake, Databricks, UiPath, Blue Prism, AWS, Azure and Google. These are all the different ways that customers want to see our solutions better integrated into the broader data landscape. So when we talk about pushing analytics down into cloud data warehouses, that requires close product development with Snowflake and Databricks. And it opens up great go-to-market relationships as well because we‘ve done this architectural work together with these companies.

And then OEMs are companies that are taking Alteryx software and wrapping it with their own software or their own services so that they have a differentiated offering for the market. An example of this would be Thomson Reuters [and its] tax solution, a branded Thomson Reuters solution that leverages Alteryx software.

Can you give me an idea as to how much of Alteryx’s sales involve the channel?

Historically, we haven’t publicly shared that number. But I was pleased to see that in Q2, 50 percent of new bookings involved a partner of some type. It is a stated desire, an imperative KPI [key performance indicator], that we are driving across the business for that to move to a much higher percentage because we know the benefit that comes from that, we know how that helps customers. Ultimately, we believe it will drive faster business growth.

The redesign of the partner program was built to really understand what partners need from us to make that happen, to ensure that they see the opportunity in the market for their businesses to grow and to be profitable. We built different incentive structures, we invested in [partner] enablement and their training. We‘ve welcomed them in very early to our cloud product portfolio, giving them access to it before it’s generally available so they could get familiar with it and start building their capabilities around it.

In my past lives at SAP, and then prior to that [at] Cisco, leading multibillion-dollar businesses, I understood the significant role that the partner community plays in getting to those levels of business. Our next stop is to be a billion-dollar business and then a multibillion-dollar business and the partner community will play an important role in our ability to achieve that.

Things are very unsettled in the economy right now. Are you seeing any kind of impact? Any pullback from customers in reaction to the broader macroeconomic climate?

You can imagine we watch this stuff really, really closely, both through forecasting processes and quarterly business reviews. We’re instrumented very tightly as an organization to understand the direction of the business. And we use our own software to do that, by the way. We leverage Alteryx to build a dashboard that our executive team looks at daily, multiple times a day, [with] all the different metrics, pipeline and coverage and productivity, and all of these things that give us leading indicators into what‘s happening in the business.

At this time there’s nothing that we see in that data that would suggest to us that the guidance that we provided for Q3 and the full year isn’t achievable. We‘re watching it really closely, but I don’t see any indications of significant variance to what we‘ve seen in Q2 and Q1 and Q4 [ended Dec. 31, 2021].

This goes back to what I mentioned earlier – and we‘ve seen this in CIO surveys – data analytics makes the top three investment areas for most companies right now. Even in light of the macroeconomic environment, if you’re a business leader today, you really need to have a handle on what‘s happening in your business. You need to have signals that you can separate from the noise and you need to be able to make agile business decisions as the world is evolving around us. And data analytics plays a vital role in the ability for that to happen.