Michael Dell-Linked Firm Acquiring 1,047-Room Florida Resort

Barry Sholem, a partner at MSD Partners and co-head of MSD's real estate group, says the acquisition of the resort from an affiliate of private equity powerhouse Blackstone ‘represents a natural extension of our portfolio of luxury hotels and resorts.’

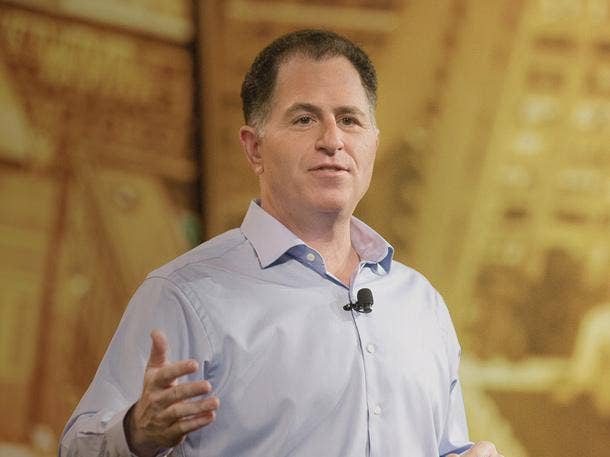

A New York investment firm connected with Michael Dell announced this week that it had agreed to acquire a 1,047-room resort famous for its well-to-do clientele in Florida.

MSD Partners L.P. on April 22 announced that it had entered into a definitive agreement to acquire the Boca Raton Resort & Club from an affiliate of private equity powerhouse Blackstone. MSD Partners was formed in 2009 by the partners of MSD Capital, which exclusively manages the assets of Michael Dell and his family.

The resort in Boca Raton, Fla. was built in 1926 and is home to 1,047 hotel rooms across 337 acres. Its amenities include two 18-hole golf courses, a 50,000-square-foot spa, seven swimming pools, 30 tennis courts, a full-service 32-slip marina, 13 restaurants and bars, and 200,000 square feet of meeting space. The property fronts both the Intracoastal Waterway and the Atlantic Ocean, where its beach extends a half mile.

Terms of the transaction, which is expected to close by the end of June, were not disclosed. The property will continue to be managed by Hilton under the Waldorf Astoria Hotels & Resorts brand.

Blackstone had invested more than $300 million in the resort, according to a release.

Barry Sholem, a partner at MSD Partners and co-head of MSD's real estate group, said in a statement that the investment “represents a natural extension of our portfolio of luxury hotels and resorts and complements our Four Seasons properties in Wailea and Hualalai, and the Fairmont Miramar in Santa Monica. Boca Raton Resort & Club offers an opportunity to continue to improve the customer and member offering, as we have done successfully with our other properties."

MSD real estate group said it has committed over $2 billion of equity into over 30 real estate and real estate-related transactions since its founding in 2004.

In 2013, Blackstone had offered to buy Dell Technologies but later backed out of its bid.